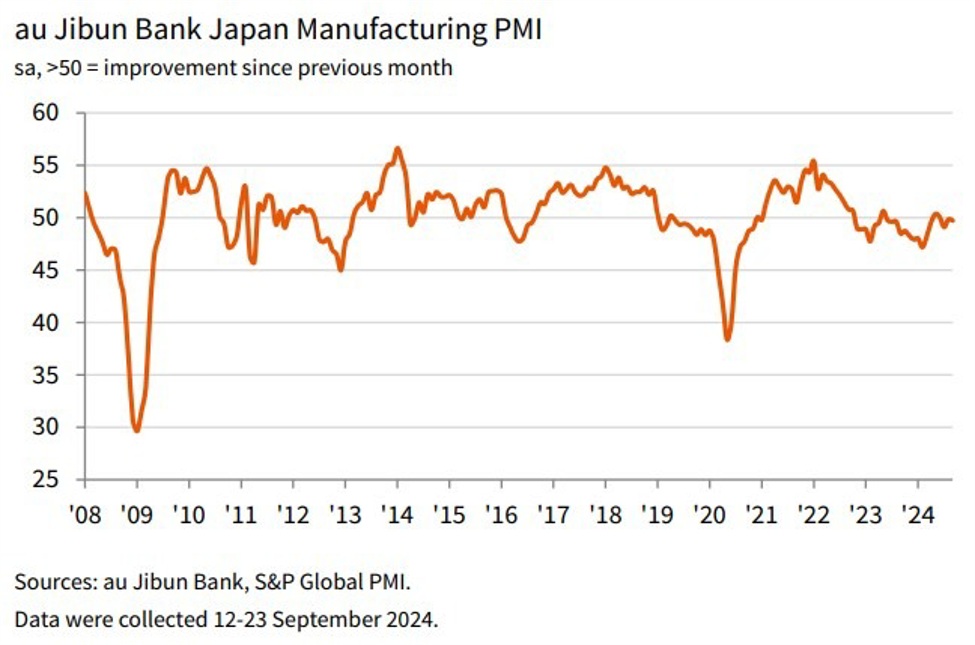

Manufacturing PMI from Japan for September 2024, the final from S&P Global / Jibun Bank.

Another contraction result.

Preliminary is here:

The key points in the report:

- Output levels fall for second time in three months

- Slowest rise in employment levels in current seven month sequence

- Output charge inflation reaches lowest since June 2021

This is not a great report, but they haven’t been for a while. Japan’s latest Purchasing Managers’ Index (PMI) results indicate a subdued outlook for the manufacturing sector, with both output and new orders slipping into contraction. The data also shows a significant slowdown in job creation, and companies have reported a decline in vendor performance.

In response to these challenges, many manufacturers have ramped up their input purchases, aiming to stockpile materials in anticipation of a future recovery in demand. Some businesses also cited extended delivery times as a motivation for early procurement, seeking to mitigate the risk of further delays.

Despite the current challenges, manufacturers remain optimistic about a rebound in output over the next year, with overall confidence above the long-term average. However, the level of positive sentiment has softened, reaching its lowest point since late 2022, as some firms express growing concerns about the future.