Safe haven currencies are dominating the market as the steep selloff in the US extended into Asian trading, with Nikkei down more than -5%. Poor US manufacturing data released overnight has intensified investor concerns about an impending recession, overshadowing the benefits of monetary policy easing from Fed. The market’s attention is now firmly on today’s non-farm payroll data, with the potential for another significant selloff if the numbers disappoint.

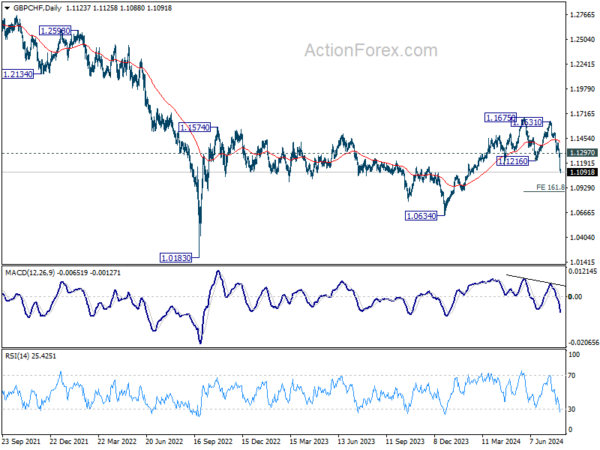

GBP/CHF has been one of the most notable movers this week. The British Pound has been under pressure following BoE’s decision to cut rates yesterday. Concurrently, Swiss Franc has strengthened due to increased risk aversion in stock markets and safe haven flows triggered by escalating tensions in the Middle East.

Technically, fall from 1.1675 resumed yesterday by breaking through 1.1216 support. Near term outlook will stay bearish as long as 1.1297 support turned resistance holds. Next target is 161.8% projection of 1.1675 to 1.1216 from 1.1631 at 1.0888. Decisive break there will argue that the whole medium term rise from 1.0183 is reversing. In this bearish case, deeper decline would be seen to 1.0634 support and even below.

In Asia, at the time of writing, Nikkei is down -5.45%. Hong Kong HSI is down -2.48%. China Shanghai SSE is down -0.59%. Singapore Strait Times is down -1.07%. Japan 10-year JGB yield is down -0.0616 at 0.973. Overnight, DOW fell -1.21%. S&P 500 fell -1.37%. NASDAQ fell -2.30%. 10-year yield fell -0.133 to 3.976.

Market anxiety drives US 10-year yield under 4%, eyes on crucial NFP

US benchmark 10-year yield plummeted overnight, breaking below 4% mark for the first time since February, signaling heightened investor anxiety. This sharp decline came amidst a broad market sell-off, with DOW dropping nearly -500 points, or -1.21%, and even the small-cap Russell 2000 index plunging -3%.

The rise in initial jobless claims to their highest level since August last year contributed to the risk-off sentiment. However, the more pressing concern for investors was the dismal ISM manufacturing report, with PMI falling deeper into contraction, and production and employment falling to their lowest levels since mid-2020.

The market’s reaction to these reports has shifted expectations towards more aggressive monetary easing. Investors are now starting to bet on a 50bps rate cut by Fed in September, with the probability of such a cut now around 30%. However, rather than cheering the potential for fast monetary easing, investors seem more concerned about a looming recession.

This development heightens the importance of today’s non-farm payroll report. Headline jobs are expected to grow by 176k in July, with the unemployment rate remaining unchanged at 4.1%. Meanwhile, average hourly earnings are anticipated to grow by 0.3% month-over-month.

Given the current sentiment, markets may react more strongly to any significant miss in the headline job growth number, which could signal a worse-than-expected slowdown in the employment market. In comparison, the unemployment rate and wage growth, which are more indicative of inflationary pressure, might take a back seat.

Technically, 10-year yield’s (TNX) strong break of near term falling channel indicates downside acceleration. More importantly, the bearish case is strengthening that fall from 4.737 is the third leg of the pattern from 4.997 top. Near term outlook will stay bearish as long as 4.292 resistance holds. Next target is 3.785 low. Break there will target 100% projection of 4.997 to 3.785 from 4.737 at 3.525.

As for Russell 2000, yesterday’s steep fall and breach of 2176.47 support suggests that a short term top is already in place at 2299.99. This came after just missing 61.8% projection of 1633.66 to 2135.45 from 1993.22 at 2303.32. Sustained break of 2176.47 would set the stage for deeper correction to 55 D EMA (now at 2116.13) and possibly further to 38.2% retracement of 1633.66 to 2299.99 at 2045.45.

Looking ahead

Swiss CPI and PMI manufacturing, France industrial production will be released in European session. Later in the day, in addition to NFP, US will release factory orders too.

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.3777; (P) 1.3818; (R1) 1.3849; More…

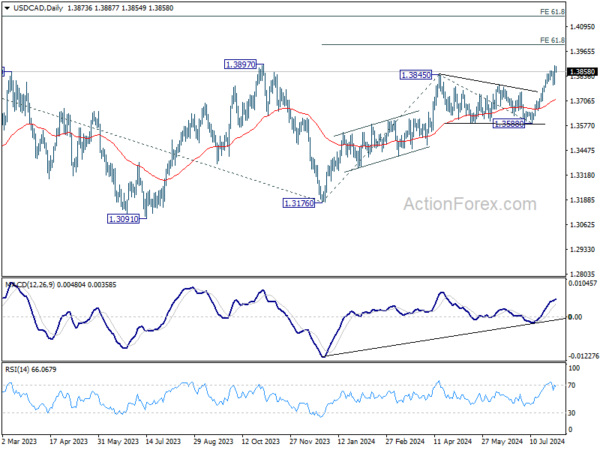

USD/CAD’s rally resumed after brief consolidations and intraday bias is back on the upside. Current rise is part of the whole rally from 1.3176 and next target is 61.8% projection of 1.3176 to 1.3845 from 1.3588 at 1.4025. On the downside, break of 1.3786 support is needed to indicate short term topping. Otherwise, outlook will remain bullish in case of retreat.

In the bigger picture, price actions from 1.3976 (2022 high) are viewed as a corrective pattern, that might have completed at 1.3176 (2023 low) already. Firm break of 1.3976 will confirm resumption of whole up trend from 1.2005 (2021 low). Next target is 61.8% projection of 1.2401 to 1.3976 from 1.3176 at 1.4149. This will be the favored case as long as 1.3588 support holds, in case of pullback.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Monetary Base Y/Y Jul | 1.00% | 0.90% | 0.60% | |

| 01:30 | AUD | PPI Q/Q Q2 | 1.00% | 1.00% | 0.90% | |

| 01:30 | AUD | PPI Y/Y Q2 | 4.80% | 4.30% | ||

| 06:30 | CHF | CPI M/M Jul | -0.20% | 0.00% | ||

| 06:30 | CHF | CPI Y/Y Jul | 1.30% | 1.30% | ||

| 06:45 | EUR | France Industrial Output M/M Jun | 0.90% | -2.10% | ||

| 07:30 | CHF | Manufacturing PMI Jul | 44.6 | 43.9 | ||

| 08:00 | EUR | Italy Industrial Output M/M Jun | -0.20% | 0.50% | ||

| 09:00 | EUR | Italy Retail Sales M/M Jun | 0.20% | 0.40% | ||

| 12:30 | USD | Nonfarm Payrolls Jul | 176K | 206K | ||

| 12:30 | USD | Unemployment Rate Jul | 4.10% | 4.10% | ||

| 12:30 | USD | Average Hourly Earnings M/M Jul | 0.30% | 0.30% | ||

| 14:00 | USD | Factory Orders M/M Jun | 0.50% | -0.50% |