Risk-on sentiment is back in the global markets, with DOW and S&P 500 surging to new record highs in the latest session. Notably, this rally isn’t limited to just the big tech giants. ETFs tracking both industrials and financials sectors also closed at record highs, signaling that the strength is broad-based, extending across multiple sectors of the economy.

Today’s spotlight is on the US CPI report, which is expected to show further easing in headline inflation. However, core inflation may continue to show signs of stickiness. This CPI data is unlikely to alter market expectations of a 25bps rate cut by Fed in both November and December, which fed funds futures indicate have over 80% probability. However, the CPI numbers could significantly influence Fed’s upcoming economic projections in December, shaping expectations for the first quarter of 2025 and beyond.

In Asia, markets are also staging a strong comeback, with both Hong Kong and China seeing robust rebounds following a bout of extreme volatility. The People’s Bank of China has launched a CNY 500B initiative to inject liquidity into the financial system by allowing institutional investors to swap their bond and stock holdings for government securities. This move, alongside expectations for a fiscal stimulus announcement during Finance Minister Lan Foan’s press conference on Saturday, is bolstering market sentiment in the region.

Currency markets, meanwhile, show a familiar theme of strength in Dollar, which remains the strongest performer of the week so far, followed by Euro and Swiss Franc. Commodity-linked currencies, including New Zealand Dollar, Canadian Dollar, and Australian Dollar, continue to underperform despite today’s recovery. Yen and Pound are holding in mid-range positions.

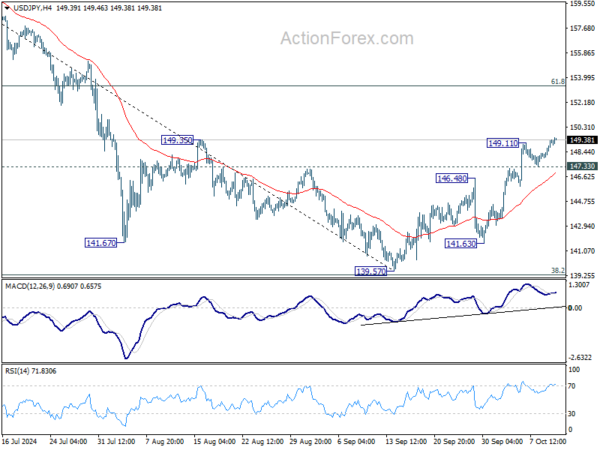

Technically, USD/JPY’s rally from 139.57 resumed after brief consolidations. Further rise is expected as long as 147.33 support holds, towards 61.8% retracement of 161.94 to 139.57 at 153.39. The question is, however, whether Japan would step up verbal intervention as USD/JPY rises through 150 psychological level, and the impacts on the markets.

In Asia, at the time of writing, Nikkei is up 0.29%. Hong Kong HSI is up 3.82%. China Shanghai SSE is up 2.72%. Singapore Strait Times is down -0.02%. Japan 10-year JGB yield is up 0.0156 at 0.949. Overnight, DOW rose 1.03% S&P 500 rose 0.71%. NASDAQ rose 0.60%. 10-year yield rose 0.034 to 4.067.

Fed’s 50bps rate cut backed by majority, but divisions emerge on future easing pace

Fed’s decision to cut interest rates by 50 basis points last month was backed by a “substantial majority,” but the minutes of the meeting revealed a more intense debate among policymakers. Only Governor Michelle Bowman dissented, while others showed mixed views on the appropriate pace of easing.

Some participants expressed that a 25bps cut would have been more suitable given inflation remains elevated, economic growth is stable, and unemployment is low. These participants argued that a smaller reduction could support a “more gradual path” for policy normalization, allowing time to assess the economy’s response. A few also noted that a 25bps move would signal a “more predictable path” to the markets.

Looking ahead, the split in views deepens. Nearly all participants agreed that the upside risks to inflation had diminished, while most observed increasing downside risks to employment. However, the timing and extent of further rate cuts remain debated.

Some participants stressed that waiting too long to ease policy could “unduly weaken” economic activity and employment, with significant costs if such a weakening were “fully under way”. In contrast, others warned that easing “too soon or too much” could risk “stalling or a reversal of the progress on inflation”. Given the uncertainty regarding the “longer-term neutral rate” and its implications, some said it’s “appropriate to reduce policy restraint gradually”.

Fed’s Daly: One or two more cuts likely this year

San Francisco Fed President Mary Daly expressed a cautious stance on monetary policy in a discussion last night, indicating that “two more cuts this year, or one more cut this year, really spans the range” of likely outcomes.

With inflation cooling, she noted that inflation-adjusted rates have been rising, which could overburden an economy nearing Fed’s employment and inflation targets. Daly warned that such conditions could “break the economy,” stating her desire to prevent further slowing in the labor market.

In a separate speech, Boston Fed President Susan Collins reinforced this measured approach, stating that she supported Fed’s initial 50bps cut and sees further adjustments as likely.

Collins emphasized the importance of a “careful, data-based approach” as rates are lowered to support the economy while ensuring policy remains adaptable to incoming data.

Japan’s PPI rises 2.8% yoy in Sep, import prices tumble

Japan’s PPI rose by 2.8% yoy in September, a notable increase from the previous month’s 2.6% yoy and well above the market’s expectation of 2.3% yoy.

A significant development was the shift in import prices. Yen-based import price index dropped sharply by -2.6% yoy, turning negative for the first time in eight months. This is a stark reversal from the 10.7% yoy rise recorded as recently as July. Export prices also followed a similar downward trend, falling by -1.0% yoy after previously rising by 2.5% yoy.

On a month-over-month basis, PPI remained flat at 0.0% mom, while yen-based import price index decreased by -2.9% mom, and the export price index fell by -1.7% mom. The decline in both import and export prices reflects a combination of softer global demand and a stronger Yen.

Looking ahead

ECB meeting accounts will be the main focus in European session. Later in the day, US CPI will take center stage while weekly jobless claims will also be published.

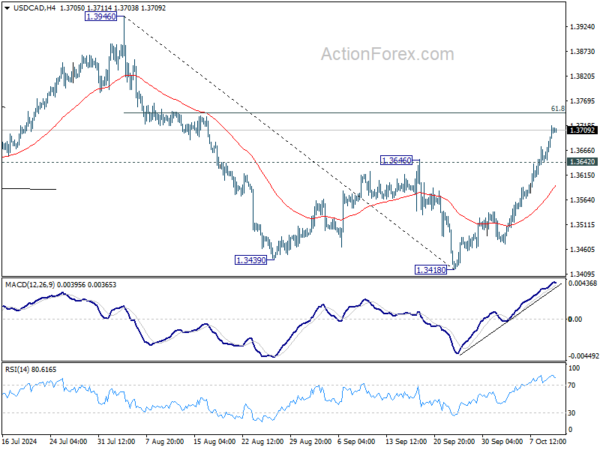

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.3663; (P) 1.3691; (R1) 1.3739; More…

USD/CAD’s rally from 1.3418 continues today and intraday bias stays on the upside. Pullback from 1.3946 should have completed at 1.3418 already. Rise from there would target 61.8% retracement of 1.3946 to 1.3418 at 1.3559. Decisive break there will target 1.3946 again. On the downside, below 1.3642 minor support will turn intraday bias neutral first.

In the bigger picture, sideway consolidation pattern from 1.3976 (2022 high) might still extend further. While another decline cannot be ruled out, strong support should emerge above 1.2947 resistance turned support to bring rebound. Rise from 1.2005 (2021 low) is still in favor to resume at a later stage.