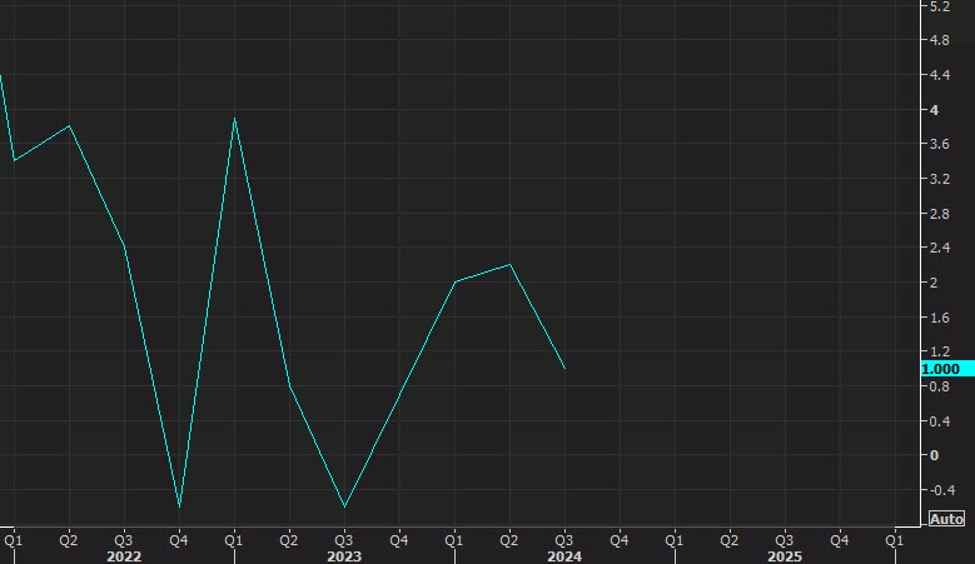

Canada GDP q/q

The headline from today’s Canadian GDP report is that growth declined on a per-capita basis for the sixth consecutive quarter. In addition, monthly GDP data showed just 0.1% m/m growth in September and October.

CIBC writes:

“While growth in the Canadian economy slowed to a crawl in Q3, that was broadly anticipated and was mainly driven

by inventories and net trade. Domestic demand growth was much more solid and similar to the prior quarter. More

concerning for the Bank of Canada will be the monthly data that showed the quarter ending with a whimper rather

than the expected bang, leaving early tracking for Q4 well below the October MPR projection. Because of that, today’s

data are somewhat supportive of a 50bp cut at the next meeting, rather than a smaller 25bp reduction, although next

week’s employment figures will be just as important in making the final decision.”

RBC continues to see a 50 bps cut but will also be watching Friday’s jobs report closely ahead of the December 11 BOC decision:

“The

GDP numbers should help to reinforce that interest rates are higher than

they need to be to maintain inflation sustainably at a 2% rate. The BoC

will also be watching next week’s labour market data closely, but our own

base-case assumption is for another 50 basis point cut to the overnight

rate in December.”

At the moment, the BOC is projecting 2% GDP growth in Q4 but that’s likely to be scaled down and the central bank may also take a more-cautious approach for 2025, given Canadian government forecasts for a declining population.

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)