There is an interesting dynamic this week with non-farm payrolls on Friday and the FOMC blackout period starting Friday at midnight. If the jobs report is middling, it doesn’t leave much time for officials to signal that a 50 basis point cut is likely. Of course, they could always turn to a leak to the WSJ or someone else.

In any case, Citi has already seen enough, citing JOLTS that are weaker than in 2019.

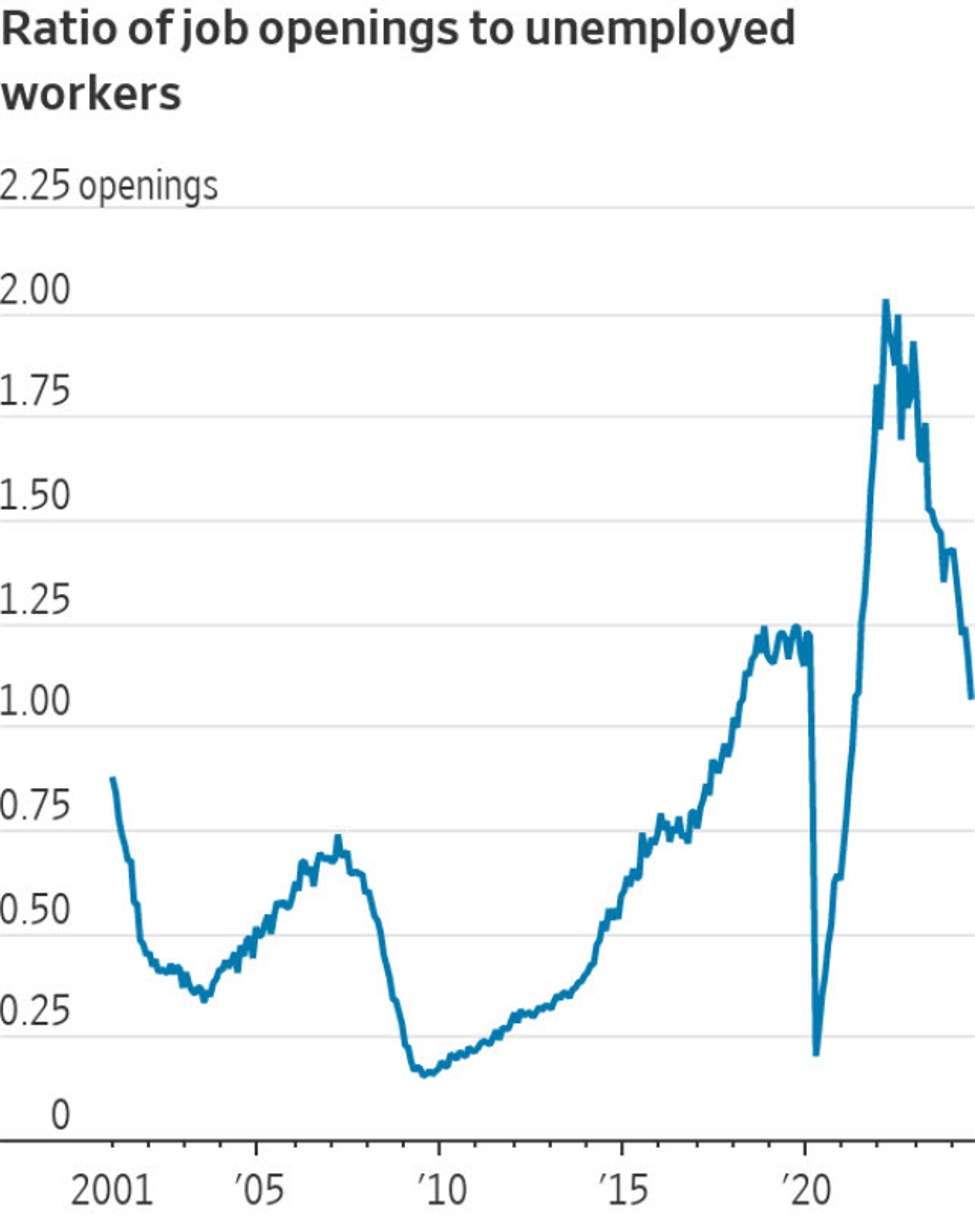

“The labor market is looser than it was pre-pandemic and continues to loosen further, according to the July JOLTS report. Job openings fell from 8184k in June (now revised down) to

a below-consensus 7673k in July. The ratio of openings to unemployed individuals is down to 1.1-to-1, below the 1.2-to-1 ratio that prevailed just prior to the pandemic. The hiring rate increased to a still-subdued 3.5% from 3.3% with government hiring falling. The layoff rate remains low at 1.2%, but the labor market increasingly looks to be at an inflection point with an even sharper weakening likely coming. A 50bp rate cut in September is likely.”

The same stat was also cited by the WSJ’s Nick Timiraos: