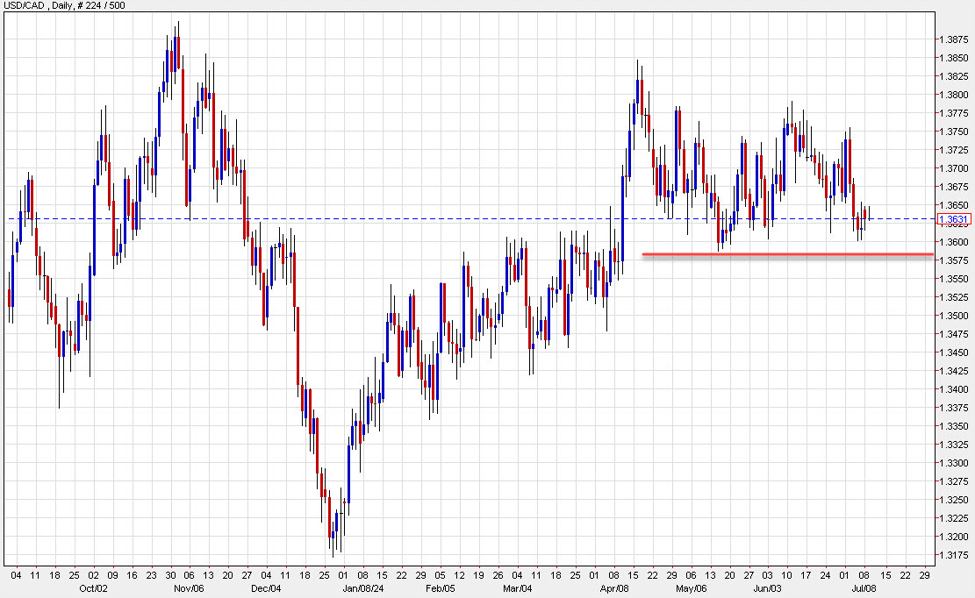

USD/CAD daily chart

There are two probabilities that matter in Canada right now:

1) A 64% chance the Bank of Canada cuts rates on July 24

The market has tilted towards a cut in the past two weeks. Despite that, the Canadian dollar has strengthened and I think that’s instructive. The market is increasingly saying that the growth side of the equation is most-important right now and if the BOC cuts more now to get ahead of the curve, they ultimately won’t have to cut as deeply next year or in 2026. That’s the dynamic I’ll be watching through the decision, though the USD side of the equation is also in play.

In terms of the calendar, there are no speeches from the BOC scheduled before the meeting while the key data will be the July 16 CPI report and the July 19 retail sales report. I’m also keeping a close eye on the real estate market, which is struggling.

I suspect some of the resilience in CAD is due to a four-week rally in oil prices. Unfortunately, that streak is likely to end after two days of selling to start the week.

2) Messi? Never heard of him

Canada plays Argentina in the semi-finals of the Copa America tonight and the implied odds of Canada advancing are about 18%, which sounds rich. Even richer is a rapper betting $300,000 on Canada winning it in normal time.