We’ve been spared from summer doldrums in financial markets this year but early next week could be something of a dud, particularly until Jackson Hole begins.

Monday kicks off with Fed’s Waller speaking at 09:15 am ET but that will be all for the day.

Tuesday features speeches from the Fed’s Bostic and Barr but is otherwise bare.

Wednesday is hardly better with only EIA weekly crude oil stocks and a 20-Year bond auction. The highlight will be the FOMC Minutes release at 14:00 pm ET; expect some dovish indicators there.

Thursday is when it picks up with jobless claims data, S&P Global PMIs (composite, services, and manufacturing), and existing home sales. The consensus for Initial Jobless Claims is 229K while existing home sales are expected to show a 0.4% decline. The Jackson Hole Symposium also begins, with extra Fed interviews usually scheduled for the early US morning.

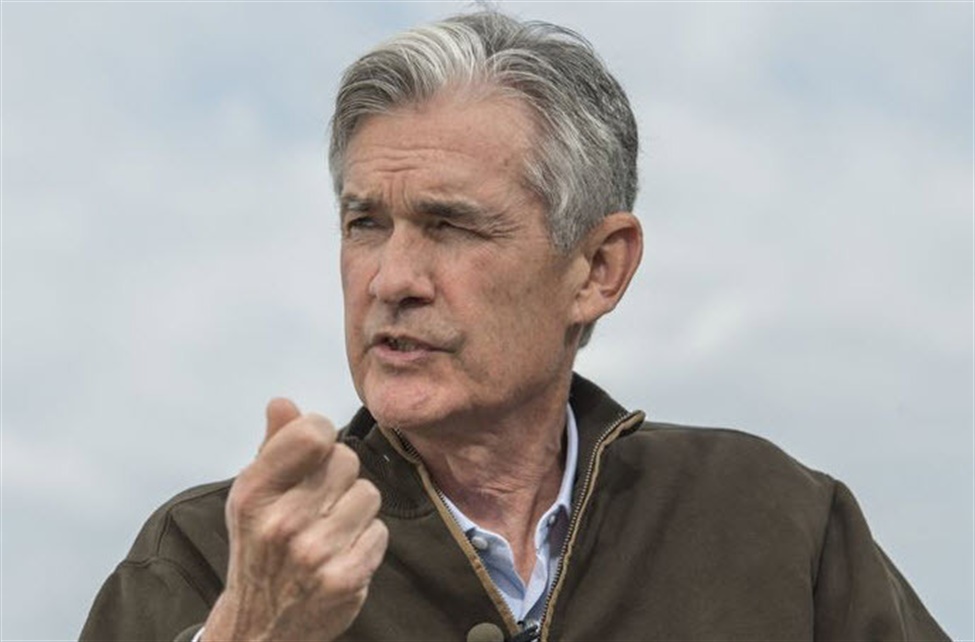

Friday closes the week with new home sales data, expected to show a 0.6% decline to 0.63 million. The main event will be Fed Chair Powell’s speech at 10:00 am ET from Jackson Hole but with Fed pricing at 75% for 25 bps, I don’t currently see a need to make any big waves. Baker Hughes US Oil Rig Count and CFTC position data round out the day.

The Jackson Hole Symposium continues through Saturday.

For more, see the economic calendar.