Via a note from JP Morgan on the China stimulus proposals that hit the headlines on Tuesday:

- The US has been the anchor for global growth, but a China reboot will also benefit the globe

- It may create another inflationary pressure, so keep an eye on commodities and bond yields over the coming weeks

—

JPM highlights in the note that global growth has gained an additional boost from China, a factor that had been absent in recent years. This development significantly lowers the risk of a recession and is positive for the markets.

However, they also warn of a potential risk of reinflation.

Its difficult to disagree with this as a risk. China’s stimulus could drive up commodity prices, which may contribute to a renewal of inflation pressure, at least to some extent in headline figures. For the US, core inflation should continue to drip lower given shelter costs decreasing.

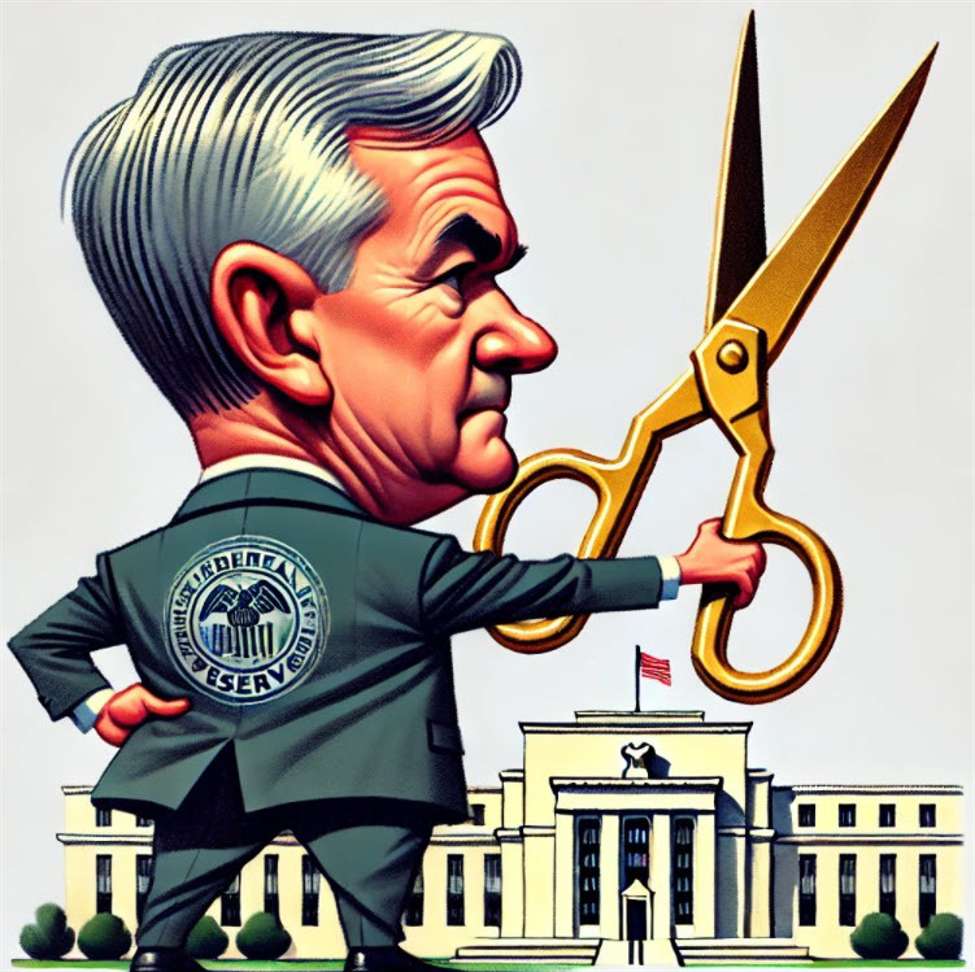

Chair Powell preparing for a BIG cut?

This article was originally published by Forexlive.com. Read the original article here.