Yen weakened across the board today in an otherwise consolidative market , as traders increasingly anticipate that BoJ will hold steady on monetary policy at its upcoming this week. BoJ policymakers appear to see no urgency in extending the tightening cycle this month, preferring instead to wait for January’s updated economic projections before deciding on further hikes. This cautious approach reflects both near-term and structural challenges, including uncertainty over domestic wage growth and shifts in US trade policies under the incoming administration.

A critical issue for Japan’s inflation outlook is whether wage increases can extend beyond large corporations to smaller and medium-sized enterprises. While Rengo, the country’s largest labor federation, has set a lofty target of at least 6% wage hikes for SMEs in 2025, early indications suggest businesses in this segment are hesitant to commit to such significant increases, due to their own challenges including surging import prices. Without broader wage gains, domestic demand may struggle to expand sufficiently, limiting the sustainability of inflation at BoJ’s 2% target. This would complicate any sustained policy normalization and could keep the central bank cautious well into next year.

In the broader currency markets, British Pound is the day’s strongest performer so far, supported by UK PMI data. While, the underlying economic outlook for the UK remains fragile, resurgence of inflationary pressures is expected to keep the BoE on track for up to four rate cuts next year, at most. New Zealand Dollar follows as the second strongest, underpinned by a robust improvement in services sector data, while Dollar rounds out the top three. On the other hand, Swiss Franc and Canadian Dollar are among the weakest currencies alongside Yen, while Euro and Australian Dollar are mixed in the middle.

Meanwhile, in the cryptocurrency market, Bitcoin surged to a new all-time high following comments from US president-elect Donald Trump, who revealed plans to implement a strategic cryptocurrency reserve akin to the US oil reserve. Speaking to CNBC on Sunday, Trump promised “something great” for the cryptocurrency sector under his administration. Technically, outlook in Bitcoin will stay bullish as long as 93951 support holds. Current up trend is on track to 138.2% projection of 24896 to 73812 from 52703 at 120304, i.e. 120k handle.

In Europe, at the time of writing, FTSE is down -0.40%. DAX is down -0.30%. CAC is down -0.87%. UK 10-year yield is down -0.016 at 4.402. Germany 10-year yield is down -0.029 at 2.234. Earlier in Asian, Nikkei fell -0.03%. Hong Kong HSI fell -0.88%. China Shanghai SSE fell -0.16%. Singapore Strait Times rose 0.28%. Japan 10-year JGB yield rose 0.314 to 1.072.

ECB’s Lagarde: Shifting focus to appropriate policy from prolonged monetary restriction

ECB President Christine Lagarde’s speech today marked a departure from previous guidance shaped by high inflation and significant uncertainty.

Lagarde highlighted that the earlier approach, which aimed to maintain restrictive rates “for as long as necessary,” is no longer aligned with the ECB’s evolving outlook for inflation and risk balance.

However, with “disinflation process well on track” and growth risks becoming more pronounced, ECB now aims for an “appropriate” policy approach.

She reiterated that if data continues to confirm their expectations, ECB expects to lower rates further.

UK PMI composite unchanged at 50.5, triple whammy of growth, employment and inflation

UK PMI Manufacturing PMI slipped from 48.0 to 47.3, an 11-month low. Services PMI improved from 50.4 to 51.4. PMI Composite held steady at 50.5, signaling stagnation in overall economic activity.

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, described a “triple whammy” facing businesses: stalled growth, declining employment, and renewed inflationary pressures.

While the PMI suggests that the economy remained broadly stagnant in Q4, the outlook for 2025 appears increasingly uncertain. Weak confidence, labor market retrenchment, and inflation risks could weigh heavily on economic activity.

Williamson said BoE faces the difficult task of balancing support for growth against the need to maintain inflation control, suggesting a cautious approach to monetary easing in the coming months.

Eurozone PMI improves to 49.5 with potential positive surprises from politics ahead

Eurozone PMI Services rose notably from 49.5 to 51.4, marking a return to expansion territory. However, PMI Manufacturing remained static at 45.2, firmly in contraction. Consequently, PMI Composite edged up from 48.3 to 49.5, signaling ongoing weakness in overall economic momentum.

Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, noted that the service sector’s rebound is a “welcome boost” to the Eurozone economy, while manufacturing continues to face a severe downturn.

Inflationary pressures remain a concern, particularly in the services sector. Input costs have risen for the third consecutive month, largely due to higher wage agreements, with businesses passing these costs onto customers. This persistent inflation challenge informed ECB’s cautious decision earlier this month to cut rates by just 25bps.

Germany and France, the Eurozone’s largest economies, add to the uncertainty with ongoing political challenges, delaying necessary reforms to stimulate growth. Despite this, de la Rubia suggested there is potential for “positive surprises” in 2025 if clearer economic policies emerge from future governments.

Japan’s PMI composite rises to 50.8, stubborn inflation caps growth

Japan’s private sector activity showed a modest improvement in December, driven by a stronger services sector, while manufacturing continued to contract.

PMI Manufacturing index declined from 49.5 to 49.0, marking the fourth consecutive month of contraction. In contrast, PMI Services index rose from 50.5 to 51.4, lifting Composite PMI from 50.1 to 50.8, indicating mild overall growth.

Usamah Bhatti, economist at S&P Global Market Intelligence, pointed out the contrasting trends: “Services firms saw the strongest rise in new business in four months, while goods producers faced a sharper decline in orders.” This divergence highlights persistent weakness in manufacturing amid subdued demand and improving momentum in the services sector.

Inflationary pressures persisted, fueled by the Yen’s weakness, which increased the cost of imported materials. Input prices rose at the fastest pace in four months, while selling price inflation hit its highest level since May, as businesses passed on rising costs to consumers. Bhatti noted, “Stubborn inflation held back a stronger expansion of the Japanese private sector in December.”

Australian PMI composite falls to 49.9, bolsters case for early RBA rate cut

Australia’s December PMI data pointing to a broad-based slowdown. The Manufacturing index fell from 49.4 to 48.2. Services PMI edged down from 50.5 to 50.3. Meanwhile, Composite PMI dropped from 50.2 to 49.9, slipping into mild contraction territory.

Jingyi Pan, Economics Associate Director at S&P Global Market Intelligence, noted that the data reflects growing strain across sectors, with manufacturing leading the downturn and services beginning to falter.

Forward indicators presented mixed signals. While business confidence reached its highest level in over two-and-a-half years, new business growth slowed, and unfinished work declined further. Employment gauge showed its first contraction since August 2021.

Muted selling price inflation provides room for RBA to consider rate cuts in early 2024. However, rising cost pressures remain a concern.

NZ BNZ services jumps to 49.5, closer to stability

New Zealand’s BusinessNZ Performance of Services Index rose significantly from 46.2 to 49.5 in November, signaling a move closer to stabilization. However, the index remains under the no-change threshold of 50.0 and well below its long-term average of 53.1.

Key subcomponents offered a mixed picture. Activity/sales improved from 44.4 to 48.6, and new orders/business rose to 49.8, nearing expansion territory. Employment showed only a slight uptick, from 46.4 to 46.8, reflecting continued caution among firms. Stocks/inventories and supplier deliveries moved into expansionary territory at 52.2 and 52.5, respectively, signaling some recovery in supply chain dynamics.

Negative sentiment among respondents eased, with the proportion of unfavorable comments dropping to 53.6% from October’s 59.1%. However, the ongoing concerns over the economic climate and the cost of living remain dominant themes, indicating persistent headwinds for the sector.

USD/JPY Mid-Day Outlook

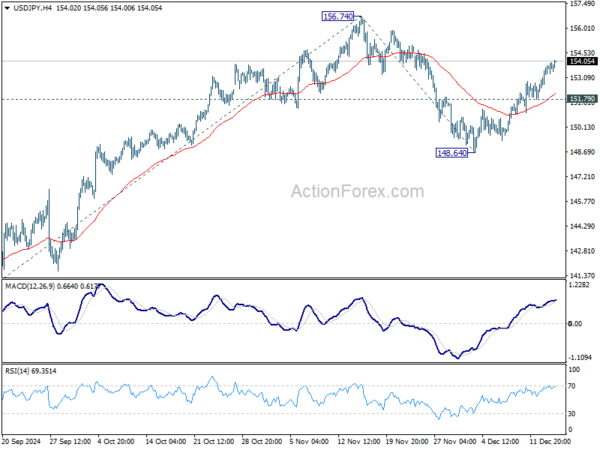

Daily Pivots: (S1) 152.80; (P) 153.30; (R1) 154.14; More…

Intraday bias in USD/JPY remains on the upside as rebound from 148.64 is in progress. Further rally should be seen to retest 156.74 first. Firm break there will resume whole rally from 139.57, and target 61.8% projection of 139.57 to 156.74 from 148.64 at 159.25 next. On the downside, below 151.79 minor support will turn intraday bias neutral. But risk will stay on the upside as long as 148.64 support holds, in case of retreat.

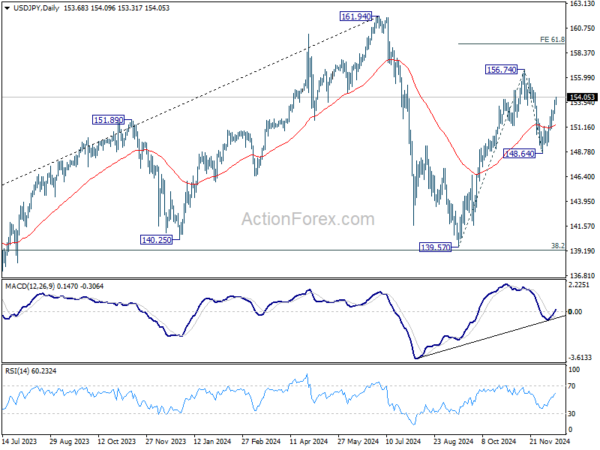

In the bigger picture, price actions from 161.94 are seen as a corrective pattern to rise from 102.58 (2021 low). The range of medium term consolidation should be set between 38.2% retracement of 102.58 to 161.94 at 139.26 and 161.94. Nevertheless, sustained break of 139.26 would open up deeper medium term decline to 61.8% retracement at 125.25.