Dollar strengthened in the early session, buoyed by surprisingly strong ADP private sector job data that far outpaced expectations. This robust employment figure has bolstered optimism for Friday’s upcoming non-farm payrolls report, which many anticipate will confirm sustained strength in the US labor market. With job growth remaining solid, Fed may feel less pressure to ease its policy aggressively in the near term. However, Dollar’s gains are somewhat tempered by Q3 GDP data, which came in slightly below forecasts, indicating some moderation in overall growth momentum.

Meanwhile, Euro also found support and rallied modestly after Eurozone GDP for Q3 exceeded expectations. Germany, in particular, delivered a surprise by reporting economic growth, allowing it to narrowly avoid a technical recession. This economic resilience lessens the immediate need for ECB to consider more aggressive policy easing in the coming meeting.

In currency markets for the week so far, Euro stands out as the strongest performer, as it’s consolidating recent losses against a resilient Dollar, which holds second place. British pound follows as the third-strongest currency. Yen lags at the bottom of the rankings, while Aussie and Swiss Franc also underperformed. Kiwi and Loonie are positioning in the middle.

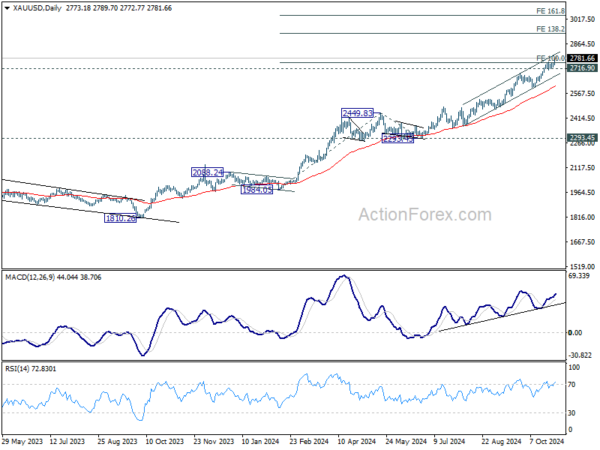

Technically, Gold record-breaking trend resumed after brief consolidations. Outlook will now stay bullish as long as 2716.90 support holds. Next targets are 138.2% projection of 1984.05 to 2449.83 from 2293.45 at 2937.15, and then 161.8% projection at 3047.08.

In Europe, at the time of writing, FTSE is down -0.56%. DAX is down -1.27%. CAC is down -1.54%. UK 10-year yield is down -0.088 at 4.232. Germany 10-year yield is down -0.002 at 2.334. Earlier in Asia, Nikkei rose 0.96%. Hong Kong HSI fell -1.55%. China Shanghai SSE fell -0.61%. Singapore Strait Times fell -0.88%. Japan 10-year JGB yield fell -0.0239 to 0.953.

US Q3 GDP growth slows to 2.8% annualized, vs exp 3.0%

US economy expanded at an annual rate of 2.8% in the third quarter, slightly below the expected 3.0% and down from the previous quarter’s 3.0% growth.

This increase in real GDP was primarily supported by stronger consumer spending, exports, and federal government expenditures. However, a rise in imports, which detracts from GDP, partially offset these gains.

Inflation pressures moderated, with PCE (PCE) Price Index rising by 1.8%, down from 2.5% in Q2 and well below the expected 2.7%.

US ADP jobs rises 233k, hiring robust and resilient

US ADP report revealed robust private sector job growth in October, with employment rising by 233k, well above the forecasted 110k. Sector-wise, service-providing jobs led the way with a 211k increase, while goods-producing jobs added 22k.

By company size, large businesses contributed the most with 140k jobs, followed by medium-sized firms at 86k, and small companies at 4k.

Wage growth trends continued to ease, with year-over-year pay gains for job-stayers slowing to 4.6% and for job-changers to 6.2%.

ADP Chief Economist Nela Richardson highlighted the labor market’s resilience, noting that “even amid hurricane recovery, job growth was strong in October.” As the year approaches its end, the U.S. hiring remains “robust and broadly resilient.”

Eurozone GDP grows 04% qoq in Q3, Germany avoids recession

Eurozone GDP rose by 0.4% qoq in Q3, surpassing the anticipated 0.2% qoq growth. A notable surprise came from Germany, where GDP grew by 0.2% qoq against expectations of a -0.1% qoq contraction, allowing Europe’s largest economy to narrowly avoid a recession. France also outperformed, with GDP increase of 0.3% qoq for the quarter.

For the EU as a whole, GDP expanded by 0.3% qoq. Among member states, Ireland posted the strongest growth at 2.0% qoq, followed by Lithuania at 1.1% qoq and Spain at 0.8% qoq.

However, some economies faced contraction, with Hungary’s GDP declining by -0.7% qoq, Latvia’s by -0.4% qoq, and Sweden’s by -0.1% qoq.

Year-over-year growth was mixed across the EU, with positive annual growth rates reported in seven countries, while six saw negative growth.

Swiss KOF falls to 99.5 in Oct, recovery very hesitant

Swiss KOF Economic Barometer declined sharply from 104.5 to 99.5 in October, missing the expected 105.0 and falling below the 100-point threshold for the first time since January. This shift suggests a weakening outlook for the Swiss economy, with the KOF describing the recovery as “very hesitant.”

In October, indicators across all production-related sectors, including manufacturing, financial and insurance services, hospitality, and construction, showed declines.

Demand-side indicators, such as those for foreign and consumer demand, remained stable but showed little promise of stimulating stronger economic momentum.

Australia’s Q3 CPI slows to 2.8% yoy, goods prices fall but services edge higher

Australia’s Q3 CPI came in softer than anticipated, with consumer prices rising just 0.2% qoq, down from 1.0% qoq in Q2 and below expectations of 0.3% qoq. This marks the lowest quarterly increase since Q2 2020.

On an annual basis, CPI slowed from 3.8% yoy to 2.8% yoy, comfortably returning to RBA’s target range of 2-3% and registering the lowest year-over-year inflation rate since Q1 2021.

Core inflation, measured by trimmed mean CPI, showed resilience with a 0.8% qoq rise, down from Q2’s 0.9% qoq, but slightly above the expected 0.7% qoq. Annually, trimmed mean CPI slowed from 3.9% yoy to 3.5% yoy, aligning with market expectations.

The breakdown shows a notable shift in price pressures: annual goods inflation dropped sharply from 3.2% yoy to 1.4% yoy, largely due to substantial declines in electricity and fuel costs. However, services inflation edged up slightly from 4.5% yoy to 4.6% yoy, driven by higher costs in rents, insurance, and child care.

September monthly CPI echoed this trend, slowing significantly from 2.7% yoy to 2.1% yoy, undershooting expectations of 2.3% and marking the smallest annual increase since July 2021.

This softer inflation data should provide the RBA with room to consider easing its policy stance in the coming months, should inflation remain within target.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0783; (P) 1.0804; (R1) 1.0840; More…

EUR/USD recovered today but stays in range of 1.0760/0871. Intraday bias remains neutral and further decline is still expected. On the downside, break of 1.0760 will resume the fall from 1.1213 to 61.8% retracement of 1.0447 to 1.1213 at 1.0740. Firm break there will target 1.0601 support next. However, considering bullish convergence condition in 4H MACD, break of 1.0871 will indicate short term bottoming, and turn bias back to the upside for 55 D EMA (now at 1.0946).

In the bigger picture, price actions from 1.1274 (2023 high) are seen as a consolidation pattern to up trend from 0.9534 (2022 low), with fall from 1.1213 as the third leg. Downside should be contained by 50% retracement of 0.9534 (2022 low) to 1.1274 at 1.0404, to bring up trend resumption at a later stage.