Euro has seen a notable rebound as the new week commenced, though the lack of follow-through buying momentum is evident. The initial results from French parliamentary elections were not as dire as investors had feared. The far-right National Rally’s victory was not as overwhelming as anticipated. However, significant uncertainty remains as political parties scramble to form a coalition to block the National Rally from gaining power.

Leaders of both the left-wing New Popular Front and President Macron’s centrist alliance announced on Sunday night that they would withdraw their candidates in districts where another candidate stands a better chance of defeating the National Rally in the upcoming run-off on Sunday. Despite this strategic move, it remains unclear how such a coalition will be effectively implemented and whether it will succeed in preventing the far-right from gaining a foothold in the government.

Currently, Euro remains the strongest currency for the day, but the second-placed Sterling and third-placed Dollar are attempting to fight back. On the other hand, Swiss Franc is the weakest performer, followed by Yen and then Canadian Dollar. Aussie and Kiwi are positioned somewhere in the middle of the performance chart.

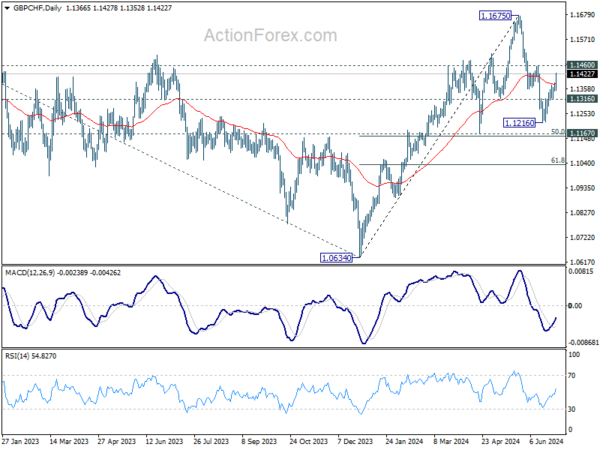

Technically, GBP/CHF’s extended rebound suggests that corrective pullback from 1.1675 has completed at 1.1216, ahead of 1.1167 key support level. Further rise is now in favor as long as 1.1316 minor support holds. Break of 1.1460 resistance will pave the way back to retest 1.1675 high.

In Europe, at the time of writing, FTSE is up 0.36%. DAX is up 0.51%. CAC is up strongly by 1.58%. UK 10-year yield is up 0.0642 at 4.241. Germany 10-year yield is up 0.082 at 2.583. Earlier in Asia, Nikkei rose 0.12%. Hong Kong was on holiday. China Shanghai SSE rose 0.92%. Singapore Strait Times rose 0.17%. Japan 10-year JGB yield rose 0.160 to 1.064.

UK’s PMI manufacturing finalized at 50.9, renewed cost pressures despite growth

UK’s PMI Manufacturing was finalized at 50.9 in June, slightly down from May’s 22-month high of 51.2. This marks a continued period of growth for the sector, but with some emerging concerns.

Rob Dobson, Director at S&P Global Market Intelligence, commented, “The UK manufacturing sector is enjoying its strongest spell of growth for over two years”. Performance of the domestic market remains a “real positive.” However, he noted the persistent challenges in export markets, with manufacturers struggling to secure new business in the US, China, and mainland Europe.

Despite the overall optimism for future growth, manufacturers are focusing heavily on cost minimization and cash flow protection. This cautious approach has resulted in further job losses, cuts to non-essential spending, and leaner stock holdings. The renewed cost inflation pressure is also a significant concern, with input prices rising at the fastest pace since early 2023.

This surge in manufacturing costs will likely heighten worries among hawkish policymakers at BoE regarding the persistence of underlying inflationary pressures.

Eurozone PMI manufacturing finalized at 45.8, recovery pushed to late summer

Eurozone manufacturing PMI for June was finalized at 45.8, down from May’s 47.3, signaling continued contraction in the manufacturing sector. This decline indicates ongoing challenges for manufacturers, with only Italy showing some improvement among the member countries.

Country-specific data for June showed Greece at 54.0, Spain at 52.3, the Netherlands at 50.7, and Ireland at 47.4. Italy recorded a slight improvement at 45.7, while France was at 45.4, Austria at 43.6, and Germany at 43.5. All these figures reflect either multi-month lows that are insufficient to suggest a strong recovery.

Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, highlighted that despite the decline in PMI indices across most Eurozone countries, the trend appears to be a “temporary blip” rather than a sign of a prolonged downturn. He pointed out that the global recovery provides a “supportive backdrop” for Eurozone manufacturers. Moreover, optimism about future production remains high, similar to levels seen in May, indicating sustained confidence among businesses for the upcoming year.

However, de la Rubia also noted a troubling trend in new orders, which are falling at an accelerated pace. This decline follows a record stretch of 25 consecutive months of falling demand. Despite a brief improvement in May, the June data suggests that any significant recovery will likely be “postponed” until at least the end of summer or early fall.

Japan’s Tankan manufacturing improves but non-manufacturing may have peaked

BoJ’s closely watched Tankan survey revealed that while manufacturing sector showed continued improvement, sentiment among non-manufacturers appeared to have peaked, which may complicate BoJ’s considerations for another rate hike later this month.

The Tankan survey reported that large manufacturing index rose from 11 to 13, reaching its highest level since March 2022. Large manufacturing outlook also increased from 10 to 14. However, non-manufacturing index dipped slightly from 34 to 33, marking its first decline in 16 quarters, and non-manufacturing outlook remained unchanged at 27.

Long-term corporate inflation expectations edged up, with companies forecasting inflation to hit 2.3% in three years and 2.2% in five years. Despite these rising expectations, the mixed sentiment data do not strongly support another imminent rate hike by BoJ.

In a separate development, an unscheduled revision to historical data indicated that Japan’s real GDP contracted at an annualized rate of -2.9% in January-March, a much steeper decline than the previously estimated -1.8% contraction. This significant revision is likely to impact BoJ’s upcoming quarterly growth and price forecasts, which are due at the July 30-31 policy meeting.

Japan’s PMI manufacturing finalized at 50, stagnation amid cost pressures and weak demand

Japan’s PMI Manufacturing index for June was finalized at 50.0, slightly down from May’s 50.4, indicating a stagnation in the sector. S&P Global highlighted a marginal increase in manufacturing production, but new orders continued to decline, albeit slightly. Employment in the sector expanded, with business confidence reaching a six-month high.

Pollyanna De Lima at S&P Global Market Intelligence stated, “Notably, the latest PMI data revealed the first rise in Japanese factory production for over a year, and a rebound in business confidence.”

However, she also pointed out significant challenges, including heightened cost pressures due to Yen depreciation, which increased the price of imported materials. Labor costs also strained budgets.

“There was clear evidence that the sharp rise in overall purchasing prices was not caused by supply-chain issues, as delivery times improved to the greatest extent in over 15 years,” she added.

Consequently, manufacturers raised their selling prices at the highest rate in over a year, a move seen as unfavorable given the weak domestic and external demand.

China’s Caixin PMI manufacturing rises to 51.8, growth continues but optimism dips

China’s Caixin PMI Manufacturing index edged up from 51.7 to 51.8 in June, surpassing expectations of 51.2 and marking its highest level since May 2021. This rise keeps the index in expansionary territory for the eighth consecutive month. Notably, output price inflation reached an eight-month high, reflecting increased activity in the sector.

Wang Zhe, Senior Economist at Caixin Insight Group, noted, “Overall, the manufacturing sector kept improving in June, with supply, domestic demand, and exports continuing to grow.” He highlighted that manufacturers increased their purchases, resulting in higher inventory and price levels. Despite this positive trend, optimism among surveyed companies fell significantly, suggesting that market expectations need further strengthening.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0692; (P) 1.0708; (R1) 1.0731; More….

EUR/USD edged higher to 1.0775 earlier today but failed to break through 55 D EMA (now at 1.0773) and retreated. Intraday bias stays neutral first. On the upside, firm break of 55 D EMA will argue that pull back from 1.0915 has completed. Further rise should be seen back to 1.0915 resistance. However, break of 1.0665 will resume larger down trend through 1.0601 low instead.

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern that’s still in progress. Break of 1.0601 will target 1.0447 support and possibly below . For now, this will remain the favored case as long as 1.0915 resistance holds, in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Tankan Large Manufacturing Index Q2 | 13 | 11 | 11 | |

| 23:50 | JPY | Tankan Large Manufacturing Outlook Q2 | 14 | 10 | ||

| 23:50 | JPY | Tankan Non – Manufacturing Index Q2 | 33 | 33 | 34 | |

| 23:50 | JPY | Tankan Non – Manufacturing Outlook Q2 | 27 | 27 | ||

| 23:50 | JPY | Tankan Large All Industry Capex Q2 | 11.10% | 4% | ||

| 00:30 | JPY | Manufacturing PMI Jun F | 50 | 50.1 | 50.1 | |

| 01:45 | CNY | Caixin Manufacturing PMI Jun | 51.8 | 51.2 | 51.7 | |

| 05:00 | JPY | Consumer Confidence Jun | 36.4 | 36.5 | 36.2 | |

| 06:30 | CHF | Real Retail Sales Y/Y May | 0.40% | 2.50% | 2.70% | 2.20% |

| 07:30 | CHF | Manufacturing PMI Jun | 43.9 | 44.9 | 46.4 | |

| 07:45 | EUR | Italy Manufacturing PMI Jun | 45.7 | 44.5 | 45.6 | |

| 07:50 | EUR | France Manufacturing PMI Jun F | 45.4 | 45.3 | 45.3 | |

| 07:55 | EUR | Germany Manufacturing PMI Jun F | 43.5 | 43.4 | 43.4 | |

| 08:00 | EUR | Eurozone Manufacturing PMI Jun F | 45.8 | 45.6 | 45.6 | |

| 08:30 | GBP | Manufacturing PMI Jun F | 50.9 | 51.4 | 51.4 | |

| 08:30 | GBP | M4 Money Supply M/M May | -0.10% | 0.20% | 0.10% | 0.00% |

| 08:30 | GBP | Mortgage Approvals May | 60K | 61K | 61K | |

| 12:00 | EUR | Germany CPI M/M Jun P | 0.10% | 0.20% | 0.10% | |

| 12:00 | EUR | Germany CPI Y/Y Jun P | 2.20% | 2.30% | 2.40% | |

| 13:45 | USD | Manufacturing PMI Jun F | 51.7 | 51.7 | ||

| 14:00 | USD | ISM Manufacturing PMI Jun | 49.3 | 48.7 | ||

| 14:00 | USD | ISM Manufacturing Prices Paid Jun | 55.9 | 57 | ||

| 14:00 | USD | ISM Manufacturing Employment Index Jun | 51.1 | |||

| 14:00 | USD | Construction Spending M/M May | 0.30% | -0.10% |