The financial markets are intently focused today on US inflation data. Expectations are that both the headline CPI and core CPI remained unchanged in October from the previous month’s readings of 2.4% and 3.3%, respectively.

This stagnation in disinflation supports the notion that bringing inflation back to Fed’s 2% target may prove increasingly challenging in its final stages.

Adding to inflationary concerns are fiscal and trade policies from President-elect Donald Trump, which could create further upward pressure on prices in the coming year.

Such an outlook would likely prompt Fed to maintain cautious and gradual pace in lowering interest rates.

In currency markets, the Dollar has shown strength this week, holding its position as the top performer. However, it remains contained below last week’s highs against commodity currencies. In contrast, Yen is lagging, followed by Sterling and Euro, while Swiss Franc positions around the middle.

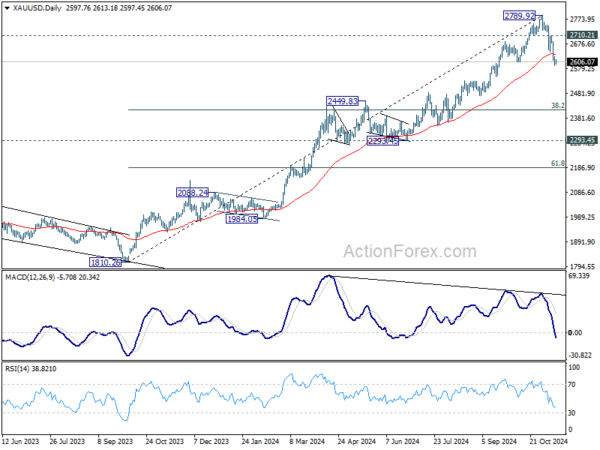

Technically, Gold’s break of 55 D EMA strengthens the case that fall from 2789.92 is corrective the whole five-wave rally from 1810.26. Further decline is now expected as long as 2710.21 minor resistance holds. Next target is 38.2% retracement of 1810.26 to 2789.92 at 2415.68, which sits inside 2293.45/2449.83 support zone.

In Asia, at the time of writing, Nikkei is down -1.73%. Hong Kong HSI is down -0.99%. China Shanghai SSE is down -0.23%. Singapore Strait Times is up 0.14%. Overnight, DOW fell -0.86%. S&P 500 fell -0.29%. NASDAQ fell -0.09%. 10-year yield rose 0.125 to 4.432.

Barkin says Fed well-positioned to respond to economic changes

Richmond Fed President Thomas Barkin noted that the economy is “in a good place” and that Fed is now positioned to react flexibly to evolving economic conditions.

Speaking at an event overnight, Barkin highlighted that interest rates are balanced—elevated from recent lows but no longer at peak levels—providing Fed with room to adjust policy as needed.

Barkin observed that more price-sensitive consumer base is contributing to moderating inflation pressures, suggesting that demand adjustments are naturally aiding Fed’s inflation objectives.

Additionally, he pointed to the resilience of the labor market, with companies retaining employees and maintaining lower turnover rates, which has provided stability and boosted productivity.

Fed’s Kashkari highlights inflation as key factor for December rate decision

Minneapolis Fed President Neel Kashkari pointed to inflation as the primary driver that could influence Fed’s policy direction at its next meeting. He stated that any decision to pause rate cut would require an “inflation surprise” before then.

“If we saw inflation surprises to the upside between now and then, that might give us pause,” Kashkari said at an event, noting that significant changes in the labor market are less likely given the limited time before the December meeting.

Kashkari reiterated that while the US economy remains strong, inflation has yet to fully return to the 2% target. He emphasized that it could still take a year or two to achieve this target, particularly given the lingering effects of housing inflation, though he noted recent cooling in that area as “encouraging.”

On the broader outlook for monetary policy, Kashkari described the current stance as “modestly restrictive,” suggesting that it is just slightly contractionary in effect. He acknowledged that the neutral rate remains uncertain but expected more clarity over the coming year as the Fed monitors the economy’s response to rate changes.

Japan’s PPI rises 3.4% yoy in Oct, highest since mid-2023

Japan’s PPI rose from 3.1% yoy to 3.4% yoy in October, surpassing market expectations of 3.0% and marking the highest annual increase since July 2023. On a monthly basis, PPI advanced by 0.2%, reflecting sustained inflationary pressure within Japan’s production sector.

The data also revealed a less pronounced decline in Yen-based import prices, down -2.2% yoy compared to a -2.5% drop in September, signaling that import costs may be stabilizing. This relative improvement aligns with a 4.3% mom increase in Yen’s exchange rate. However, on a monthly scale, import prices saw a notable 3.0% rise after a -2.8% decrease in September.

Australia’s wage growth slows as public sector outpaces private for first time since 2020

Australia’s wage growth softened in Q3, with the Wage Price Index rising by 0.8% qoq, slightly missing the forecast of 0.9%. On an annual basis, wage growth slowed from 4.1% yoy to 3.5% yoy, falling short of the expected 3.6% yoy and marking the lowest annual increase since Q4 2022. This deceleration follows four consecutive quarters of 4% or higher wage growth, pointing to easing in wage-driven inflation pressures.

For the first time since late 2020, public sector wage growth surpassed that of the private sector. Public sector wages rose by 3.7% yoy, higher than the 3.5% yoy recorded in the same quarter last year but down from the recent high of 4.2% yoy in Q4 2023, lowest since Q3 2022.

USD/CAD Daily Outlook

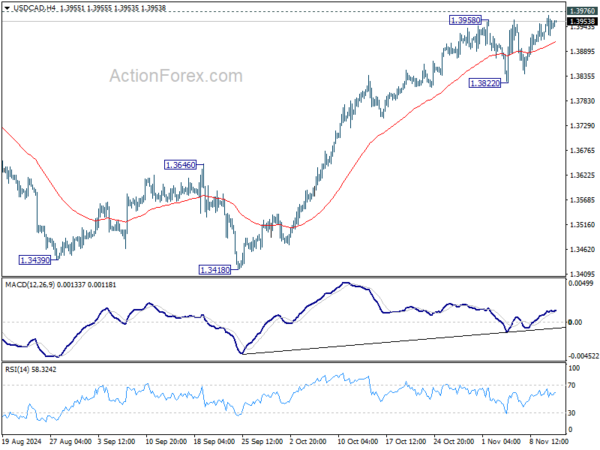

Daily Pivots: (S1) 1.3918; (P) 1.3943; (R1) 1.3969; More…

USD/CAD breached 1.3958 briefly but upside is capped below 1.3976 key resistance. Intraday bias stays neutral first. Further rise is is expected as long as 1.3822 support holds. On the upside, decisive break of 1.3976 key resistance will confirm larger up trend resumption. On the downside break of 1.3822 support will bring deeper pullback towards 55 D EMA (now at 1.3762).

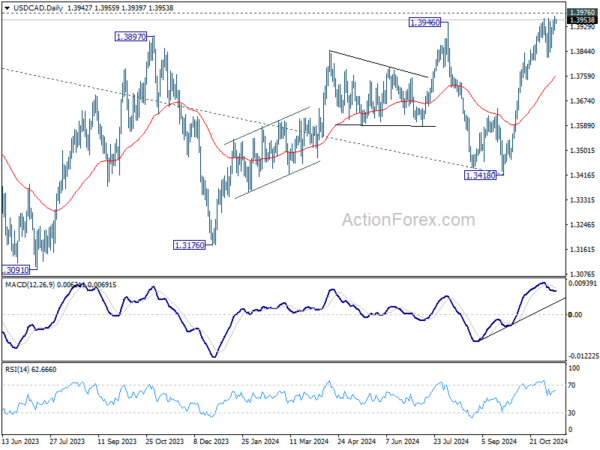

In the bigger picture, sideway consolidation pattern from 1.3976 (2022 high) might still extend further. While another decline cannot be ruled out, strong support should emerge above 1.2947 resistance turned support to bring rebound. Rise from 1.2005 (2021 low) is still in favor to resume at a later stage. Decisive break of 1.3976 will target 61.8% projection of 1.2401 to 1.3976 from 1.3418 at 1.4391.