Fundamental

Overview

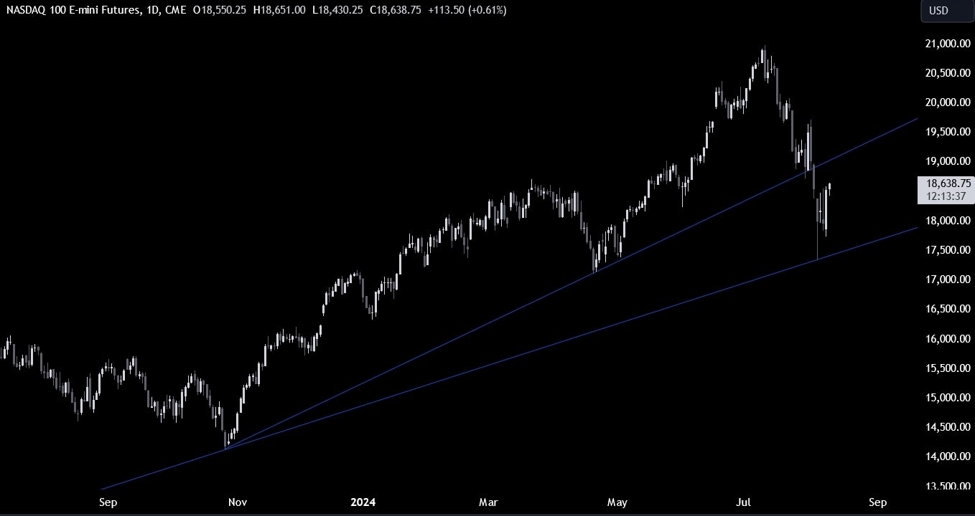

The Nasdaq bounced strongly from the lows yesterday following good US Jobless Claims figures as the data

quelled some of the fears around the labour market after the weak US NFP report last Friday.

The market pricing for rate

cuts eased a bit but remains quite elevated with a 55% probability of a 50 bps

cut in September and a total of 103 bps of easing by year-end. If the NFP

report was indeed negatively impacted by Hurricane Beryl, which is what has

been transpiring from the data, then we can expect the market to go back to the

old script of resilient growth and positive risk sentiment.

Moreover, the Japanese

markets shouldn’t be a problem anymore given that the Japanese officials made

it pretty clear that they won’t proceed with more tightening given the

volatility in the markets.

Nasdaq

Technical Analysis – Daily Timeframe

Nasdaq Daily

On the daily chart, we can

see that the Nasdaq eventually bounced on the trendline around the 17400 level and extended

the gains following the US Jobless Claims figures. The target for the buyers

should stand around the broken trendline at the 19000 level. That’s where we

can expect the sellers to step in with a defined risk above the trendline to

position for a drop back into the lows targeting a breakout.

Nasdaq Technical

Analysis – 4 hour Timeframe

Nasdaq 4 hour

On the 4 hour chart, we can

see that we had a strong resistance

zone around the 18500 level but the price is breaking out today. We can expect

more buyers piling in with a defined risk below the zone to increase the

bullish bets into the 19000 level. The sellers, on the other hand, will want to

see the price falling back below the zone to position for a drop back into the

lows.

Nasdaq Technical

Analysis – 1 hour Timeframe

Nasdaq 1 hour

On the 1 hour chart, we can

see that in case the price were to fall back below the zone, we might see a

pullback into the upward trendline. That’s where we can expect the buyers to

step back into the market to position for a rally into the 19000 level with a

much better risk to reward setup. The sellers, on the other hand, will want to

see the price breaking below the trendline to increase the bearish bets into

the lows targeting a break below the major trendline. The red lines define the average daily range for today.