Significant volatility was seen in the global financial markets last week, driven by the highly anticipated US presidential election. Contrary to expectations of a tight contest, Donald Trump secured a comfortable victory over Kamala Harris, with the Republican Party also achieving a “Red Sweep” by taking control of both the Senate and the House. This political outcome ignited optimism in US equity markets, propelling major indices, including even NASDAQ, to new record highs.

However, Dollar struggled to maintain its post-election momentum. Despite initial gains, Dollar’s rally was capped by a retreat in Treasury yields. If these post-election trends persist, there is prospect of further correction for Dollar in the near term, especially if Treasury yields continue to soften.

Global markets did not uniformly share the US’s optimism. In Europe, Euro ended the week as the worst-performing currency, along with declines in major stock indexes, Germany’s DAX and France’s CAC 40. Concerns over “Trade War 2.0” with the US under Trump’s leadership weighed on European investor sentiment. The Swiss Franc was the second weakest currency, while Dollar ranked as the third weakest performer for the week, highlighting the greenback’s relative underperformance.

Conversely, risk-on sentiment boosted commodity-linked currencies. Australian Dollar emerged as the top performer. However, questions linger about the longevity of this momentum, particularly after China’s announcement of lackluster stimulus measures that fell short of market expectations. Canadian Dollar was the second-best performer, and Yen secured the third spot. Sterling and New Zealand Dollar settled in middle positions.

Election Aftermath: US Stocks Resumes Record Runs; Yields and Dollar Likely to Consolidate

US equity markets soared to new record highs after Donald Trump’s victory in the presidential election and a Republican “Red Sweep” in Congress. DOW climbed 4.61% for the week, while S&P 500 added 4.66%, both marking their best weekly performance since November 2023. NASDAQ Composite outpaced them with a 5.74% gain. This bullish momentum appears set to continue through the remainder of the quarter, with DOW eyeing 45k level and the NASDAQ poised to break through 20k psychological mark.

Technically, the strong support from 55 D EMA (now at 42021.50) reinforces the strength of DOW’s long-term uptrend. Near term outlook will now stay bullish as long as 41647.30 support holds. Next target is 100% projection of 32327.20 to 39889.05 from 38000.96 at 45562.81.

NASDAQ finally powered through 18567.06 high with conviction. Near term outlook will now stay bullish as long as 18083.95 support holds. Immediate focus is 61.8% projection of 12543.85 to 18671.06 from 15708.53 at 19495.15. Decisive break there could prompt further upside acceleration to 100% projection of 21835.75.

In contrast, 10-year Treasury yield saw a notable retreat after initial surge following the recent election results, and it may now enter a period of near-term consolidation, with the possibility of a deeper correction ahead. While Dollar Index advanced modestly, the gain was primarily driven by weakness in Euro rather than broad-based dollar strength. The retreat in Treasury yields is exerting downward pressure on Dollar against most other major currencies, which may continue to limit its upward momentum in the near term. If Treasury yields continue to pull back and equity markets maintain their rally, Dollar Index could be drawn into a near-term correction.

Technically, despite initial spike to 4.477, 10-year yield faced strong resistance from 61.8% retracement of 4.997 to 3.603 at 4.464, as well as medium term falling trend line and retreated. Break of 4.223 support will argue that a short term top was already formed and bring deeper pullback to 55 D EMA (now at 4.083), before staging another rally. Nevertheless, sustained trading above 4.464 will target 4.737 resistance next.

Dollar Index also struggled to build momentum ahead of medium term falling trend line resistance. For now, further rally is expected as long as 103.37 support holds. Rise from 100.15 should still be in progress for 106.13/107.34 resistance zone. But break of 103.37 will confirm short term topping and bring consolidations first.

Global Markets Diverge as US Optimism Fails to Lift European and Asian Stocks

While US markets have surged on optimism, this positive sentiment has not been mirrored globally. European markets, in particular, have shown signs of strain. Major indexes FTSE 100, DAX, and CAC 40 all closed the week in negative territory. Concerns over a “Trade War 2.0” with Trump are casting a shadow over the European economic outlook. Additionally, investors were disappointed by China’s underwhelming fiscal measures announced on Friday, which fell short of expectations for more aggressive action to stimulate growth.

In the UK, the economic environment presents its own set of challenges. The recent inflationary budget appears likely to prompt BoE to adopt a more cautious pace in easing monetary policy. After reducing interest rates by 25bps, as anticipated, BoE emphasized that a “gradual approach” to reducing policy restraint remains “appropriate.” The central bank stressed the necessity for restrictive monetary policy to remain in place for “sufficiently long” to manage inflation risks effectively.

From a market perspective, FTSE’s decline suggests that medium term consolidation from 8474.41 is now extending with another falling leg. Further decline is now in favor as long as 55 D EMA (now at 8236.72) holds. Current fall might extend to 7915.94 support, or even slightly below, before completion.

DAX was relatively resilient though, as it’s still holding in range above 55 D EMA (now at 19055.67) and 18911.72 support. However, firm break of these two support levels will indicate that deeper correction is already underway to medium term trend line (now at around 18000 mark).

In the Asia-Pacific region, markets have performed slightly better. Japan’s Nikkei index rebounded last week, invalidating a near-term head and shoulders top pattern and keeping the rise from 31161.11 intact. Outlook will stay bullish as long as 37651.07 support holds, and break of 40257.34 will pave the way to retest 42426.77 high.

China’s Shanghai SSE composite also extended the near term rebound. With 3174.26 resistance turned support intact, price actions from 3674.40 are viewed as developing into a consolidation only. Further rally through 3674.40 is anticipated at a later stage, but probably only when the Chinese government would deliver something that matches market expectations.

EUR/AUD and EUR/CAD Struggled as Top Movers

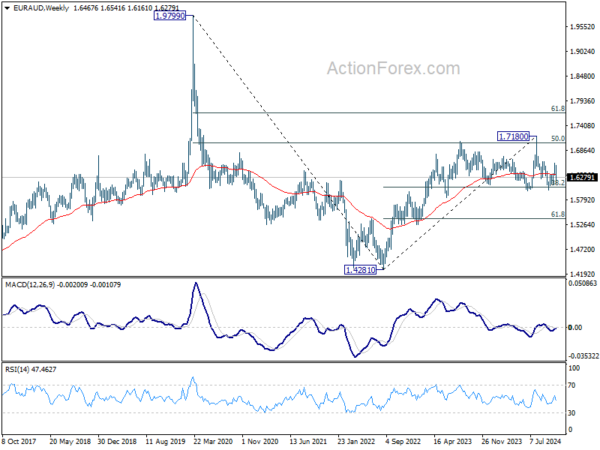

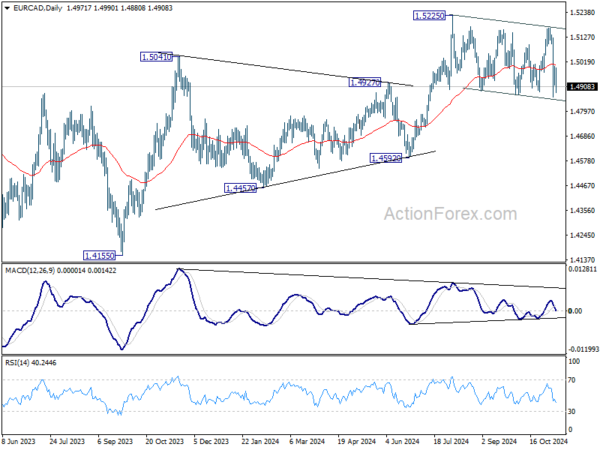

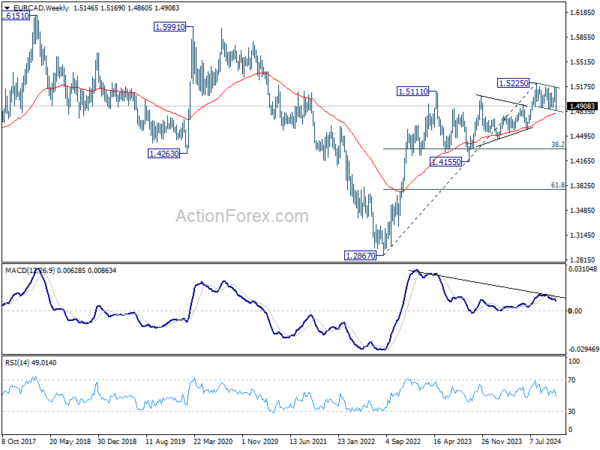

EUR/AUD and EUR/CAD ended as the week’s top movers, both posting significant declines of -1.42% and -1.38%, respectively. The selloff eflects sluggish growth outlook for the Eurozone, compounded by strong risk appetite in US markets, which has bolstered the appeal of commodity-linked currencies.

Technically, EUR/AUD’s sharp decline suggest that rebound from 1.6003 has completed with three waves up to 1.6598. Risk of medium term bearish reversal would continue to grow if EUR/AUD cannot bounce above above 1.6598 resistance zone. Firm break of 1.5996/6002 support zone will extend the fall from 1.7180, even as a correction, to 61.8% retracement of 1.4281 to 1.7180 at 1.5388.

EUR/CAD’s steep decline last week suggests that consolidation pattern from 1.5225 is still extending. While deeper decline is in favor in the near term, outlook will stay bullish as long as 55 W EMA (now at 1.4811) holds. However, considering bearish divergence condition in W MACD, sustained break of 55 W EMA will now argue that EUR/CAD is at least correcting whole up trend from 1.2867. In this case, deeper fall could be seen through 1.4592 support to 38.2% retracement of 1.2867 to 1.5225 at 1.4324.

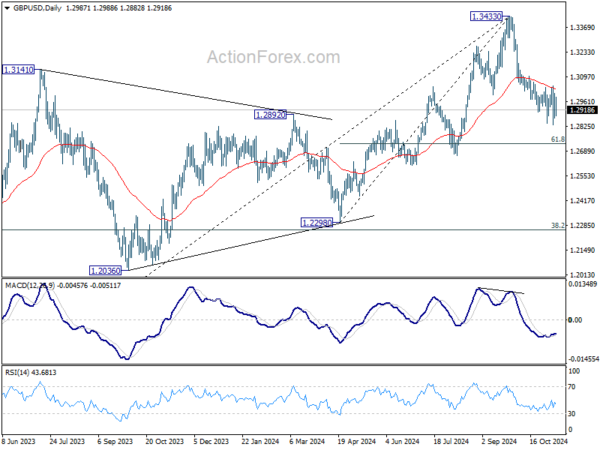

GBP/USD Weekly Outlook

GBP/USD edged lower to 12833 last week but quickly settled back into established range. Initial bias remains neutral this week first, and further decline is expected 1.3047 resistance holds. Break of 1.382 will resume the fall from 1.3433 to 61.8% retracement of 1.2298 to 1.3433 at 1.2732. However, considering bullish convergence condition in 4H MACD, firm break of 1.3047 will indicate short term bottoming, and turn bias back to the upside.

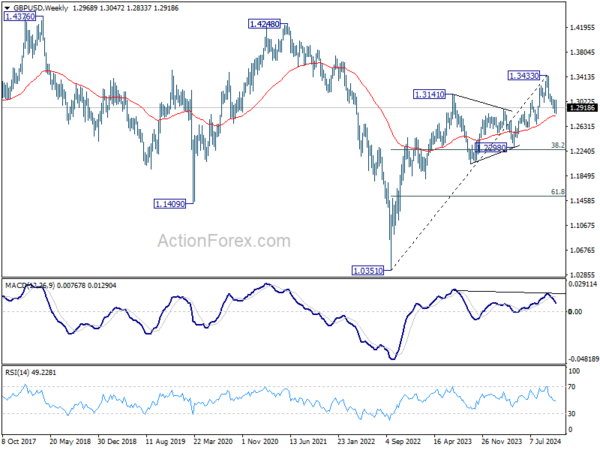

In the bigger picture, considering mildly bearish divergence condition in D MACD, a medium term top is likely in place at 1.3433 already. Price actions from there are seen as correction to whole up trend from 1.0351 (2022 low). Deeper decline would be seen to 38.2% retracement of 1.0351 to 1.3433 at 1.2256, which is close to 1.2298 structural support. Strong support should be seen there to bring rebound.

In the long term picture, as long as 1.2298 support holds, rise from 1.0351 long term bottom is expected to continue. The break of 55 M EMA (now at 1.2811) is a sign of bullish trend reversal. Yet, break of 1.4248 structural resistance is needed confirm. Otherwise, price actions from 1.0351 could just be part of a consolidation pattern.