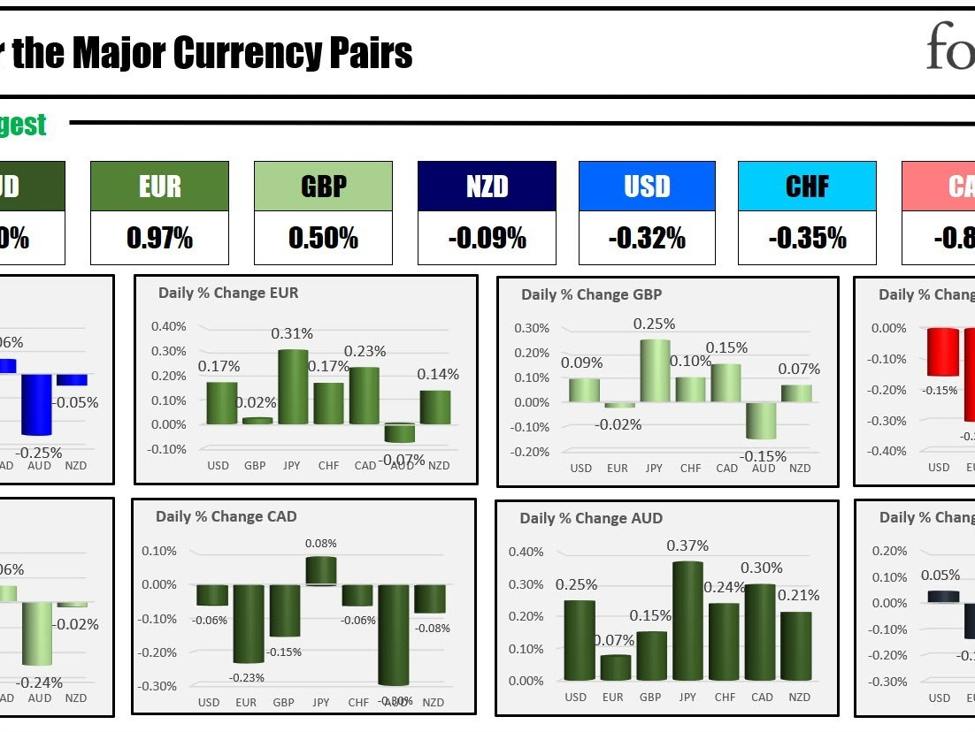

The strongest to the weakest of the major currencies

As the North American session begins, the AUD is the strongest and the JPY is the weakest. The holiday shortened week will keep the action limited. THe major currencies are scrunched together. The order can shift fairly easily. The US dollar is mixed and little changes. The 0.25% decline versus the AUD the biggest mover for the greenback. The USD is higher by 0.15% versus the JPY which represents the biggest gainer for the USD.

Today, the Richmond Fed composite index for December will be released at 10 AM. The U.S. Treasury will auction off five-year notes at 1 PM. Yesterday the treasury auctioned off 2-year notes with OK demand.

US stocks rose yesterday with the Nasdaq index leading the major three indices with a gain of 0.54%. The Russell 2000 of small-cap stocks increase by 1.24% as investors continued the shift to the more riskier smaller companies. Those companies benefit from the sharp fall in yields over the last month of trading. US yields are lower again today with the 10-year yield down around -2.7 basis points.

A stepchild market currently shows:

- Crude oil is down $1.08 or -1.43% at $74.49.

- Gold is trading up $0.50 or 0.03% at $2068.10.

- Silver is down $0.12 or -0.51% at $24.08

- Bitcoin is trading at $42,890. It’s high reached $43,224. It’s low reached $42,121.

In the premarket for US stocks, the major indices are marginally higher. The major indices have been up for eight consecutive weeks. They got off to a positive start yesterday:

- Dow Industrial Average futures are implying a gain of 23.00 points. Yesterday the index rose 159.36 points or 0.43%.

- S&P futures are implying a gain of 4.75 points. Yesterday the index rose 20.10 points or 0.42%. The high price yesterday got within about 12 points of its all-time high closing level at 4796.57.

- Nasdaq futures are implying a gain of 26.79 points. Yesterday the index rose 81.60 points or 0.54%. It reached and closed at a new high going back to January 2022.

In the European equity market, major indices are back open after yesterday’s extended holiday:

- German DAX +0.28%

- France CAC +0.21%

- UK FTSE 100 +0.58%

- Spain’s Ibex +0.15%

- Italy’s FTSE MIB +0.33% (10 minute delay)

Looking at the US debt market, yields are lower:

- 2-year yield 4.282%, -0.6 basis points

- 5-year yield 3.854% -2.1 basis points

- 10-year yield 3.50% -3.6 basis points

- 30-year yield 4.001% -4.2 basis points

In the European debt market, the benchmark 10-year yields are lower:

European benchmark 10-year yield’s