Strong trends are

- Fast

- Directional, and

- Tend to go farther than what traders expect.

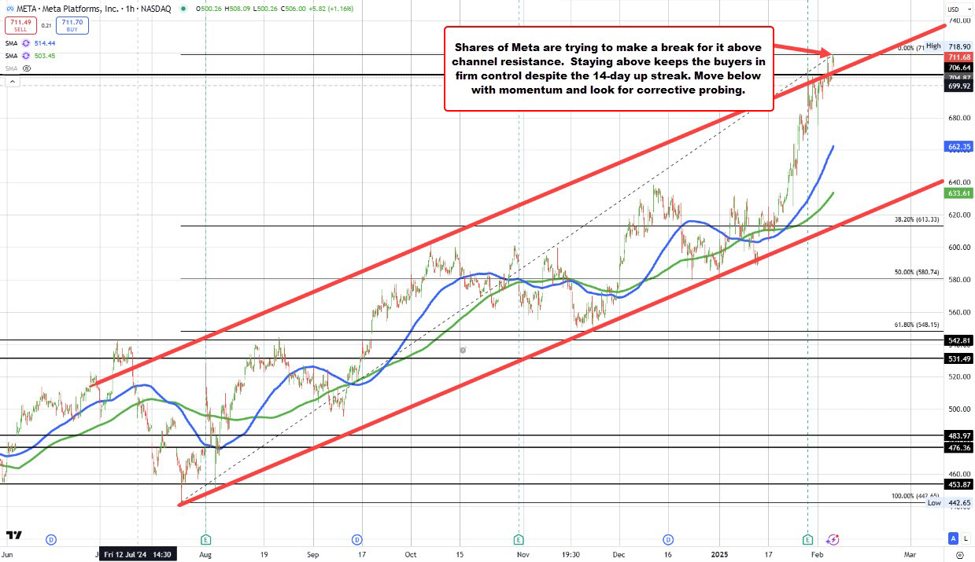

Shares of Meta are exhibiting a strong upward trend, currently working on their 14th consecutive day of gains, marking a record for the stock. While this remarkable streak might suggest overbought conditions, recent trading action indicates a breakout above the upper boundary of a topside channel trendline. This breakout signals continued bullish momentum, making it unwise to attempt to pick a top just yet despite the extended rally.

The breakout level, around $705, now serves as a key support zone. As long as the price remains above this level, the bullish bias stays firmly in favor of buyers. Today, Meta shares reached a high of $718.90 and are currently trading near $714, maintaining a healthy buffer above the breakout point. If the price falls below $705 with momentum, it could prompt profit-taking or selling, with further downside targets at $700 and potentially $680, where sellers could gain additional confidence.

Meta’s current rally exemplifies the power of momentum in the stock market. Trends like these are difficult to reverse, especially for stocks experiencing such strong upward pressure. For now, traders should let the trend ride and only consider a shift in strategy if price action and technical levels, such as the breakout point, signal otherwise.

Also, understand that even if we do get a correction, they can be short-lived. Nevertheless, they may provide an opportunity to “lighten up” and redeploy the capital in the next winner/idea.