Dollar rally shows no signs of stopping in early US session, and the greenback it buoyed slightly by stronger than expected data on durable goods orders. Yet, looming in the background is the potential for the fourth US government shutdown in the last ten years, a scenario that’s only days away. Minneapolis Fed President Neel Kashkari weighed in on the situation, stating a shutdown could “slow the economy,” suggesting that Fed “might then have to do less” to fight inflation. However, there’s another side to the coin: a delay in the release of economic data could complicate Fed’s decision-making process. All eyes are now turned to Washington, keenly observing the next moves.

In the wider currency markets, Australian Dollar is struggling, particularly after the news that China Evergrande Group’s chairman has been put under police watch, as per Bloomberg reports. This adds another layer of uncertainty about the company’s future, and by extension, impacts sentiment towards China’s broader property sector, subsequently placing pressure on Aussie. European currencies are also navigating choppy waters, with Swiss Franc being notably weaker. Contrarily, Canadian Dollar trails just behind Dollar in terms of strength, followed by Japanese Yen.

Technically, AUD/CAD is resuming recent down trend by breaking through 0.8622 support. Next target the key support zone between 0.8569 and 61.8% projection projection of 0.9545 to 0.8781 from 0.9054 at 0.8582. Decisive break there could prompt downside acceleration towards 100% projection at 0.8290. The unfolding scenario is intrinsically tied to sentiment shifts in China and the stability of oil prices, factors that will critically influence the pair’s directional momentum.

In Europe, at the time of writing, FTSE is up 0.01%. DAX is down -0.01%. CAC is up 0.11%. Germany 10-year yield is down -0.0025 at 2.783. Earlier in Asia, Nikkei rose 0.18%. Hong Kong HSI rose 0.83%. China Shanghai SSE rose 0.16%. Singapore Strait Times dropped -0.47%. Japan 10-year JGB yield dropped -0.0062 to 0.740.

US durable goods orders rose 0.2% mom in Aug, above expectations

US durable goods orders rose 0.2% mom to USD 284.7B in August, much better than expectation of -0.4% mom decline.Ex-transport orders dropped rose 0.4% mom to USD 187.0B, above expectation of 0.2% mom. Ex-defense orders dropped -0.7% mom to USD 267.2B. Machinery rose 0.5% mom to USD 37.8B.

ECB’s Elderson: Policy rates have peaked? Not necessarily

In an MNI interview, ECB Executive Board Member Frank Elderson responded to the speculation on whether interest rates have reached their pea. He noted, “Does that mean policy rates have peaked? Not necessarily. There is still a lot of uncertainty.”

Elderson emphasized the efficacy of the decisions taken by ECB, remarking, “we consider that, with the decisions we’ve made and on the basis of our current assessment, the current interest rate levels will make a substantial contribution to us reaching our inflation target in the medium term.”

Refraining from speculation, he underscored the bank’s methodical approach: “we take these decisions meeting by meeting, on a data-dependent basis. Making any predictions about what we will do next would not be consistent with that approach.”

Highlighting the challenges in the euro area’s economic performance, Elderson revealed, “What we’re seeing is a more protracted period of sluggish growth than we were expecting.” He pointed out several contributing factors to this slowdown, including “lower demand for euro area exports, the impact of tighter financing conditions, lower residential and business investment, and the weakening services sector.”

Yet, not all indicators spell caution. Offering a balanced view, Elderson noted the resilience in certain sectors. “On the other hand, labour markets are still strong and disposable income is expected to rise, which would have a stabilising effect on overall GDP growth.”

German Gfk consumer sentiment fell to -26.5, chance of recovery probably fallen to zero

Germany’s Gfk Consumer Sentiment for October fell from -25.6 to -26.5. In September, economic expectations rose from -6.2 to -3.4. Income expectations ticked up from -11.5 to -11.3. Propensity to buy rose slightly from -17.0 to -16.4. Propensity to save jumped from 0.5 to 8.0, highest since April 2011.

“This means that the chances of a recovery in consumer sentiment this year have probably fallen to zero,” explains Rolf Bürkl, GfK consumer expert. “The reasons for this are a persistently high inflation rate due to sharply rising food and energy prices. Consequently, private consumption will not be able to positively contribute to overall economic development this year.”

Australia’s monthly CPI rose to 5.2%, led by housing and transport

Australia CPI for August rose from 4.9% yoy to 5.2% yoy, in line with market expectations.

Digging into the specifics, the sectors showing the most substantial annual gains were housing, which surged by 6.6%, followed by transport at 7.4%. Additionally, food and non-alcoholic beverages reported an increase of 4.4%. Notably, insurance and financial services marked the highest significant rise of 8.8%.

On the other hand, when considering CPI that excludes volatile items such as holiday travel, there was a slight dip from 5.8% yoy to 5.5% yoy. Meanwhile, the Annual trimmed mean CPI, which gives a clearer picture by removing the most volatile items, remained steady at 5.6% yoy.

BoJ minutes reveal diverging views on future policy direction

The minutes from BoJ meeting held on July 27 and 28 have unveiled differing perspectives among board members regarding the future direction of monetary policy. While a consensus was apparent on the immediate need to sustain ultra-low interest rates, members were divided on how to approach the medium to long term.

One member stated, “there was still a significantly long way to go before revising the negative interest rate policy, and the framework of yield curve control needed to be maintained”.

The same member emphasized the importance of patience and consistency, suggesting that “it should carefully nurture the long-awaited signs of change in firms’ behavior by patiently continuing with monetary easing.”

Another participant weighed the risks of delaying versus hastening monetary tightening. In their perspective, the “risk of missing a chance to achieve the 2 percent target due to a hasty monetary tightening outweighed the risk of the inflation rate continuing to exceed 2 percent if monetary tightening fell behind the curve.”

Yet another member presented a more optimistic outlook on the inflation target, noting that the “achievement of 2 percent inflation in a sustainable and stable manner seemed to have clearly come in sight.” They further suggested that between January and March 2024, it might be feasible to evaluate the Bank’s success in achieving the inflation target.

Despite the differences in outlook, BoJ decided to persist with its current easing policy settings but also opted to grant long-term borrowing costs more flexibility to rise.

EUR/USD Mid-Day Outlook

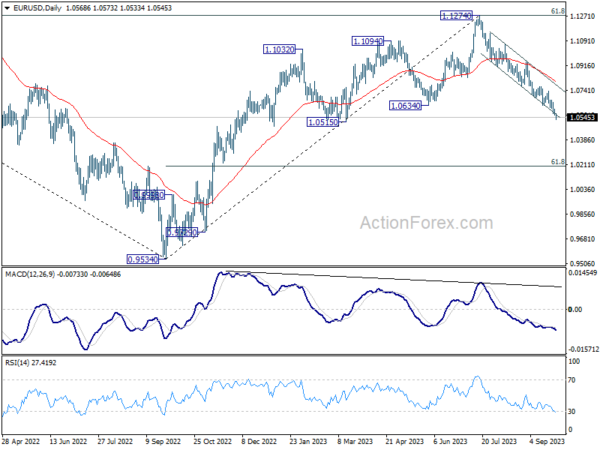

Daily Pivots: (S1) 1.0553; (P) 1.0581; (R1) 1.0600; More…

Intraday bias in EUR/USD remains on the downside for the moment. Current fall from 1.1274 is in progress for 1.0515 support. Firm break there will pave the way to next fibonacci level at 1.0199. On the upside, above 1.0615 minor resistance will turn intraday bias neutral and bring consolidations. But outlook will stay bearish as long as 1.0764 support turned resistance holds.

In the bigger picture, fall from 1.1274 medium term top could still be a correction to rise from 0.9534 (2022 low). But chance of a complete trend reversal is rising. In either case, firm break of 1.0515 support will target 61.8% retracement of 0.9534 to 1.1274 at 1.0199. For now, risk will stay on the downside as long as 55 D EMA (now at 1.0798) holds, in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BoJ Minutes | ||||

| 01:30 | AUD | Monthly CPI Y/Y Aug | 5.20% | 5.20% | 4.90% | |

| 06:00 | EUR | Germany Gfk Consumer Confidence Oct | -26.5 | -25.5 | -25.5 | -25.6 |

| 08:00 | CHF | Credit Suisse Economic Expectations Sep | -27.6 | -38.6 | ||

| 08:00 | EUR | Eurozone M3 Money Supply Y/Y Aug | -1.30% | -1.00% | -0.40% | |

| 12:30 | USD | Durable Goods Orders Aug | 0.20% | -0.40% | -5.20% | -5.60% |

| 12:30 | USD | Durable Goods Orders ex Transportation Aug | 0.40% | 0.20% | 0.40% | |

| 14:30 | USD | Crude Oil Inventories | -0.7M | -2.1M |