On the final day of each month the US Energy Information Administration releases monthly demand figures and they continue to stress that the weekly data can’t be trusted.

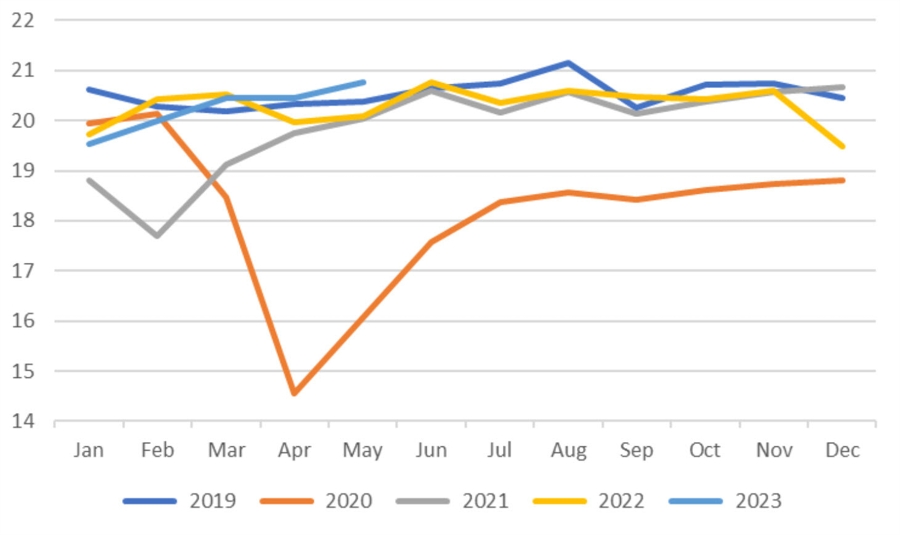

Today’s report pegs US total demand at 20.776m bpd in May using monthly data, that’s up 973,000 bpd from the 19.803m bpd using the weekly data.

More importantly, it shows that May US oil demand was at a record for the month of May and up 3.4% y/y. That’s with a struggling manufacturing sector leading to middling distillate demand.

h/t @staunovo

As for Goldman Sachs, their latest note estimates that global oil demand hit an all-time high of 102.8m bpd in July. They also revised estimates for 2023 demand higher by 550k bpd mostly due to the US and India.

The next big question is what Saudi Arabia does with its 500k bpd voluntary cut (we should find out this week). Goldman’s base case is an extension through Sept but that it’s halved in October.

Overall they see a 1.8 million barrel per day global deficit in H2, drawing down inventories. They maintain a $93/barrel brent target for H2.