Dollar extended its broad decline overnight following release of FOMC minutes, which confirmed that a vast majority of Fed members see a rate cut in September as appropriate. However, the market reaction was relatively muted, as this outcome has already been largely priced in by traders. The real uncertainty centers on the size of the rate cut—whether Fed will opt for a modest 25bps reduction or take a more aggressive stance with 50bps cut. Current market pricing suggests about 35% probability of the latter.

Attention is now turning to Fed Chair Jerome Powell’s speech at the Jackson Hole Symposium on Friday, where investors will be keen to glean any hints about Fed’s upcoming decision. However, it’s unlikely that Powell will commit to a definitive course of action, given that Fed will have another set of key economic data, including CPI and NFP reports, before its next meeting.

For the week so far, Dollar remains the weakest performer, continuing to struggle amid expectations of an imminent rate cut. Canadian Dollar and Australian Dollar are also under pressure. In contrast, Swiss Franc has emerged as the strongest currency, followed by New Zealand Dollar and Japanese Yen. Euro and British Pound are positioning in the middle of the currency performance spectrum.

One notable development is Australian Dollar’s loss of upside momentum, which seems to be mirroring the slowdown in US stock market rally, as major indexes approach the record highs set in July.

Technically, S&P 500’s rally from 5119.26 has been losing steam as seen in H MACD. Break of 55 H EMA (now at 5539.20) will indicate initial rejection by 5669.67 high, and bring deeper pullback. Aussie could follow lower if that materializes.

In Asia, at the time of writing, Nikkei is up 0.63%. Hong Kong HSI is up 0.11%. China Shanghai SSE is down -0.01%. Singapore Strait Times is down -0.14%. Japan 10-year JGB yield is up 0.0110 at 0.877. Overnight, DOW rose 0.14%. S&P 500 rose 0.42%. NASDAQ rose 0.57%. 10-year yield fell -0.0400 to 3.778.

FOMC minutes: Vast majority see September rate cut as likely

Minutes from FOMC meeting held on July 30-31 reveal that a “vast majority” of participants believe it would likely be appropriate to ease monetary policy “at the next meeting” if incoming data aligns with expectations. This signals a strong possibility of a rate cut in September.

The minutes highlighted that economic activity had shown solid growth, inflation had made some further progress toward the target, and labor market conditions had eased. However, the Committee emphasized the importance of maintaining a “data-dependent” approach. Decisions, they noted, are based on the “evolution of the economy” rather than following a “preset path,” and depend on the “totality of the incoming data” rather than any single data point.

In terms of risk management, the majority of participants acknowledged that risks to the employment goal had increased, while many noted that risks to the inflation goal had decreased. Some expressed concern that gradual easing in labor market conditions could lead to a “more serious deterioration.”

On the other hand, several participants cautioned against reducing policy restraint too quickly or excessively, warning that it could lead to resurgence in aggregate demand and potentially undo progress on inflation. They pointed to risks such as economic shocks that could drive inflation higher or the possibility that inflation could be more persistent than currently anticipated.

Japan’s PMI composite rises to 53.0, increasing margin pressures

Japan’s PMI data for August revealed a mixed yet overall positive picture for the economy. PMI Manufacturing inched up from 49.1 to 49.5, still indicating contraction but showing improvement. PMI Services increased from 53.7 to 54.0, signaling continued strong expansion in the service sector. As a result, PMI Composite, which combines both manufacturing and services, rose from 52.5 to 53.0, reflecting sustained overall growth.

Jingyi Pan, Economics Associate Director at S&P Global Market Intelligence, noted that the solid expansion of business activity at Japanese private sector firms continued into Q3. She highlighted that growth was largely driven by an acceleration in services activity, while manufacturing output returned to positive growth after a brief decline in July.

Pan pointed out that “overall optimism levels remained above average,” suggesting that firms are confident about growth in the months ahead. However, she also warned of rising “margin pressures” across both manufacturing and service sectors. This concern arises as overall selling price inflation dropped to its lowest level since November 2023, even though average input costs rose at the fastest pace in 16 months.

Australia’s PMI composite rises to 51.4, inflation risks remain

Australia’s PMI data for August revealed a slight uptick in economic activity, with Manufacturing PMI rising from 47.5 to 48.7, Services PMI increasing from 50.4 to 52.2, and Composite PMI climbing from 49.9 to 51.4.

Warren Hogan, Chief Economic Advisor at Judo Bank, noted “improvement in activity indicators,” coupled with “further upward pressure on business costs,” and “weakening in final prices.” Hogan emphasized that the Australian economy continues to expand in the third quarter, with rising demand for labor being a positive sign.

Meanwhile, the final prices index dipped, indicating that Australian businesses are struggling to pass on higher costs to consumers. Hogan warned that if this trend continues, it could signal some easing of inflation pressures, but at the expense of business margins and profitability.

Hogan also expressed caution regarding the outlook for inflation, pointing out that the ongoing rise in business costs and improving economic activity—likely boosted by the tax cuts implemented in July—underscore the continued inflation risks in the economy.

He questioned the financial markets’ certainty in pricing the next move in RBA’s cash rate as a cut, stating, “There is nothing in these results that allows us to reduce the probability that the RBA may still have to raise the cash rate further before a concerted easing cycle can begin.”

Looking ahead

Eurozone and UK PMI flash will be released in European session, along with ECB meeting accounts. Later in the day, US will release jobless claims, PMI flash and existing home sales.

EUR/AUD Daily Outlook

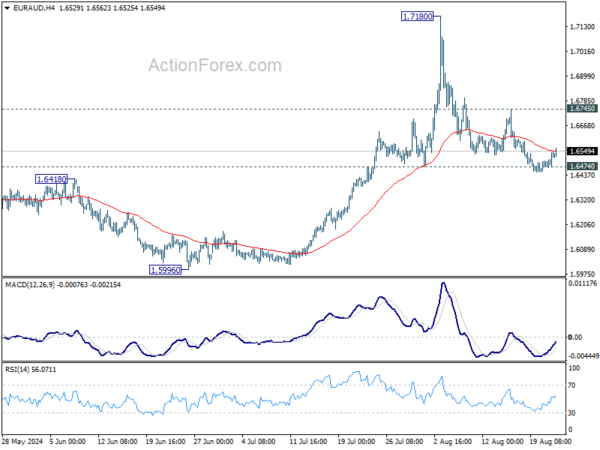

Daily Pivots: (S1) 1.6489; (P) 1.6518; (R1) 1.6564; More…

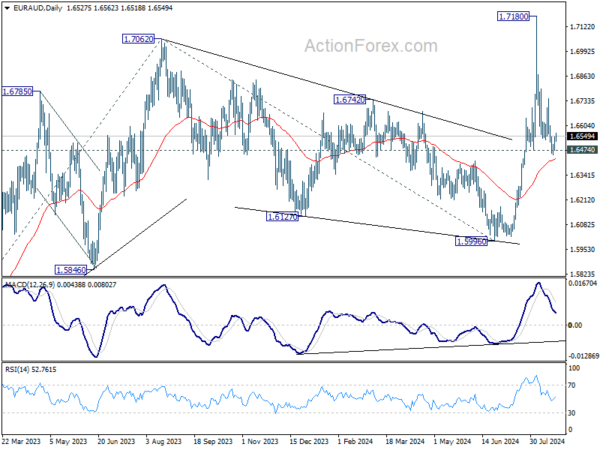

EUR/AUD recovered after failing to sustain below 1.6474 support, but stays below 1.6745 resistance. Intraday bias remains neutral first, and rise from 1.5996 is still in favor to continue. On the upside, break of 1.6745 resistance will suggest that pullback from 1.7180 has completed, and retain near term bullishness. Further rise should then be seen back to retest 1.7180 high. However, decisive break of 1.6474 will argue that rise from 1.5996 has completed, and dampen the larger bullish view.

In the bigger picture, corrective fall from 1.7062 medium term top should have completed at 1.5996. Larger up trend from 1.4281 (2022 low) is resuming. Next target is 61.8% projection of 1.4281 to 1.7062 from 1.5996 at 1.7715. This will now remain the favored case as long as 1.6474 support holds. However, decisive break of 1.6474 will argue that EUR/AUD is still engaging in medium term range trading.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:00 | AUD | Manufacturing PMI Aug P | 48.7 | 47.5 | ||

| 23:00 | AUD | Services PMI Aug P | 52.2 | 50.4 | ||

| 00:30 | JPY | Manufacturing PMI Aug P | 49.5 | 49.8 | 49.1 | |

| 00:30 | JPY | Services PMI Aug P | 54.0 | 53.7 | ||

| 07:15 | EUR | France Manufacturing PMI Aug P | 44.6 | 44 | ||

| 07:15 | EUR | France Services PMI Aug P | 50.5 | 50.1 | ||

| 07:30 | EUR | Germany Manufacturing PMI Aug P | 43.5 | 43.2 | ||

| 07:30 | EUR | Germany Services PMI Aug P | 52.4 | 52.5 | ||

| 08:00 | EUR | Eurozone Manufacturing PMI Aug P | 46.1 | 45.8 | ||

| 08:00 | EUR | Eurozone Services PMI Aug P | 52.2 | 51.9 | ||

| 08:30 | GBP | Manufacturing PMI Aug P | 52.2 | 52.1 | ||

| 08:30 | GBP | Services PMI Aug P | 52.8 | 52.5 | ||

| 11:30 | EUR | ECB Meeting Accounts | ||||

| 12:30 | USD | Initial Jobless Claims (Aug 16) | 230K | 227K | ||

| 13:45 | USD | Manufacturing PMI Aug P | 49.4 | 49.6 | ||

| 13:45 | USD | Services PMI Aug P | 54.2 | 55 | ||

| 14:00 | USD | Existing Home Sales Jul | 3.89M | 3.89M | ||

| 14:00 | EUR | Eurozone Consumer Confidence Aug P | -11 | -13 | ||

| 14:30 | USD | Natural Gas Storage | 26B | -6B |