Yen rose broadly today after the BoJ raised interest rates for the second time this year, and maintained hawkish bias. However, buying momentum has not been decisive. This lack of strong momentum can be attributed to the fact that the rate hike decision was likely well priced in by the markets. Nikkei’s rebound following the announce further indicates that BoJ’s move was anticipated. Additionally, traders remain cautious ahead of FOMC rate decision later today, where Fed might signal a rate cut in September.

In contrast, Australian Dollar tumbled broadly following release of quarterly CPI data. Markets and economists showed relief as the trimmed mean CPI slowed in Q2, which overshadowed the rise in headline CPI. The continued core disinflation provides RBA with some room to keep interest rates unchanged next week, avoiding the need for another rate hike.

Overall, Dollar is following Aussie as the second weakest currency of the day so far, with Loonie r trailing in third place. Swiss Franc has emerged as the strongest currency, followed by Yen and then Euro. British pound and Kiwi are positioned in the middle of the performance spectrum.

Technically, EUR/AUD’s rally from 1.5996 resumed today and hits as high as 1.6685 so far. The bullish view remains intact, and correction from 1.7062 should have completed with three waves down to 1.5996. Further rise is expected as long as 1.6491 support holds. Decisive break of 1.6742 resistance will argue that larger up trend from 1.4281 (2022 low) is ready to resume through 1.7062 high.

In Asia, at the time of writing, Nikkei is up 0.03%. Hong Kong HSI is up 1.90%. China Shanghai SSE is up 1.75%. Singapore Strait Times is up 0.29%. Japan 10-year JGB yield is up 0.0533 at 1.050. Overnight, DOW rose 0.50%. S&P 500 fell -0.50%. NASDAQ fell -1.28%. 10-year yield fell -0.035 to 4.143.

BoJ hikes to 0.25%, signals more increases if outlook realizes

BoJ raised the uncollateralized overnight call rate from 0-0.10% to around 0.25% today. The decision was made by a 7-2 vote, with dissenting votes from Toyoaki Nakamura and Asahi Noguchi, who preferred to gather more information and conduct a careful assessment before adjusting the interest rate.

Regarding JGB purchases, there was a unanimous decision to reduce the amount of monthly outright purchases to about JPY 3T by Q1 2026. The amount will be cut by JPY 400B each calendar quarter.

BoJ stated that economic activity and prices have been “developing generally in line with the Bank’s outlook.” Moves to raise wages have been spreading, and the annual rate of import price growth has “turned positive again,” with upside risks to prices requiring attention.

It also noted if the outlook presented in the July Outlook Report is realized, BoJ will continue to raise the policy interest rate and adjust the degree of monetary accommodation accordingly.

In the new economic projections, the BoJ made several adjustments:

- Fiscal 2024 growth forecast was lowered from 0.8% to 0.6%.

- Fiscal 2025 growth forecast remains unchanged at 1.0%.

- Fiscal 2026 growth forecast remains unchanged at 1.0%.

For inflation projections:

- Fiscal 2024 CPI core forecast was lowered from 2.8% to 2.5%.

- Fiscal 2025 CPI core forecast was raised from 1.9% to 2.1%.

- Fiscal 2026 CPI core forecast remains unchanged at 1.9%.

- Fiscal 2024 CPI core-core forecast remains unchanged at 1.9%.

- Fiscal 2025 CPI core-core forecast remains unchanged at 1.9%.

- Fiscal 2026 CPI core-core forecast remains unchanged at 2.1%.

Australia’s trimmed mean CPI drops to 3.9%, continuing six-quarter downtrend

In Q2, Australia’s CPI rose by 1.0% qoq, matching both expectations and the pace set in Q1. Annual rate increased from 3.6% to 3.8% , also in line with forecasts.

More notably, the core inflation measure marked its sixth consecutive quarter of cooling. Trimmed mean CPI, which is a key indicator of underlying inflation, rose by 0.8% qoq. This represents a slowdown from the prior quarter’s 1.0% qoq increase and falls below the expected 0.9% qoq. Annually, trimmed mean CPI slowed from 4.0% yoy to 3.9% yoy, below the expected 4.0% and continuing its downward trend from the peak of 6.8% in the December 2022 quarter.

Additionally, the monthly CPI for June slowed from 4.0% yoy to 3.8% yoy, again matching expectations.

NZ ANZ business confidence jumps to 27.1, inflation expectations fall further

In July, New Zealand’s ANZ Business Confidence saw a notable increase, jumping from 6.1 to 27.1. Own Activity Outlook also improved, rising from 12.2 to 16.3. Meanwhile, cost expectations fell slightly from 69.2 to 68.2, and wage expectations edged up from 73.5 to 74.6. Pricing intentions saw an increase from 35.3 to 37.6. Importantly, inflation expectations continued their steady decline, falling from 3.46% to 3.20%.

ANZ commented that the economic climate remains one where “bad news is good news” for RBNZ. With mounting evidence that monetary policy has been effective, perhaps overly so, there is now a broad expectation that RBNZ will start easing the Official Cash Rate this year.

ANZ noted that “evidence is mounting that the inflation dragon is on its last legs,” which positions the New Zealand economy for a more robust recovery compared to a scenario where inflation control efforts were only partially successful.

China’s NBS PMI manufacturing falls to 49.4 in amid weak demand and extreme weather

China’s official NBS PMI Manufacturing index fell slightly from 49.5 to 49.4 in July, just above the expected 49.3. This index has remained below the 50-mark, which separates growth from contraction, for all but three months since April 2023.

NBS analyst Zhao Qinghe attributed the decline in manufacturing activity to the typical off-season for production in July, insufficient market demand, and extreme weather conditions such as high temperatures and floods in some areas.

PMI Non-Manufacturing index also fell, dropping from 50.5 to 50.2, in line with expectations, but still indicating expansion for the 19th consecutive month. Within this category, construction subindex decreased from 52.3 to 51.2, while services subindex slipped from 50.2 to 50e.

Overall, the official PMI Composite, which combines both manufacturing and non-manufacturing sectors, declined from 50.5 to 50.2.

Looking ahead

Eurozone CPI flash is the main focus in European sesion today while German import prices and eunemployment, as well as Swiss UB economic expectations will be released.

Later in the day, Canada GDP would be a focus while US will release ADP employment, Chicago PMI and pending sales. But the main event is definitely FOMC rate decision.

GBP/JPY Daily Outlook

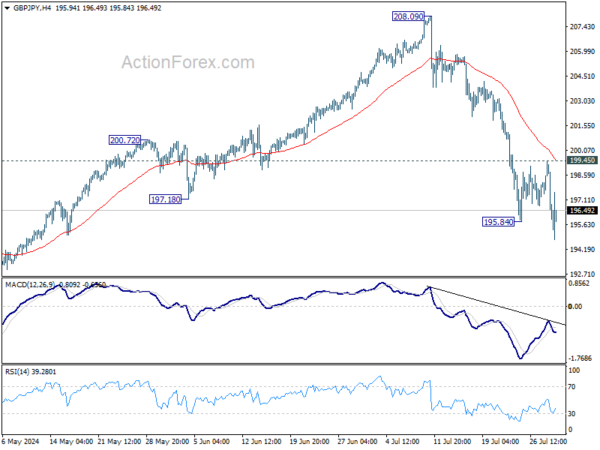

Daily Pivots: (S1) 194.86; (P) 197.17; (R1) 198.37; More…

Intraday bias in GBP/JPY is back on the downside with breach of 195.84 temporary low. Fall from 208.09 is probably a larger scale correction and should target 185.49 fibonacci level. Nevertheless, on the upside, firm break of 199.45 resistance will mix up the outlook and turn intraday bias neutral first.

In the bigger picture, considering bearish divergence condition in W MACD, 208.09 might be a medium term top and fall from there could already be correcting whole up trend from 148.93 (2022 low). Risk will now stay on the downside as long as 55 D EMA (now at 200.51) holds. Deeper fall would be seen to 38.2% retracement of 148.93 to 208.09 at 185.49.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Building Permits M/M Jun | -13.80% | -1.70% | -1.90% | |

| 23:50 | JPY | Industrial Production M/M Jun P | -3.60% | -4.20% | 3.60% | |

| 23:50 | JPY | Retail Trade Y/Y Jun | 3.70% | 3.30% | 2.80% | |

| 01:00 | NZD | ANZ Business Confidence Jul | 27.1 | 6.1 | ||

| 01:30 | AUD | Monthly CPI Y/Y Jun | 3.80% | 3.80% | 4.00% | |

| 01:30 | AUD | CPI Q/Q Q2 | 1.00% | 1.00% | 1.00% | |

| 01:30 | AUD | CPI Y/Y Q2 | 3.80% | 3.80% | 3.60% | |

| 01:30 | AUD | RBA Trimmed Mean CPI Q/Q Q2 | 0.80% | 0.90% | 1.00% | |

| 01:30 | AUD | RBA Trimmed Mean CPI Y/Y Q2 | 3.90% | 4.00% | 4.00% | |

| 01:30 | AUD | Retail Sales M/M Jun | 0.50% | 0.30% | 0.60% | |

| 01:30 | AUD | Private Sector Credit M/M Jun | 0.60% | 0.40% | ||

| 01:30 | CNY | NBS Manufacturing PMI Jul | 49.4 | 49.3 | 49.5 | |

| 01:30 | CNY | NBS Non-Manufacturing PMI Jul | 50.2 | 50.2 | 50.5 | |

| 03:57 | JPY | BoJ Interest Rate Decision | 0.25% | 0.25% | 0.10% | |

| 05:00 | JPY | Housing Starts Y/Y Jun | -6.70% | -2.00% | -5.30% | |

| 05:00 | JPY | Consumer Confidence Jul | 36.7 | 36.5 | 36.4 | |

| 06:00 | EUR | Germany Import Price Index M/M Jun | 0.10% | 0.00% | ||

| 07:55 | EUR | Germany Unemployment Change Jul | 16K | 19K | ||

| 07:55 | EUR | Germany Unemployment Rate Jul | 6.00% | 6.00% | ||

| 08:00 | CHF | UBS Economic Expectations Jul | 17.5 | |||

| 09:00 | EUR | Eurozone CPI Y/Y Jul P | 2.40% | 2.50% | ||

| 09:00 | EUR | Eurozone CPI Core Y/Y Jul P | 2.80% | 2.90% | ||

| 12:15 | USD | ADP Employment Change Jul | 166K | 150K | ||

| 12:30 | USD | Employment Cost Index Q2 | 1.00% | 1.20% | ||

| 12:30 | CAD | GDP M/M May | 0.10% | 0.30% | ||

| 13:45 | USD | Chicago PMI Jul | 44.1 | 47.4 | ||

| 14:00 | USD | Pending Home Sales M/M Jun | 1.60% | -2.10% | ||

| 14:30 | USD | Crude Oil Inventories | -1.6M | -3.7M | ||

| 18:00 | USD | Fed Interest Rate Decision | 5.50% | 5.50% | ||

| 18:30 | USD | FOMC Press Conference |

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)

This “NEW CONCEPT” Trading Strategy Prints Money!… (INSANE Results!)