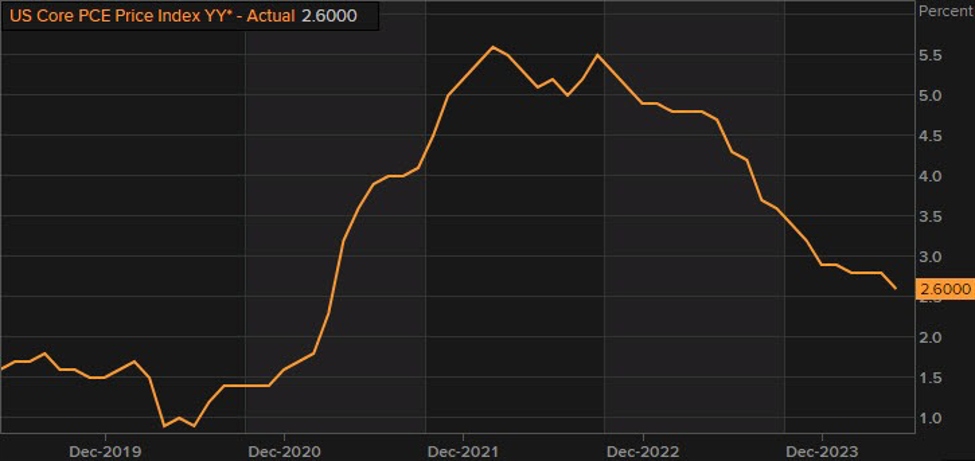

US core PCE price index year-on-year (%)

Broader markets are seeking a respite today and if that is to hold, it will need the next key US inflation indicator to play ball. So far, risk trades are sensing some relief today after a rough week. But can it hold through until the weekend?

The expectation for the US PCE price index is for the monthly reading to come in at +0.1% for both the headline and core estimates. Meanwhile, the annual reading is expected to be at +2.5% for both the headline and core estimates as well. However, Goldman Sachs argues that we could see the core reading be at +0.2% m/m and +2.6% y/y with the latter unchanged from May.

The narrative at the moment is that the disinflation process in the US is continuing to take hold. However, it is moving at a rather gradual pace. And given the circumstances, there might be bumps in the road as per what policymakers are expecting as well.

So, even with a 2.6% reading in the core annual estimate today, it’s not a major setback to the Fed.

But with markets pretty much sitting on edge this week, any readings above that could easily spook investors. And all of the early gains we’re seeing in stocks and risk could be in jeopardy before the weekend comes along.