Fundamental

Overview

The USD continues to be

backed by good economic data as we have also seen recently from the US PMIs last Friday and the US Consumer Confidence report this week. Although such

data keeps the interest rates expectations stable around two cuts by the end of

the year, it should also support the risk sentiment amid a pickup in growth.

This could be a headwind for the greenback.

The CHF, on the other hand,

weakened after the SNB cut interest rates by 25 bps to 1.25%. The market was

pricing a 68% chance of a cut going into the decision, so it wasn’t really a

surprise. The central bank also lowered its inflation forecasts though, so that

added to the Swiss Franc weakness.

The only thing bullish for

the CHF was the line saying that the SNB “will be ready to intervene in FX

market if needed and as necessary”, although we already know that, and they

won’t do it unless inflation surprises to the upside or they see risks of

inflation overshooting their projections.

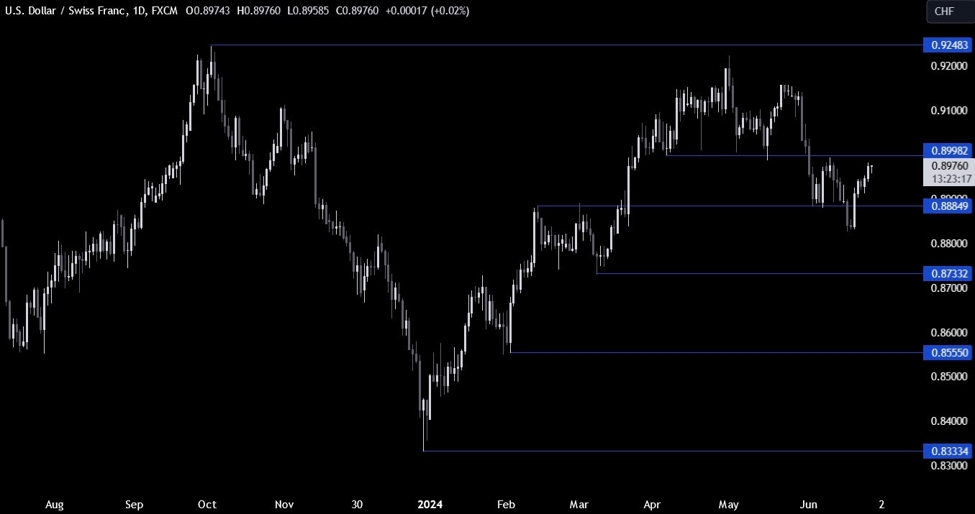

USDCHF

Technical Analysis – Daily Timeframe

USDCHF Daily

On the daily chart, we can

see that USDCHF is approaching a key resistance around the 0.90 handle. That’s

where we can expect the sellers to step in with a defined risk above the level

to position for a drop into new lows. The buyers, on the other hand, will want

to see the price breaking higher to increase the bullish bets into the highs.

USDCHF Technical Analysis – 4 hour Timeframe

USDCHF 4 hour

On the 4 hour chart, we can

see that we have also the 50% Fibonacci

retracement level adding confluence to the resistance level. If we get

an upside breakout, the next target should be the trendline

around the 0.9050 level, which is also where we will likely find the sellers piling

in for a drop into new lows.

USDCHF Technical Analysis – 1 hour Timeframe

USDCHF 1 hour

On the 1 hour chart, we can

see that if we were to get a pullback, the buyers will likely lean on the support

zone around the 0. 8945 to position for a breakout with a better risk to reward

setup. The sellers, on the other hand, will want to see the price breaking

lower to increase the bearish bets into new lows. The red lines define the average daily range for today.

Upcoming

Catalysts

Today we get the latest US Jobless Claims figures, while tomorrow we conclude

the week with the US PCE report.