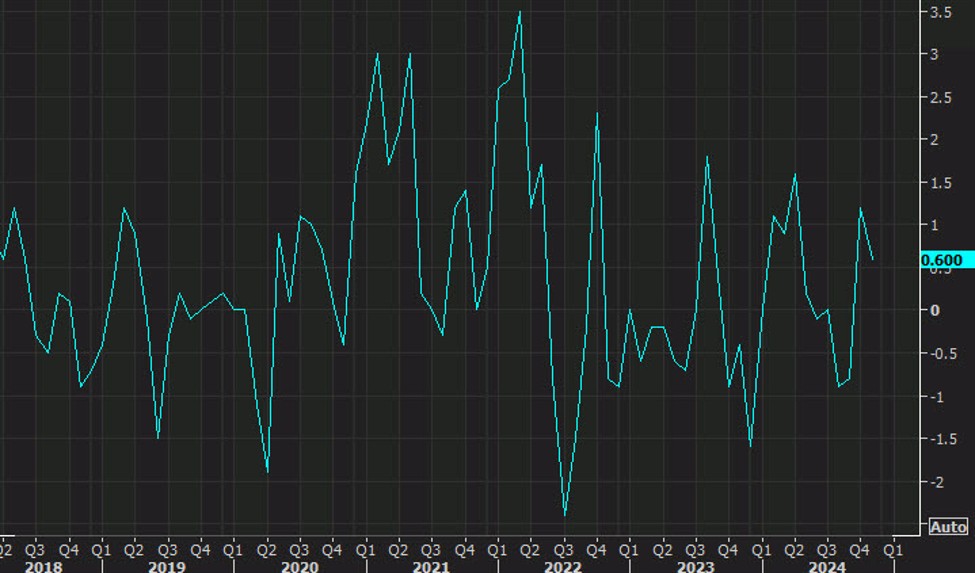

Canada PPI

- Prior was +0.6%

- PPI y/y +4.1% vs +2.2% prior

- Raw materials price index +1.3% m/m vs -0.5% expected

- Raw materials price index +9.1% m/m vs +2.0% expected

The headline here is deceptive as there are some big year-over-year declines. Much of that is base effects with last December’s reading of -1.6% m/m rolling off but those headline y/y numbers should give pause.

Another driver of the higher prices of materials is the softening of the Canadian dollar as commodities are priced in USD and many intermediate goods are imported.

Finally, the PPI was boosted by gold prices, which shouldn’t be an important factor for the Bank of Canada:

“Prices for unwrought gold, silver, and platinum group metals, and their alloys (+32.4%) were the main contributor to the IPPI’s

year-over-year gain in December. Prices for these metals increased

frequently throughout 2024 as geopolitical uncertainty boosted demand

for safe haven assets and falling interest rates made precious metals

more attractive to investors.”