Dollar strength and European weakness is currently the main theme in the markets this week so far. The greenback shrugs off strong risk-on sentiment, as reflected in another day of record closes in major US indexes, with strong momentum against Euro and Swiss Franc.

A lineup of Fed officials today will provide commentary that could shed light on the central bank’s stance as markets look for cues about its policy easing pace moving forward. However, the most anticipated event remains tomorrow’s US CPI release. While another 25bps cut is widely expected in December to round up the year, the outlook for rate reduction in 2025 remains highly uncertain.

Meanwhile, Sterling is also on the verge of breaking to new low against the greenback. Focuses is now on UK job data today, with attention particular on wages growth. Euro will also look into ZEW economic sentiment, which might reveal some reactions to US elections.

Commodity-linked currencies are among the stronger performers this week, after Dollar, supported by the prevailing risk-on environment. Meanwhile, Yen is mixed in the middle.

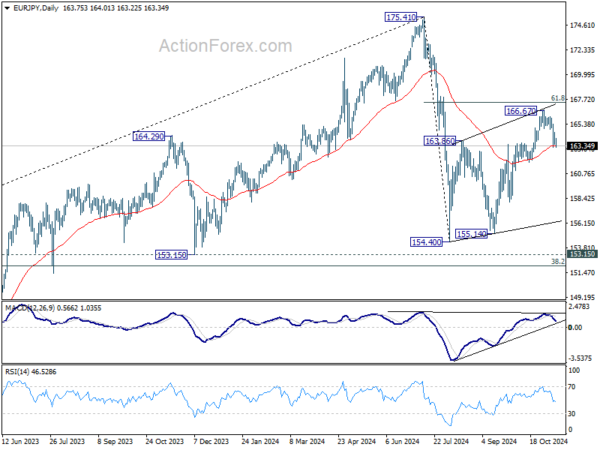

Technically, a focus for rest of the week is whether Euro’s decline will persist and if Yen can extend its near term rebound. EUR/JPY is now pressing 55 D EMA (now at 106.33). Sustained trading below there would argue that the corrective rise from 154.40 has completed with three waves up to 166.67. In this case, near term outlook will be turned bearish for 155.14/154.40 support zone.

In Asia, at the time of writing, Nikkei is down -0.98%. Hong Kong HSI is down -2.81%. China Shanghai SSE is down -0.93%. Singapore Strait Times is down -0.95%. Japan 10-year JGB yield is up 0.0022 at 1.004. Overnight, DOW rose 0.69%. S&P 500 rose 0.10%. NASDAQ Rose 0.06%. 10-year yield rose 0.002 to 4.308.

Australian Westpac consumer sentiment jumps 5.3%, but US election casts shadow on outlook

Australian consumer sentiment saw a solid rebound in November, with Westpac Consumer Sentiment Index climbing by 5.3% mom to reach 94.6. This marks a 14.4% rise from its mid-year low, leaving it just 5.4 points shy of the neutral 100 mark.

The improvement was led by increased optimism about the short-term economic outlook. The “economic outlook, next 12 months” sub-index jumped 8.7% to 100.9, the first optimistic reading (above 100) since post-COVID recovery. Confidence around personal finances also strengthened, with the “family finances, next 12 months” sub-index up 4.4% to 104.1. Meanwhile, Unemployment Expectations Index dropped by -7.2% to 120.5, indicating the highest level of labor market confidence since April 2023.

Westpac noted three important observations in November’s sentiment trends. First, confidence reached 99.7 in the early survey period, prior to RBA’s rate decision, reflecting marked optimism. Secondly, consumer sentiment remained unaffected by RBA’s decision to hold rates steady. Lastly, sentiment dropped sharply after US election result, averaging 91.1 in the survey’s latter half. This indicates an unusually wide range of ±5% for November’s final read, suggesting a degree of uncertainty not typically seen.

Australian NAB business confidence surges to 5, easing cost pressures but persistent retail inflation

Australia’s NABs Business Confidence Index jumped from -2 to 5, marking a notable improvement after a prolonged period of below-average sentiment. Business conditions remained stable at 7, while trading conditions saw a slight increase from 12 to 13. Profitability held steady at 5, and employment conditions edged lower from 5 to 3.

Gareth Spence, NAB’s Head of Australian Economics, highlighted the jump in confidence as an encouraging development, noting that it is “just one month” but shows “tentative improvement” in forward orders, suggesting possible momentum.

Input cost pressures continued to ease, with labor cost growth decelerating from 1.9% to 1.4% on a quarterly basis from 1.9%, and purchase cost growth slowing from 1.3% to 0.9%. Retail price growth, however, saw a rebound, rising from 0.6% to 1.1%.

Spence noted, “The survey, like other price indicators, continues to suggest an ongoing gradual easing in inflation pressure, but also that there is still some way to go in in the inflation moderation when we look at the consumer facing components”.

Bitcoin extends powerful rally amid “Trump Pump” optimism, ready for 100k milestone

Bitcoin’s robust rally continues at the start of this week, buoyed by the so-called “Trump Pump” effect. Cryptocurrency investors are optimistic about US President-elect Donald Trump’s promises to create a more supportive and friendly regulatory environment for crypto businesses.

The crypto market has long struggled with a lack of regulatory clarity, and these anticipated policy changes are fueling strong positive sentiment. Expectation of a more defined regulatory framework is encouraging both institutional and retail investors to increase their exposure to Bitcoin, driving further price appreciation.

Such optimism is expected to persist through the rest of 2024, with Bitcoin setting its sights on the significant 100k mark.

Technically, Bitcoin is in clear upside acceleration as seen in D MACD. The immediate focus is on 161.8% projection of 58846 to 73608 from 66763 at 90647. Break could push Bitcoin a bit further higher to 200% projection at 96287.

The real test lies in medium term level at 100% projection of 24898 to 73812 from 52703 at 101617, which is slightly above 100k psychological level. Strong resistance could be seen there to bring consolidations on first attempt.

Looking ahead

UK employment and Germany ZEW economic sentiment are the main feature in European session. Later in the day, US will release NFIB small business index, and Canada will puiblish building permits.

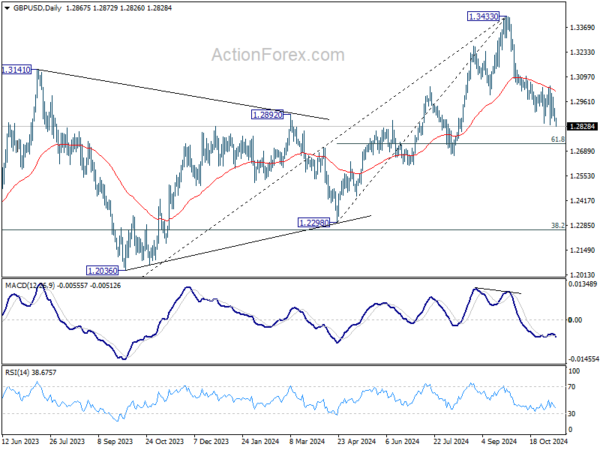

GBP/USD Daily Outlook

Daily Pivots: (S1) 1.2841; (P) 1.2884; (R1) 1.2911; More…

GBP/USD’s breach of 1.2833 temporary low suggests that fall from 1.3433 is resuming. Intraday bias is back on the downside for 61.8% retracement of 1.2298 to 1.3433 at 1.2732. Sustained break there will pave the way towards 1.2298 key support. On the upside, above 1.3008 resistance will turn intraday bias neutral again first.

In the bigger picture, considering mildly bearish divergence condition in D MACD, a medium term top is likely in place at 1.3433 already. Price actions from there are seen as correction to whole up trend from 1.0351 (2022 low). Deeper decline would be seen to 38.2% retracement of 1.0351 to 1.3433 at 1.2256, which is close to 1.2298 structural support. Strong support should be seen there to bring rebound.