Dollar finished last week on the back foot, reacting to Fed’s decision to cut rates by 50 bps. While the greenback lost ground to most major rivals, its decline was relatively modest. Notably, Dollar managed to close higher against both Japanese Yen and Swiss Franc, and it continued to hold above key near term support level versus Euro. US stock market’s rally to fresh record highs lacked its usual exuberance, with market sentiment appearing somewhat half-hearted. This tempered risk-on mood, coupled with rebound in US treasury yields, helped mitigate more substantial selling pressure on Dollar.

Weakness in Japanese Yen was much more pronounced, primarily due to the cautious tone struck by BoJ, which signaled that it’s not in a rush to raise interest rates again in the near term. This stance weighed heavily on Yen, which had already been under pressure from surging bond yields in the US and Europe. Technically, Yen’s short-term rebound seems to have well concluded, and the currency is now embarking on a fresh decline.

Sterling, on the other hand, stood out as one of the top performers, supported by a combination of strong UK economic data and more hawkish-than-expected outcome from BoE. The Pound broke key resistance levels against both Euro and Swiss Franc, solidifying its position as one of the top gainers, with more upside potential ahead.

For the week overall, Yen was the clear laggard, followed by Swiss Franc and Dollar. On the flip side, Australian Dollar emerged as the best performer, while Sterling was a close second. New Zealand Dollar also performed well, rounding out the top three. The Euro and Canadian Dollar ended the week more neutrally, positioning themselves in the middle of the pack.

DOW and S&P 500 Break Records after Fed, Yet Market Rally Lacks Usual Excitement

Following Fed’s 50bps rate cut last week, US markets responded with measured gains as DOW and S&P 500 climbed to fresh record highs. However, the rally lacked the exuberance typically seen in the wake of major policy shifts. This tempered reaction can be attributed to the fact that much of the cut had already been priced in the prior week, fueled by growing speculation. Additionally attention has already shifted back to the uncertainty surrounding Fed’s next move.

The updated dot plot revealed a nearly even split within the FOMC. Ten of the 19 Fed members have signaled the possibility of an additional 50bps cut by the end of the year, while nine are leaning towards a more cautious 25bps cut. Meanwhile, the futures market reflects a different sentiment, pricing in 51.4% probability of a 50bps cut in November and 74.2% likelihood of a total 75bps reduction by year’s end. This divergence highlights the uncertainty in the market, making it difficult to predict how aggressive Fed will be in its upcoming meetings.

The path forward for Fed will surely depend on upcoming economic data, but how? While inflation has been moderating, the question remains whether this disinflationary trend will be enough to warrant another bold move. In all likelihood, only a significant drop in inflation or a marked deterioration in labor market conditions could prompt a more aggressive cut. However, a weakening job market could reignite fears of an economic slowdown, raising recession concerns, which would likely be viewed unfavorably by investors.

Complicating the outlook further is the looming US presidential election in November. With political uncertainty hanging over the markets, many investors may choose to hold off on making significant moves until there is more clarity regarding the election outcome. This added layer of uncertainty will likely keep markets cautious in the months ahead.

Technically, for DOW, 61.8% projection of 32327.20 to 39889.05 from 38000.96. at 42674.18 could present signficant resistance, at least for the first attempt. But in any case, outlook will stay bullish as long as 55 D EMA (now at 40554.65) holds. Decisive break of 42674.18 would pave the way to 100% projection at 45562.81.

For the bullish scenario to fully materialize, several factors must align. The markets would need to see meaningful improvements in inflation data, continued strength in the labor market, and a favorable outcome from the US election, or at least one that is perceived as market-friendly. Without these supportive conditions, the market’s rally could stall, and the outlook could become increasingly fragile.

US 10-Year Yield Stabilizes into Range Trading, Dollar Index Lacks Strong Downward Momentum

US 10-year yield’s rebound last week brought D MACD back above signal line. Considering bullish convergence condition too, a short term bottom might be in place at 3.603 already. While there is prospect of stronge recovery, upside will likely be limited by 3.923 resistance to set the range for sideway trading.

On the downside, in case of another fall through 3.603, strong support is now expected from 100% projection of 4.997 to 3.785 from 4.737 at 3.253 to bring rebound. For 10-year yield to break through 3.253, a significant policy shift by Fed towards continously aggressive rate cuts would likely be necessary.

While Dollar Index breached 100.51 to resume the fall from 106.13, there is a lack of clear downside momentum. EUR/USD’s struggle to breakout from near term range is a major factor flooring Dollar Index’s fall. At the same time, the rebound from USD/JPY is another support.

Still, near term outlook in Dollar Index will stay bearish as long as 101.91 resistance holds, for 99.57 (2023 low). But the speed of the decline would depends on overall development in risk sentiment as well as treasury yields.

BoJ’s Cautious Tone Drags Yen Lower, Lifts Nikkei

The Japanese Yen ended last week as the weakest currency, partly driven by surging bond yields in the US and Europe, and coupled with a more cautious tone from BoJ. Although the decision to keep interest rates unchanged was anticipated, BoJ Governor Kazuo Ueda’s remarks during the post-meeting press conference left markets somewhat disappointed, with some even interpreting his remarks as slightly dovish. This development not only weighed on the yen but also spurred a strong rebound in Japan’s Nikkei index.

Governor Ueda reaffirmed that rate hikes are on the card if economic conditions and inflation align with BoJ’s projections. However, he was quick to highlight the uncertainties in the global economy, especially regarding the US. Additionally, Ueda pointed out that inflationary pressures resulting from Yen’s weakness were fading, giving the BoJ some leeway to mull over its next move. Overall, the messages suggested that BoJ isn’t in any rush to raise interest rates again this year.

Nikkei’s strong rally last week and the break of 55 D EMA suggests that pullback from 39080.64 has already completed at 35253.43. Rise from 31156.11, as the second leg of the corrective pattern from 42426.77 high, should still be in progress, and could extend to 61.8% projection of 31156.11 to 39080.64 from 35253.43 at 40150.78.

Nikkei’s anticipated break of 39080.64 resistance, if realized, should be accompanied by break of corresponding resistance in Yen crosses.

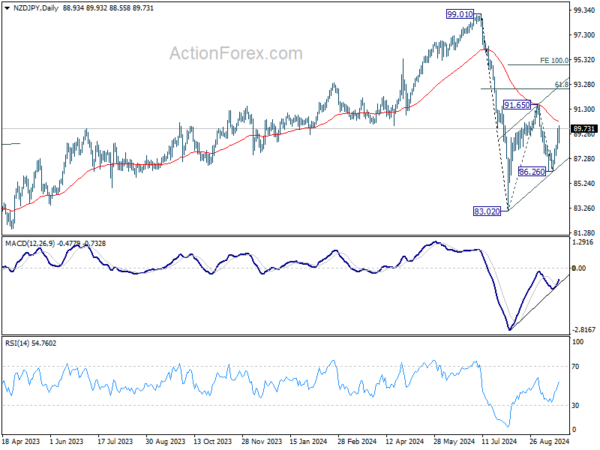

In similar developments, NZD/JPY’s strong rebound from 86.26 argues that pull back from 91.65 has already completed. On the upside, sustained break of 55 D EMA (now at 90.30) will solidify the case that rise from 83.02, as the second leg of the corrective pattern from 99.01 high), is ready to resume through 91.65. NZD/JPY would then target 61.8% retracement of 99.01 to 83.02 at 92.90, or even further to 100% projection of 83.02 to 91.65 from 86.26 at 94.89.

GBP Breaks Key Levels on Strong UK Data and Hawkish BoE

Sterling finished last week as one of the top performers, breaking through key resistance levels against both Euro and Swiss Franc. The Pound’s momentum was largely driven by a combination of strong UK economic data and a more hawkish-than-anticipated outcome from BoE’s meeting.

While the decision to hold rates at 5.00% was widely expected, the surprise came with an 8-1 vote, as Deputy Governor Dave Ramsden unexpectedly sided with the majority in holding rates. BoE’s statement underlined that a “gradual approach” to easing would be taken, as services inflation remains “elevated.” The market consensus still leans toward a rate cut in November, but after this week’s developments, it’s no longer a certainty.

Meanwhile, UK inflation data pointed to persistent price pressures. CPI remained steady at 2.2% in August, but core CPI rose more than expected to 3.6%. Services inflation also climbed from 5.2% to 5.6%. Another surprise came in retail sales, which jumped 1% in August, with annual growth reaching 2.5%, the highest since February 2022. These figures suggest that despite high interest rates, demand remains robust, keeping inflation risks elevated.

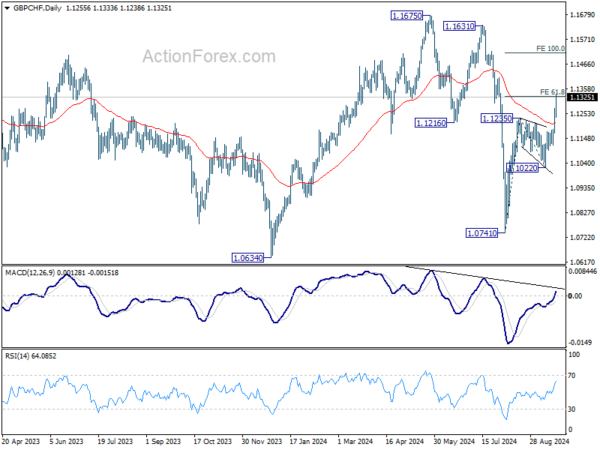

GBP/CHF’s strong break of 1.1235 resistance confirmed resumption of whole rebound from 1.0741. Outlook will stay bullish as long as 55 D EMA (now at 1.1214) holds. Sustained trading above 61.8% projection of 1.0741 to 1.1235 from 1.1022 will pave the way to 161.8% projection at 1.1516.

From a medium-term perspective, the break of 55 W EMA is also a bullish sign, and there is prospect of resuming whole rebound from 1.1083 (2022 low). Even as a corrective move, GBP/CHF could target 61.8% retracement of 1.3070 to 1.0183 at 1.1967 in the medium term.

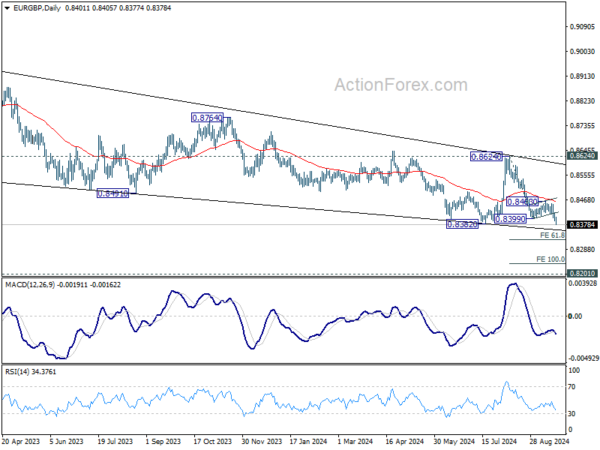

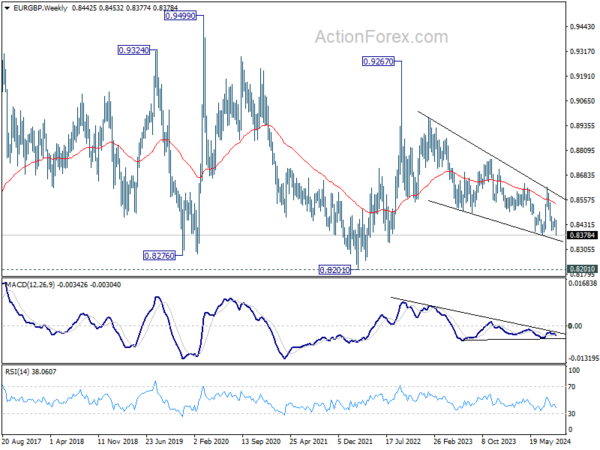

EUR/GBP’s close below 0.8382 support indicates that down trend from 0.9267 (2022 high) is resuming. For the near term, next target will be 61.8% projection of 0.8624 to 0.8399 from 0.8463 at 0.8324.

The medium-term outlook remains bearish with recovery attempts capped by falling 55 W EMA. The key question now is whether EUR/GBP could break through lower trend line support (now at around 0.8345) decisively. That could prompt downside acceleration towards 0.8201 key support (2022 low).

AUD/USD Weekly Report

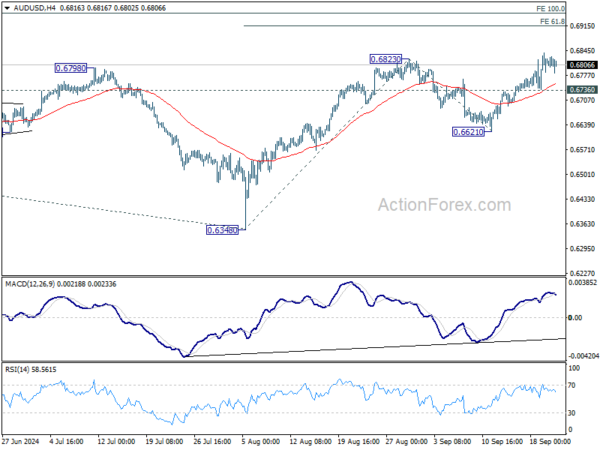

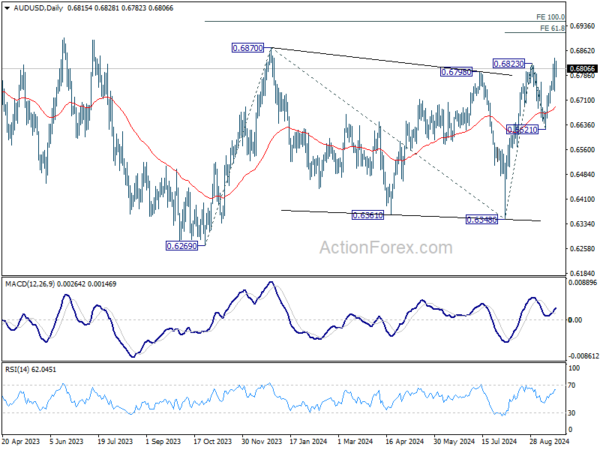

AUD/USD’s rally from 0.6438 resumed by breaking through 0.6823 last week. Initial bias stays on the upside this week for 61.8% projection of 0.6348 to 0.6823 from 0.6621 at 0.6915 next. On the downside, below 0.6376 minor support will turn intraday bias neutral first. But outlook will remain cautiously bullish as long as 0.6621 support holds, in case of retreat.

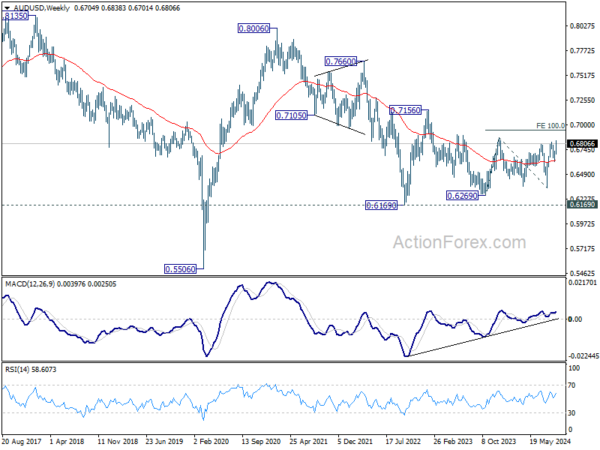

In the bigger picture, overall, price actions from 0.6169 (2022 low) are seen as a medium term corrective pattern, with rise from 0.6269 as the third leg. Firm break of 6870 resistance zone will target 100% projection of 0.6269 to 0.6870 from 0.6340 at 0.6941. In case of another fall, strong support should be seen from 0.6169/6361 to bring rebound.

In the long term picture, the down trend from 1.1079 (2011 high) should have completed at 0.5506 (2020 low) already. It’s unsure yet whether price actions from 0.5506 are developing into a corrective pattern, or trend reversal. But in either case, fall from 0.8006 is seen as the second leg of the pattern. Hence, in case of deeper decline, strong support should emerge above 0.5506 to bring reversal.