In the Asian trading session today, the forex markets remained largely in consolidative state, with most major currency pairs moving within familiar ranges. Japanese Yen showed slight firmness, trading in a tight range alongside the Dollar and Kiwi. Conversely, British Pound Sterling softened, accompanied by Loonie and Aussie. The widely anticipated rate cut by PBoC did not elicit significant reactions in Asian markets, indicating that the move was already priced in by investors.

Market activity is expected to remain subdued today due to a near-empty economic calendar. Although several Fed officials are scheduled to speak, they are unlikely to provide substantial new insights that could influence market dynamics. Fed remains on track for two additional 25 basis point rate cuts this year. Some policymakers might indicate the possibility of only one more cut, depending on upcoming economic data.

The main events for the week will take place midweek, with BoC’s widely anticipated rate cut on Wednesday, followed by the release of PMI data from Australia, Japan, the Eurozone, the UK, and the US on Thursday.

Technically, Bitcoin is starting to feel heavy around 70k handle. There is still no decisive momentum to push it through 73812 high. Indeed, break of 66627 support will suggest short term topping, and extend the consolidation pattern from 73812 with another falling leg.

In Asia, at the time of writing, Nikkei is up 0.11%. Hong Kong HSI is down -1.44%. China Shanghai SSE is up 0.36%. Singapore Strait Times is down -0.58%. Japan 10-year JGB yield is down -0.0087 at 0.962.

RBA’s Hauser signals no early rate cuts as inflation remains too high

RBA Deputy Governor Andrew Hauser emphasized today that inflation remains “too high” for the central bank to consider immediate rate cuts.

Recent strong employment data led markets to push back the expected timing for the first rate cut from February to April. Hauser refrained from commenting on the market’s pricing, but noted, “the response of rates to the data does seem to be quite encouraging.”

While acknowledging the importance of data, Hauser stressed that RBA is “data-dependent but not data-obsessed,” noting that broader economic conditions also factor into policy decisions.

“Activity has been weak, very weak, and we haven’t seen the inflation number for the third quarter yet,” he added.

The RBA’s cautious approach contrasts with other central banks that have already begun easing, highlighting Australia’s persistent inflationary pressures. The market will be closely watching the third-quarter inflation data to gauge the timing and magnitude of future policy changes.

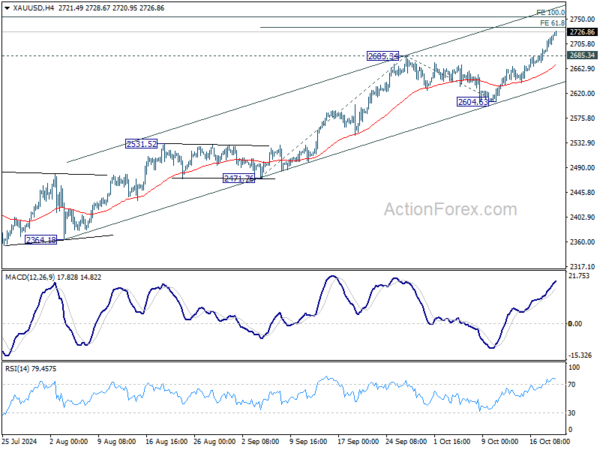

Gold continues record rally amid rising world war fears

Gold prices edged higher in Asian session today, extending their recent record-breaking run. While some market observers attribute the precious metal’s rally to uncertainty surrounding the upcoming US presidential election—with no clear frontrunner between Democrat Kamala Harris and Republican Donald Trump—the persistent climb in U.S. stock markets to new record highs suggests that domestic political factors may not be the primary driver. Instead, escalating geopolitical risks appear to be fueling increased demand for Gold as a safe-haven asset.

In the Middle East, Israel has intensified its military operations in both Gaza and Lebanon following recent developments, including the death of a prominent Hamas leader. Reports indicate that Iran-backed Hezbollah has conducted drone attacks targeting areas near Israeli Prime Minister Benjamin Netanyahu’s residence. The prospects for a near-term ceasefire seem increasingly remote, raising concerns about broader regional instability.

Even more concerning,, tensions are escalating in Eastern Europe. Thousands of North Korean troops are reportedly preparing to support Russia in its ongoing conflict in Ukraine, with some North Korean military officers already deployed. Ukrainian President Zelenskyy warned this could be the “first step to world war,” raising global alarm.

Technically, further rally is expected in Gold as long as 2685.34. Next target is 61.8% projection of 2471.76 to 2685.34 from 2604.53 at 2736.62.

But the a bigger test lies in 100% projection of 1984.05 to 2449.82 from 2239.45 at 2759.23. Strong resistance could be seen there to limit upside initially. However, decisive break above there would prompt upside acceleration. Next medium term target would then be 161.8% projection at 3047.08, which is slightly above 3000 psychological level.

PBoC slashes loan prime rates, HSI unmoved

People’s Bank of China lowered its one-year loan prime rate to 3.1% and trimmed the five-year LPR to 3.6%, as anticipated by market watchers. This move, at the upper end of the 20-25 basis point range suggested by Governor Pan Gongsheng during a Beijing forum last Friday, impacts a broad spectrum of loans in China. The one-year LPR directly influences corporate and household loans, while the five-year LPR serves as a benchmark for mortgage rates.

While this rate cut signifies some level of monetary stimulus, analysts continue to stress that China’s core issue is not the supply of credit, but rather a lack of demand. Many argue that without substantial fiscal stimulus, the impact of these rate adjustments will remain muted.

Hong Kong market barely reacted to the rate cut news. HSI continues to trade in a narrow range between 20k and 21k. However, technically, HSI’s up trend from 14794.16 would remain intact as long as 38.2% retracement of 14794.16 to 23241.74 at 20014.76 holds. Break of 21622.65 resistance will indicate that the correction is over, and bring retest of 23241.74 high.

BoC to Cut Rates by 50bps as Markets Eye PMIs Too

BoC is the focal point in an otherwise light economic calendar this week, with widespread expectations of a 50bps rate cut that would bring the policy rate down to 3.75%. This anticipated move would mark the fourth consecutive rate reduction.

Accompanying the rate decision, BoC will release its quarterly Monetary Policy Report, which is likely to feature downward revisions to its forecasts for economic growth and inflation. The central bank’s aggressive easing stance reflects growing concerns over the need to bolster the economy in the face of persistent headwinds.

A recent Reuters poll highlights market sentiment, with 19 out of 29 economists predicting a 50bps cut, while the remaining 10 expect a smaller 25bps reduction.

Beyond BoC’s decision, the markets will closely monitor PMI readings from major economies, with particular attention on the Eurozone. ECB has expressed clear concern over recent weak economic indicators, and if the upcoming data fails to show significant improvement, it could set the stage for another rate cut in December.

Additional key data releases include US durable goods orders, Germany’s Ifo Business Climate Index, Japan’s Tokyo CPI, and Canada’s retail sales figures.

Here are some highlights for the week:

- Monday: Germany PPI; US leading index.

- Tuesday: New Zealand trade balance; UK public sector net borrowing; Canada IPPI and RMPI.

- Wednesday: BoC rate decision; Eurozone consumer confidence; US existing home sales, Fed’s Beige Book.

- Thursday: Australia PMIs; Japan PMIs; Eurozone PMIs; UK PMIs; US jobless claims, PMIs, new home sales.

- Friday: UK Gfk consumer sentiment; Japan Tokyo CPI, SPPI; Germany Ifo business climate; Eurozone M3 money supply; Canada retail sales, new housing price index; US durable foods orders.

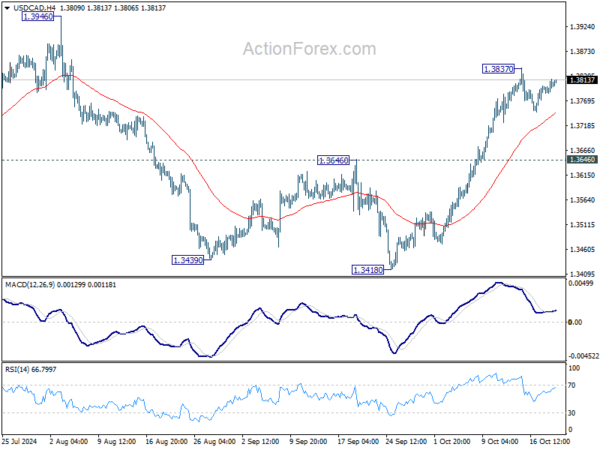

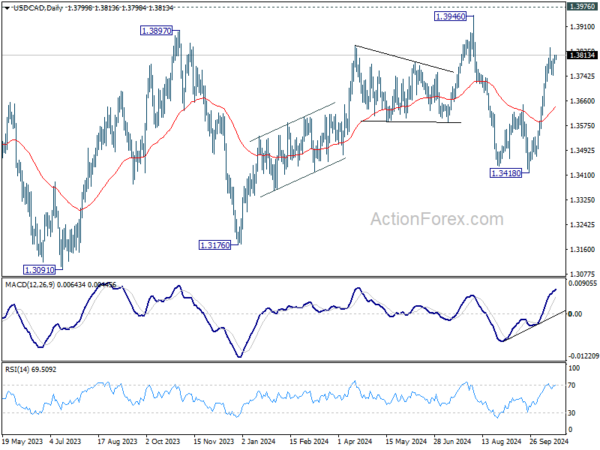

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.3787; (P) 1.3801; (R1) 1.3816; More…

USD/CAD is extending the consolidation pattern from 1.3837 and intraday bias stays neutral. Another retreat cannot be ruled out, but downside should be contained above 1.3646 resistance turned support. On the upside, break of 1.3837 will resume the rally from 1.3418 and target 1.3946/76 key resistance zone.

In the bigger picture, sideway consolidation pattern from 1.3976 (2022 high) might still extend further. While another decline cannot be ruled out, strong support should emerge above 1.2947 resistance turned support to bring rebound. Rise from 1.2005 (2021 low) is still in favor to resume at a later stage.