News flow has been slow today, with only second-tier economic data coming out of Europe and no major releases from the US. Some attention is turning towards Canada, where BoC is set to release its summary of deliberations from the July 24 meeting, which resulted in the second rate cut in a row. Despite Governor Tiff Macklem’s insistence that BoC sets monetary policy independently of Fed, weak US jobs data have led some economists to speculate that both Fed and BoC might accelerate their monetary easing. In light of recent market turbulence, the insights from the BoC governing council are increasingly significant.

Overall, New Zealand Dollar is the standout performer today, bolstered by robust employment data that effectively rules out a premature rate cut by RBNZ next week. Australian Dollar and Canadian Dollar are also performing well, buoyed by recovering global risk sentiment. Conversely, Japanese Yen is the weakest performer, impacted by improved risk sentiment and remarks from a senior BoJ official dismissing the likelihood of another near-term rate hike. Swiss Franc and Euro are also underperforming, while Dollar and British Pound are positioned in the middle.

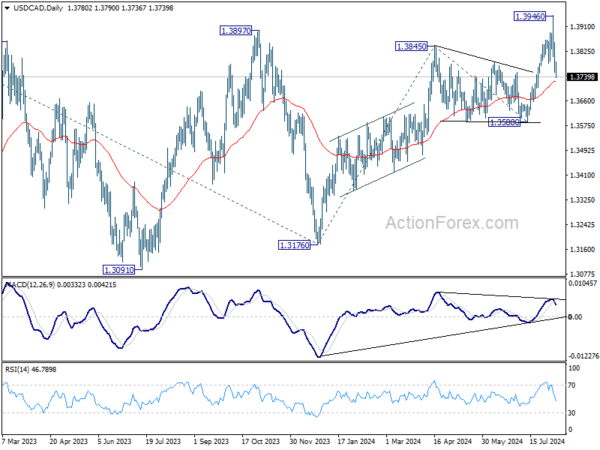

Technically, USD/CAD’s short term top is extending lower today with focus now on 55 D EMA (now at 1.3724). Strong rebound from the EMA will keep near term bullishness intact. Rise from 1.3176 would still be in favor to resume through 1.3946 at a later stage. However, sustained break of the EMA will raise the chance of reversal, and bring deeper fall to 1.3588 support for confirmation.

In Europe, at the time of writing, FTSE is up 1.10%. DAX is up 1.10%. CAC is up 1.40%. UK 10-year yield is up 0.0470 at 3.971. Germany 10-year yield is up 0.0799 at 2.281. Earlier in Asia, Nikkei rose 1.19%. Hong Kong HSI rose 1.38%. China Shanghai SSE rose 0.09%. Singapore Strait Times rose 1.60%. Japan 10-year JGB yield fell -0.0136 to 0.880.

BoJ’s Uchida: To keep interest rate for the time being due to extreme global market volatility

In a speech today, BoJ Deputy Governor Shinichi Uchida emphasized the necessity of maintaining monetary easing with the current policy interest rate “for the time being”, citing “extremely volatile” recent developments in both Japanese and global financial and capital markets. Uchida assured that BoJ is monitoring these developments with “utmost vigilance” and will adjust monetary policy as appropriate.

Uchida reiterated that if the outlook for economic activity and prices is realized, BoJ would “continue to raise the policy interest rate.” Howeer, he noted that “significant movements in stock prices and foreign exchange rates since last week” are particularly relevant in shaping this outlook.

Furthermore, Uchida pointed out that the recent correction in Yen’s depreciation has reduced the “upside risk to prices arising from higher import prices.” This adjustment in Yen’s value “affects the conduct of monetary policy.”

New Zealand employment grows 0.4% in Q2, above expectations

New Zealand’s employment data for Q2 showed unexpected strength, with employment growing by 0.4%, defying expectations of a -0.3% contraction. However, the unemployment rate increased from 4.4% to 4.6%, which was still better than the anticipated 4.7%. The labor force participation rate also saw a modest rise of 0.2% to 71.7%, while the employment rate remained steady at 68.4%.

All sector wage inflation was recorded at 1.2% qoq and 4.3% yoy. Private sector wage inflation stood at 0.9% qoq and 3.6% yoy. The public sector saw higher wage inflation at 1.8% qoq and 6.9% yoy, with the annual rate hitting a series high.

China’s exports grow 7.0% yoy in Jul, imports rises 7.2% yoy

China’s export growth for July came in at 7.0% yoy, falling short of the expected 9.7% yoy increase. Exports to the US and EU each grew by about 8% yoy, while exports to ASEAN countries surged by 12% yoy.

Imports, on the other hand, rose by 7.2% yoy, exceeding the expected 3.5% growth. Notably, imports from the US surged by 24% yoy, imports from ASEAN countries increased by 11% yoy, and imports from the EU climbed by 7% yoy.

As a result, China’s trade surplus narrowed from USD 99.1B to USD 84.6B, which was smaller than the expected USD 99.2B.

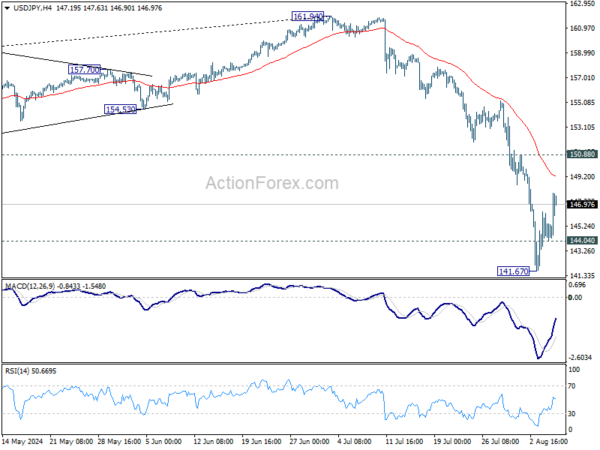

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 143.21; (P) 144.79; (R1) 145.95; More…

USD/JPY is staying below 150.88 resistance despite current rebound. Intraday bias remains neutral and further decline is expected. On the downside, below 144.04 minor support will bring retest of 141.67 first. Break there will resume the fall from 161.94 to 140.25 support next.

In the bigger picture, the strong break of 55 W EMA (now at 149.98) argue that fall from 161.94 medium term is correcting whole up trend from 102.58 (2021 low). Deeper decline could be seen to 38.2% retracement of 102.58 to 161.94 at 139.26, which is close to 140.25 support. In any case, risk will stay on the downside as long as 55 W EMA (now at 149.83) holds. Nevertheless, firm break of 55 W EMA will suggest that the range for medium term corrective pattern is already set.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Employment Change Q2 | 0.40% | -0.30% | -0.20% | -0.30% |

| 22:45 | NZD | Unemployment Rate Q2 | 4.60% | 4.70% | 4.30% | 4.40% |

| 22:45 | NZD | Labour Cost Index Q/Q Q2 | 0.90% | 0.80% | 0.80% | |

| 03:00 | CNY | Trade Balance (USD) Jul | 84.7B | 99.2B | 99.1B | |

| 05:00 | JPY | Leading Economic Index Jun P | 108.6 | 109.3 | 111.2 | |

| 06:00 | EUR | Germany Industrial Production M/M Jun | 1.40% | 1.00% | -2.50% | |

| 06:00 | EUR | Germany Trade Balance Jun | 20.4B | 21.5B | 24.9B | |

| 06:45 | EUR | France Trade Balance (EUR) Jun | -6.1B | -7.5B | -8.0B | -7.7B |

| 07:00 | CHF | Foreign Currency Reserves (CHF) Jul | 704B | 711B | ||

| 14:00 | CAD | Ivey PMI Jul | 62 | 62.5 | ||

| 14:30 | USD | Crude Oil Inventories | -1.6M | -3.4M | ||

| 17:30 | CAD | BoC Summary of Deliberations |