Australian Dollar remained stable after RBA decided to keep the cash rate unchanged at 4.35% as widely expected. In the post-meeting press conference, Governor Michelle Bullock acknowledged that there has been “good progress” in reducing inflation. However, the central bank did not adopt a more dovish stance, which came as a surprise to some market participants anticipating signals of policy easing in the near term. RBA maintained its position of “not ruling anything in or out,” indicating flexibility but no immediate plans for rate cuts.

The slight downgrade in inflation forecasts was not sufficient to warrant a rate cut son. Consequently, some analysts are now suggesting that, without significant changes in RBA’s statement, the timing of the first rate cut may be pushed beyond February. Unless there is a substantial decline in underlying inflation in the fourth-quarter CPI report, RBA might wait for first-quarter data before taking action. This scenario would make May a more realistic timeframe for initiating a policy easing cycle.

Elsewhere in the currency markets, overall activity remains low as traders await the results of the US presidential election. Dollar continues to sit at the bottom of the performance chart for the week so far, followed by Sterling and Yen. Swiss Franc is leading as the strongest currency, followed by Aussie and then Loonie. Kiwi and Euro are positioned in the middle. Despite these movements, all major currency pairs and crosses are sitting within last week’s ranges, reflecting market indecision.

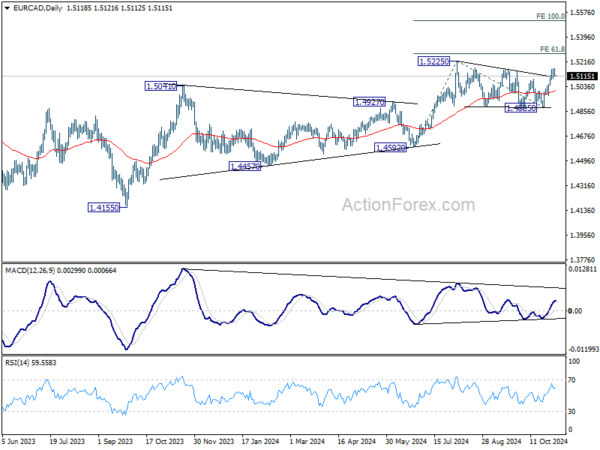

From a technical standpoint, while focus is primarily on Dollar pairs, EUR/CAD is also worth some attention after last week’s strong bounce. Consolidation pattern from 1.5225 might have completed at 1.4885 already. Firm break of 1.5225 will confirm larger up trend resumption for 61.8% projection of 1.4592 to 1.5225 from 1.4885 at 1.5276, and then 100% projection at 1.5518.

In Asia, Nikkei rose 1.45%. Hong Kong HSI is up 1.28%. China Shanghai SSE is up 1.72%. Singapore Strait Times is up 0.11%. Japan 10-year yield is down -0.0097 at 0.936. Overnight, DOW fell -0.61%. S&P 500 fell -0.28%. NASDAQ fell -0.33%. 10-year yield fell -0.052 to 4.309.

RBA stands pat, still not ruling anything in or out

RBA maintained its cash rate at 4.35% today, as expected, while underscoring that inflation risks remain a concern. In its statement, RBA noted that although headline inflation has declined and is projected to stay lower in the short term, it considers underlying inflation as “more indicative” of inflation trends, and this measure remains “too high.”

In line with this cautious approach, the emphasized the need to remain “vigilant to upside risks to inflation,” signaling flexibility by reiterating that it is “not ruling anything in or out.” The ’s latest economic projections offer a more tempered outlook, with slight downward adjustments to growth and inflation forecasts, pointing to persistent caution amid moderated expectations.

Key revisions in the RBA’s projections include:

- Year-average GDP growth: 2024 unchanged at 1.2%, but lowered for 2025 from 2.5% to 2.2% and for 2026 from 2.4% to 2.3%.

- Year-ended CPI: Forecast for December 2024 is revised down from 3.0% to 2.6%, with December 2025 held steady at 3.7%, and December 2026 slightly reduced from 2.6% to 2.5%.

- Trimmed mean inflation: Forecast for December 2024 lowered from 3.5% to 3.4%, with additional downgrade for December 2025 from 2.9% to 2.8%, and December 2026 from 2.6% to 2.5%.

These adjustments reflect an outlook of moderated economic growth and slightly eased inflation pressures. However, RBA’s flexible stance indicates it is prepared to act if inflation risks become more pronounced, balancing economic stability with its inflation objectives.

China’s Caixin PMI composite rises to 51.9, policy impact begins to show

China’s Caixin Services PMI rose to 52.0 in October, surpassing expectations of 50.5 and marking the highest rate of growth in three months. The services sector continues its expansionary streak that began in January 2023. PMI Composite also increased from 50.3 to 51.9, its highest level in four months, maintaining expansion for the 12th consecutive month, driven largely by service-sector resilience.

Wang Zhe, Senior Economist at Caixin Insight Group noted that challenges noted that a range of supportive policies has since been introduced by the Politburo since September. The recent Caixin PMI readings for both manufacturing and services suggest that “market demand stabilized and optimism improved,” signaling early effects of the new policies.

Looking ahead

Swiss unemployment rate, France industrial poroduction and UK PI services final will be released in the European session. Later in the day, Canada will release trade balance. US will release trade balance and ISM services.

AUD/USD Daily Report

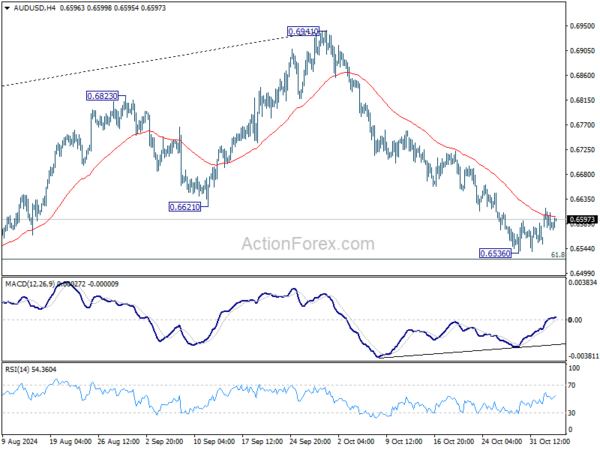

Daily Pivots: (S1) 0.6571; (P) 0.6595; (R1) 0.6611; More...

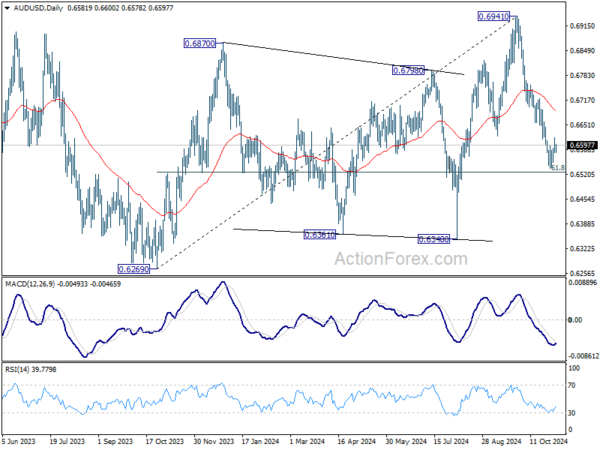

AUD/USD is staying in consolidation above 0.6536 and intraday bias remains neutral. Stronger recovery might be seen, but outlook stays bearish as long as 55 D EMA (now at 0.6688) holds. On the downside, sustained break of 0.61.8% retracement of 0.6269 to 0.6941 at 0.6526 will target 0.6348 support next.

In the bigger picture, rise from 0.6269 (2023 low) should have completed with three waves up to 0.6941. Corrective pattern from 0.6169 (2022 low) is now extending with another falling leg. Deeper decline would be seen back to 0.6269 as sideway trading extends.