Sterling fell sharply today after BoE Governor Andrew Bailey surprised markets by suggesting the possibility of aggressive rate cuts in an interview with The Guardian. Market expectations quickly adjusted, with swaps now fully pricing in a 25bps cut in November. The odds of a second 25bps cut in December also surged to 70%, up from 40% just a day earlier.

However, it is crucial to note that while being the face of BoE, Bailey’s comments reflect just his personal stance, and BoE’s MPC is known to be divided. The narrow 5-4 vote in favor of the 25bps rate cut back in August highlighted these internal divisions, and future decisions could be just as close. Greater clarity on BoE’s direction will emerge when other influential members of the MPC, such as Deputy Governor Dave Ramsden and Chief Economist Huw Pill, share their perspectives.

Meanwhile, Swiss Franc has shown relative resilience despite softer inflation data. Switzerland’s CPI for September came in lower than expected, marking the weakest inflation reading in over three years. But even without this piece data, SNB is still widely expected to implement another 25bps rate cut in December to 0.75%. The main question now is whether SNB’s terminal rate will go as low as 0.50% or even 0.25%. However, as the pace of rate cuts by ECB and BoE could outpace that of SNB, that would keep Franc relatively stable for now.

Overall in the currency markets this week so far, Dollar is the strongest performer, followed by Loonie and then Aussie. Yen is the weakest, followed by Sterling and then New Zealand Dollar, with Swiss Franc and Euro positioned in the middle.

Technically, AUD/USD’s pull back from 0.6941 is accelerating today, with focus now on 0.6823 resistance turned support. Decisive break there will confirm short term topping, and bring deeper correction towards 0.6621 support. The pair’s next move would very much depend on how the stock markets performer at the upcoming Asian session, as well as US markets’ reaction to NFP tomorrow.

In Europe, at the time of writing, FTSE is down -0.03%. DAX is down -0.72%. CAC is down -1.04%. UK 10-year yield is down -0.0104 at 4.015. Germany 10-year yield is up 0.0468 at 2.144. Earlier in Asia, Nikkei rose 1.97%. Hong Kong HSI fell -1.47%. China was on holiday. Singapore Strait Times fell -0.20%. Japan 10-year JGB yield rose 0.0076 to 0.827.

US initial jobless claims rises to 225k, vs exp 220k

US initial jobless claims rose 6k to 225k in the week ending September 28, above expectation of 220k. Four-week moving average of initial claims fell -750 to 224k.

Continuing claims fell -1k to 1826k in the week ending September 21. Four-week moving average of continuing claims fell -5k to 1829k.

BoE’s Bailey signals potential for “activist” rate cuts as inflation pressures fade

In an interview with The Guardian, BoE Governor Andrew Bailey highlighted that cost of living pressures have not been as persistent as the Bank previously feared, which could open the door for more proactive rate cuts.

He noted that if positive inflation data continues, the BoE may adopt a “more activist” stance on reducing interest rates, which currently stand at 5%.

However, Bailey also pointed to geopolitical risks, particularly in the Middle East, as a threat. “Geopolitical concerns are very serious,” he said, acknowledging that ongoing conflicts could add strain to already “stretched markets.”

UK PMI services finalized at 52.4, optimism remains amid cooling inflation

UK PMI Services was finalized at 52.4 in September, down from August’s 53.7, while PMI Composite declined to 52.6 from 53.8. Despite the slight slowdown, the UK economy remains in positive territory, supported by improving order books and easing inflationary pressures.

Tim Moore, Economics Director at S&P Global Market Intelligence, highlighted that the decline in prices charged within the service sector—an important indicator of domestic inflation—reached its lowest level since February 2021. This cooling inflation is a promising sign for the broader economy, particularly as businesses prepare for the Autumn Budget on October 30th.

Although some service sector firms reported delays in decision-making due to uncertainty surrounding the upcoming budget, a majority (56%) of respondents expect a rise in business activity over the next year, with only 11% forecasting a downturn.

Business optimism saw a modest improvement compared to August, driven by lower borrowing costs, easing inflation, and more clarity on monetary policy expectations.

Eurozone PPI rises 0.6% mom in August, energy prices drive monthly increase

Eurozone PPI rose by 0.6% mom in August, exceeding expectations of 0.3% mom. On a year-over-year basis, however, PPI fell by -2.3% yoy, slightly better than the anticipated -2.4% yoy decline.

Breaking down the monthly data, Eurozone’s industrial producer prices showed varying trends across sectors. While intermediate goods saw a slight decline of -0.1% mom, energy prices surged by 1.9% mom, driving the overall increase in PPI. Capital goods prices edged up by 0.1% mom, while prices for both durable and non-durable consumer goods remained stable.

EU’s PPI rose by 0.4% mom but was down -2.1% yoy. Among individual countries, Estonia led with a 2.2% monthly increase in industrial producer prices, followed by Greece at 1.7% and Spain at 1.5%. On the downside, Ireland recorded the largest decrease, with prices falling by -3.8%, followed by Lithuania (-1.7%) and Romania (-1.6%).

Eurozone PMI composite finalized at 49.6, all big three economies in contraction

Eurozone PMI Services was finalized at 51.4 in September, down from August’s 52.9. PMI Composite fell to 49.6 from 51.0, both hitting 7-month lows. This marks the first month since December 2023 that all of the big-three Eurozone economies showed signs of contraction.

Spain led with a Composite PMI of 56.3, a 4-month high. However, Italy recorded a 9-month low at 49.7, France fell to 48.6, a 6-month low, and Germany’s Composite PMI dropped to 47.5, a 7-month low.

Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, pointed out that service sector growth has slowed across the Eurozone, especially in Germany, Italy, and France, where activity “almost hit a wall”.

He added that the decline in new business is a worrying sign, indicating that the service sector will “continue to deteriorate,” dragging overall economic growth. With the industry also in contraction, Q3 growth in the Eurozone is expected to be minimal.

On the positive side, service sector operating costs saw their slowest rise since early 2021, and inflation in selling prices is easing. This economic softness strengthens the case for ECB to cut interest rates in October, a possibility ECB President Christine Lagarde has recently hinted at.

Swiss CPI slows to 0.8% yoy in Sep, import product prices plunge -2.7% yoy

Swiss CPI dropped by -0.3% mom in September, falling short of the expected -0.1% mom decline. Core CPI, which excludes fresh and seasonal products as well as energy and fuel, also declined by -0.2% mom. Prices for domestic products fell by -0.2% mom, while prices for imported goods saw a steeper decline of -0.5% mom.

On an annual basis, Swiss CPI growth slowed to 0.8% yoy, down from 1.1% and below expectations of 1.1% yoy. Core inflation eased to 1.0% from 1.1%. Notably, prices for imported goods dropped by -2.7% yoy, down from -1.9% yoy. Domestic product prices remained steady at 2.0% yoy.

The sharper-than-expected slowdown in inflation adds pressure on SNB to consider additional rate cuts. With core inflation and imported goods prices continuing to decline, SNB may need to act to prevent deflationary risks from taking hold in the coming months.

BoJ’s Noguchi urges patience before Japan’s inflation mindset shifts

BoJ Board Member Asahi Noguchi, a known dovish, emphasized in a speech today that Japanese society still needs “considerable time” to go before fully adopting a mindset aligned with the central bank’s 2% inflation target. Noguchi highlighted the importance of BoJ maintaining its accommodative monetary policy until this shift in mindset occurs.

With inflation surpassing the 2% target for over two years and nominal wages rising, Japanese firms are increasingly willing to pass on higher costs through price hikes. However, Noguchi highlighted that real consumption remains weak, as households continue to expect low price growth—a mindset shaped by Japan’s prolonged deflationary period.

Japan’s PMI services finalized at 53.1, composite at 52.0

Japan’s services sector continued its expansion in September, although growth eased slightly. The final Services PMI was recorded at 53.1, down from 53.7 in August, marking a sustained rise in business activity for all but one of the past 25 months. Composite PMI, which includes both services and manufacturing, stood at 52.0, down from 52.9 in August, remaining above the 50-neutral threshold for the third consecutive month.

Usamah Bhatti, economist at S&P Global Market Intelligence, highlighted that the service sector’s strong performance carried into the end of Q3. The average reading for Q3 (53.5) was largely in line with Q1’s average of 53.4, signaling “sustained growth” in the service economy.

However, the manufacturing sector continued to struggle, weighing on overall private sector performance. While service sector remains a pillar of growth, aggregate new business growth slowed in September, and backlogs of work fell for the fifth consecutive month. The outlook for the wider private sector will depend on how the service economy responds to downside risks, including a stagnating economy.

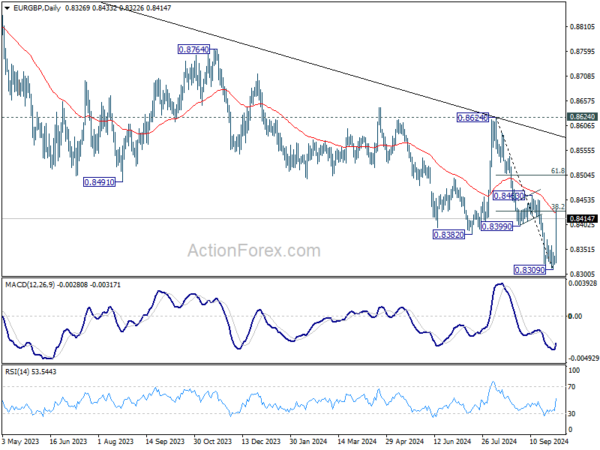

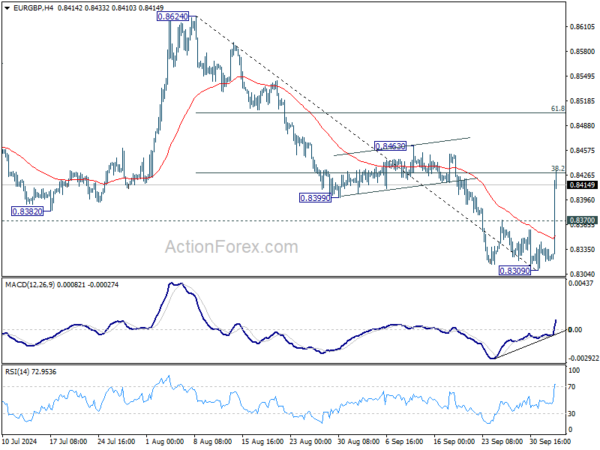

EUR/GBP Mid-Day Outlook

Daily Pivots: (S1) 0.8319; (P) 0.8329; (R1) 0.8335; More…

EUR/GBP’s strong rebound and break of 0.8370 resistance confirms short term bottoming at 0.8309. Intraday bias is back on the upside. Decisive break of 38.2% retracement of 0.8624 to 0.8309 at 0.8429 will pave the way to 61.8% retracement at 0.8504 and possibly above. On the downside, below 0.8370 resistance turned support will turn intraday bias neutral first.

In the bigger picture, down trend from 0.9267 (2022 high) is in progress. Next target is 0.8201 (2022 low), but strong support should be seen there to bring rebound. However, outlook will remain bearish as long as 0.8624 resistance holds even in case of strong rebound.