Dollar, which has dominated currency markets in recent weeks, finally eased back last week. But this retreat does not necessarily indicate a reversal of its upward momentum. Instead, the greenback appears to be taking a breather ahead of the impending US presidential election. Closing as the second strongest performer among major currencies, Dollar still has potential for further gains, if Treasury yields extends their rally and if post-election developments stir risk aversion.

Euro edged out the greenback to become the strongest currency last week, buoyed by robust economic data from the Eurozone that killed the case for aggressive monetary easing by ECB. However, Euro’s late-week softness against both Dollar and Sterling, raises questions about the sustainability of its rally. New Zealand Dollar also performed well, ending the week as the third strongest currency.

At the weaker end, Australian Dollar struggled at the bottom as disinflation progress finally cracked open the door for RBA rate cuts next year. Japanese Yen was the second weakest, continuing its divergence from Japanese stock markets. Canadian dollar ranked third among the weakest currencies.

Sterling endured a volatile week, swinging between losses and gains, and ultimately settled in the middle. Meanwhile, Swiss Franc managed to hold its ground in the middle too, despite sell off on weaker inflation data, with some market support likely stemming from its status as a safe-haven currency amid ongoing global tensions.

Yields Stay Strong, Stocks Gap Down, Dollar Resilient

The highly anticipated October non-farm payroll report had only a fleeting impact on U.S. financial markets. On the one hand, traders largely overlooked the disappointing headline job growth, recognizing that the figures were heavily distorted by hurricanes and strikes. On the other hand, With the US presidential election and FOMC rate decision imminent, stocks investors and currency traders were cautious about taking substantial positions.

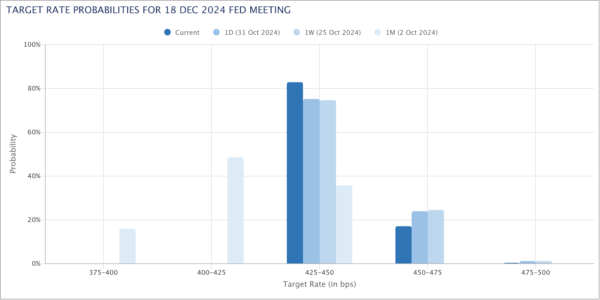

Market expectations for Fed’s policy easing remained largely unchanged after the slew of data last week. Fed funds futures indicate a 98.9% probability of a 25 bps rate cut to 4.50-4.75% at the November 7 meeting. The chance of an additional 25 bps cut to 4.25-4.50% stands at 82.7%, slightly higher than the 74.6% probability a week ago.

Two key developments warrant close attention, though. First, the persistent strength in Treasury yields continues unabated. Despite an initial dip following the non-farm payroll data, 10-year yield rebounded swiftly, closing the week on a strong note. Bond traders seem confident that expansive fiscal policies, regardless of the presidential election outcome, will drive yields higher.

Second, the mid-week selloff in US equities presents a technically concerning picture. The declines in major indices like the S&P 500 and NASDAQ raise questions about whether this is merely pre-election jitters or the beginning of a more sustained reversal.

Technically, near term outlook in 10-year yield will stay bullish as long as 4.178 support holds. Rise from 3.603 is in progress to 61.8% retracement of 4.997 to 3.603 at 4.464. Decisive break there will solidify the case that fall from 4.997 has completed as a corrective three-wave move to 3.603. Further rally should then be seen to 4.737 next.

While it’s still premature to draw a conclusion, firm break of 4.737 resistance would raise the chance that 10-year yield is indeed resuming the whole up trend from 0.398 (2020 low). Next medium term target would then be 38.2% projection of 0.398 to 4.997 from 3.603 at 5.359.

After the gap down on Thursday and subsequent selloff, immediate focus in S&P 500 is now on 5669.67 resistance turned support. Considering bearish divergence condition in D MACD, firm break of 5669.67 and sustained trading below 55 D EMA (now at 5695.63) will confirm medium term topping. Deeper fall would then be seen to channel support at around 5465, even as a correction rather then reversal.

The same gap down on Thursday in NASDAQ was seen as the first sign of rejection by 18671.06 high. Firm break of 17767.79 will argue that rise from 15708.53 has completed as the second leg of the corrective pattern from 18671.06. The third leg would have then commenced back toward 15708.53 support.

It looked like Dollar was ready for a sizeable pullback last week after the huge job growth miss. Yet, the greenback managed to rebound from initial post-NFP dip, taken up by strong bounce in 10-year yield, and closed the week as the second best performer of the week.

With 23.6% retracement of 100.15 to 104.63 at 103.57 in Dollar Index intact, consolidations from 104.63 should be relatively brief. Break of 104.63 will resume the rally from 100.15 to 106.13 resistance.

It’s still early to tell if Dollar Index is reversing the whole fall from 114.77 (2022 high). But break of 106.13.107.34 resistance is possible if 10-year yield extends its march towards 5% while stocks are in extended corrective decline.

Euro Rises, Swiss Franc Slips, Sterling Takes a Wild Ride

In Europe, Euro showed much resilience with bolstered by economic data that support measured rate cut by ECB. Swiss Franc was pressured as declining inflation opens the door for further monetary easing by SNB. In the UK, fiscal policy concerns caused huge volatility in Sterling.

For the Eurozone, Q3 GDP exceeded expectations, and Germany narrowly sidestepped a technical recession. Additionally, October CPI came in higher than anticipated, with headline inflation rebounding and core and services inflation holding firm. This data supports a measured stance from the ECB on policy easing, with no immediate pressure to increase the pace with a 50 basis point rate cut in December. The hawkish members of ECB are likely to maintain their influence, keeping dovish policymakers in the minority.

In Switzerland, however, CPI fell more than forecast in October, slipping to 0.6%—its lowest level since July 2021 and below the midpoint of SNB target range of 0-2% for the second consecutive month. Discussions are now centered on whether SNB will opt for a larger 50 bps reduction in December or adopt a more gradual approach with two 25 bps cuts in December and March. There is also growing speculation that SNB could eventually reintroduce negative interest rates if safe-haven flows into Swiss Franc intensify on escalating global geopolitical tensions and conflicts.

In the UK, Pound has experienced high volatility after the Labour government’s budget announcement. Markets reacted negatively, with criticism focusing on the budget’s emphasis on increased spending, tax hikes, and borrowing, while offering limited impact on economic growth. Pound initially sold off sharply, but a late strong rebound suggested that the market reaction may have been exaggerated. It’s possible that some institutional investors attempted, unsuccessfully, to trigger a more pronounced decline similar to the one observed after former Prime Minister Liz Truss’s mini-budget two years ago, which led to a steep fall in sterling.

While EUR/GBP‘s rebound from 0.8294 was strong, the cross failed to sustain above 0.8433 resistance and reversed after hitting 0.8446. The break of 0.8381 minor support argues that the rebound might be over, and range trading would continue in the near term. Outlook stays bearish for downside breakout through 0.8294 to resume the larger down trend at a later stage.

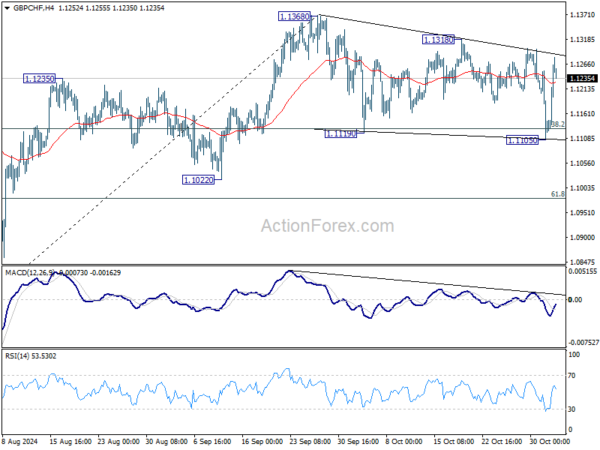

GBP/CHF spiked lower to 1.1105 last week but drew support from 38.2% retracement of 1.0741 to 1.1368 at 1.1128 again and rebounded strongly. Near term outlook stay bullish for now, with focus back on 1.1318 resistance. Firm break there should argue that consolidation from 1.1368 has completed, and the rally from 1.0741 is ready to resume through 1.1368.

EUR/CHF extended the rebound from 0.9331 but failed to breakout from recent converging range. Outlook is mixed for now, as the near term picture suggests that rebound from 0.9209 would resume after consolidation from 0.9579 completes. But failure to do so will keep the medium term outlook bearish for at least a retest on 0.9209 low later.

USD/CAD Weekly Outlook

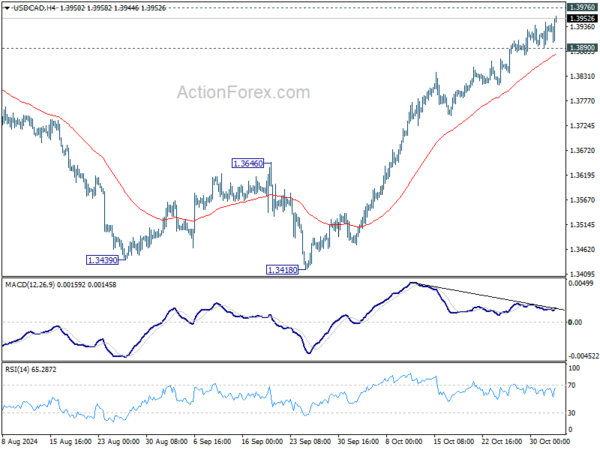

USD/CAD’s rally from 1.3418 continued last week and there is no clear sign of topping yet. Initial bias remains on the upside for 1.3976 resistance. Decisive break there will resume larger up trend. Nevertheless, considering bearish divergence condition in 4H MACD, break of 1.3890 minor support will indicate short term topping, and turn bias back to the downside for deeper pullback.

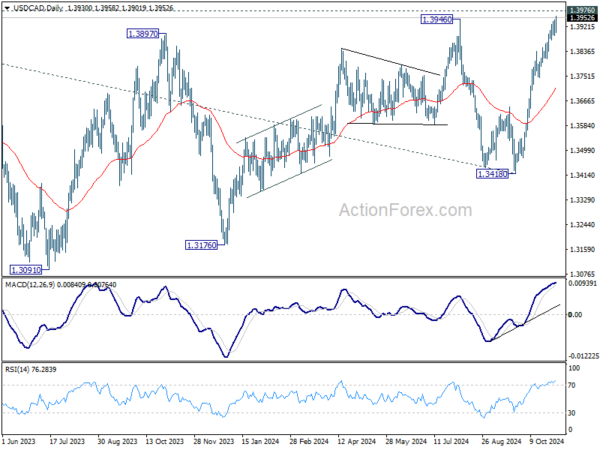

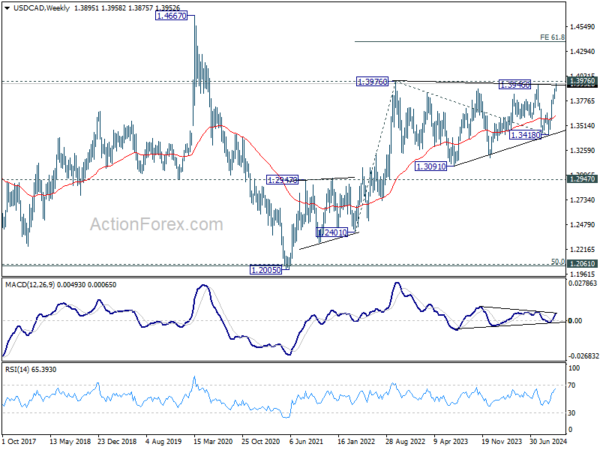

In the bigger picture, sideway consolidation pattern from 1.3976 (2022 high) might still extend further. While another decline cannot be ruled out, strong support should emerge above 1.2947 resistance turned support to bring rebound. Rise from 1.2005 (2021 low) is still in favor to resume at a later stage. Decisive break of 1.3976 will target 61.8% projection of 1.2401 to 1.3976 from 1.3418 at 1.4391.

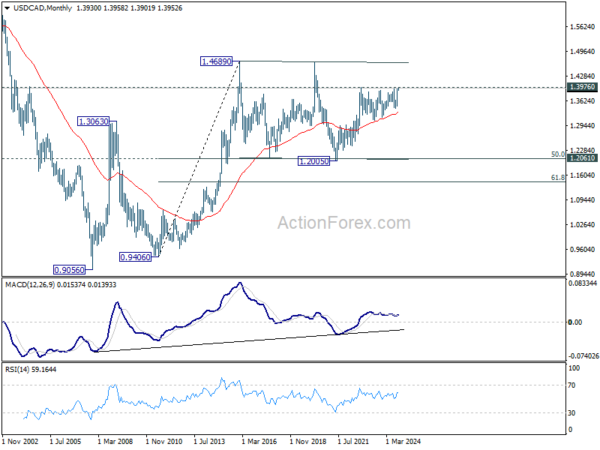

In the longer term picture, price actions from 1.4689 (2016 high) are seen as a consolidation pattern, which might have completed at 1.2005. That is, up trend from 0.9506 (2007 low) is expected to resume at a later stage. This will remain the favored case as long as 1.2947 resistance turned support holds.