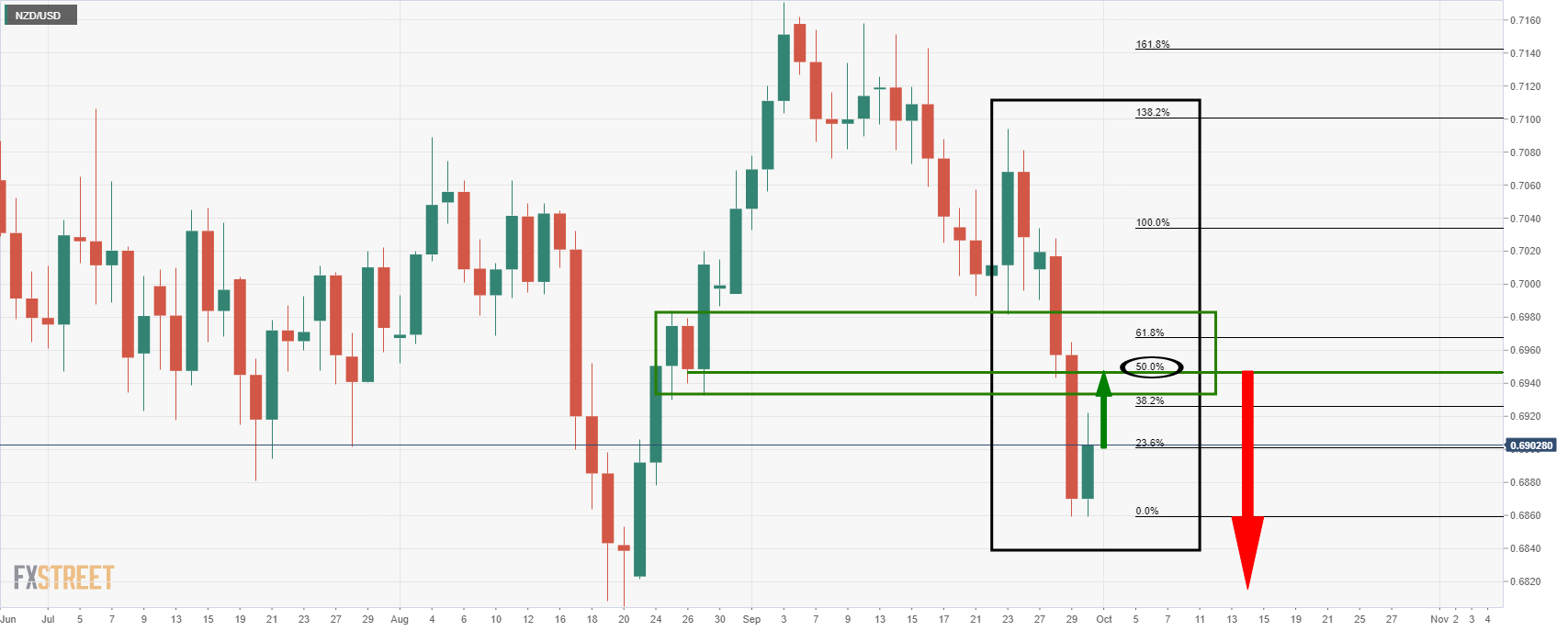

- NZD/USD bulls step in and target the 38.2% Fibo.

- The 50% mean reversion is eyed as a potential deeper target.

- US dollar is expected to be stronger for longer.

NZD/USD is trading around 0.58% higher on the day and has risen from a low of 0.6859 to a high of 0.6921, coming close to its 38.2% Fibonacci retracement of the daily drop at 0.6927.

The surprise rise in US jobless claims weighed on the greenback on Thursday. US Initial Jobless Claims rose for a third straight week to 362,000 for the period ending Sept. 25. Economists polled by Reuters had forecast 335,000 jobless applications for the latest week.

However, US equities have also responded in kind as the markets still expect the Federal Reserve to taper its monetary stimulus beginning in November. Last week, the Fed also flagged interest rate increases may follow sooner than expected.

At home, however, the overall story for the Kiwi is one of altitude adjustment, analysts at ANZ Bank said in a note on Friday in Asia. ”The three most correlated variables for the NZD of late have been US high-yield bond spreads, the USD against a basket of Asian currencies, and emerging market equities.”

”As each of these have come back, so has the NZD. Overlay the long tail of Delta over that, and the picture is arguably less optimistic than it was, even with OCR hikes and carry coming next week.”

You can’t keep a good US dollar down

Meanwhile, switching back to the US dollar, a correction might be all that we get for the meantime and a move higher could be just around the corner. Analyst’s at Brown Brothers Hamrriam are of that mind. ”The speed of this dollar move is quite frankly very surprising,” the analysts said. ”Based on the previous experience, we believe that this period of dollar strength still has legs.”

With regards to US yields, the analysts target higher in the 10-year. ”It remains on track to test the May high near 1.70% and then the March 30 high near 1.77%. The real 10-year yield is also higher and at -0.85% is the highest since July 1. A break above -0.82% is needed to set up a test of the March 19 high near -0.59%. If this rise in US yields can be sustained, it is yet another dollar-positive factor to consider. Of note, the Fed Funds strip now has lift-off in Q4 2022 almost fully priced in.”

NZD/USD technical analysis

NZD/USD is establishing and there could be a continuation to the upside beyond the 38.2% Fibo to target near 0.6950.