As US session begins, Euro continues to face significant downward pressure, largely influenced by political developments in France. The call for a snap election following the far-right National Rally party’s gains in the EU election has sparked concerns among investors, driving French 10-year yield to its highest level since November. Additionally, the spread between French and German benchmark yields has widened, reaching the largest margin seen this year, further exacerbating Euro’s volatility.

Italy’s and Spain’s bond markets are also experiencing turbulence, with Italy’s 10-year yield surging past 4% mark and Spain’s benchmark yield climbing above 3.4%. These movements in the bond markets reflect a broader sense of unease that is currently dominating the Eurozone’s financial landscape.

In contrast, the broader forex markets are displaying relative stability, attributed to slow news flow and a light economic calendar. Australian and New Zealand Dollars are emerging as the stronger currencies, with Dollar also holding its ground. Japanese Yen and Swiss Franc are trailing behind, even though they’re making notable gains against the struggling Euro. British Pound and Canadian Dollar are finding themselves in a more neutral position within the currency spectrum.

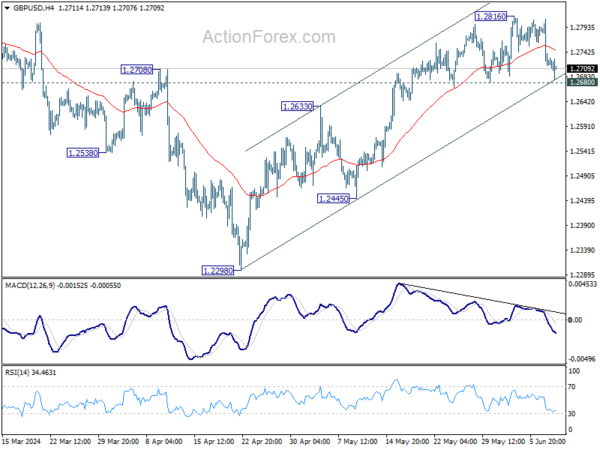

Technically, GBP/USD is still holding above 1.2680 support, as well as staying inside near term rising channel. Another rally through 1.2816 resistance is still in favor. However, sustained break of this support level will argue that rise from 1.2298 is possibly completed already, and bring deeper fall back to 1.2445/2633 support zone next. This down move could be triggered by further downside acceleration in EUR/USD or by poor GDP and employment data from the UK.

In Europe, at the time of writing, FTSE is down -0.29%. DAX is down -0.68%. CAC is down -1.71%. UK 10-year yield is up 0.046 at 4.310. Germany 10-year yield is up 0.052 at 2.669. Earlier in Asia, Nikkei rose 0.92%. Japan 10-year JGB yield rose 0.0668 to 1.039. Singapore Strait Times fell -0.26%. Hong Kong and China were on holiday.

ECB’s Nagel urges caution on rate cuts

In a speech today, ECB Governing Council member Joachim Nagel stressed the importance of caution in making further interest rate cuts, citing ongoing economic uncertainty and persistent inflation pressures.

Nagel remarked, “I don’t see us on a mountain top from which we will inevitably come down. Rather, I see us on a ridge where we still have to find the right point for a further descent,” indicating the need for a measured approach on monetary policy.

Nagel projected that inflation in Eurozne area would gradually decrease towards the ECB’s target, reaching 2% by the end of 2025, albeit later than previously expected. This suggests a longer path to achieving stable inflation, necessitating careful policy decisions.

Earlier today, fellow Governing Council member Peter Kazimir underscored the ongoing battle against inflation, referring to it as the “inflation beast.” Kazimir emphasized that the upcoming September meeting will be pivotal for determining the necessity of further rate cuts.

Eurozone Sentix rises to 0.3, recovery continues but lacks momentum

In June, Eurozone Sentix Investor Confidence improved to 0.3 from -3.6, exceeding the expected -1.9. This marks the eighth consecutive monthly increase and the highest reading since February 2022. Current Situation Index also rose for the eighth month in a row, reaching -9.0 from -14.3, its highest level since May 2023. Similarly, Expectations Index increased to 10.0 from 7.8, the ninth consecutive rise and the highest since February 2022.

Sentix commented that while the recovery is ongoing, the “upswing lacks momentum”. The increase in expectations offers some optimism that this positive trend could continue in the coming weeks. However, a stronger signal from Germany’s economy is needed to boost this momentum, which has yet to emerge.

The slow pace of improvement in the current situation supports the case for ECB to consider further interest rate cuts. Nonetheless, the opportunity for such cuts appears limited. Sentix inflation barometer indicates an unfavorable inflation environment, putting additional pressure on ECB.

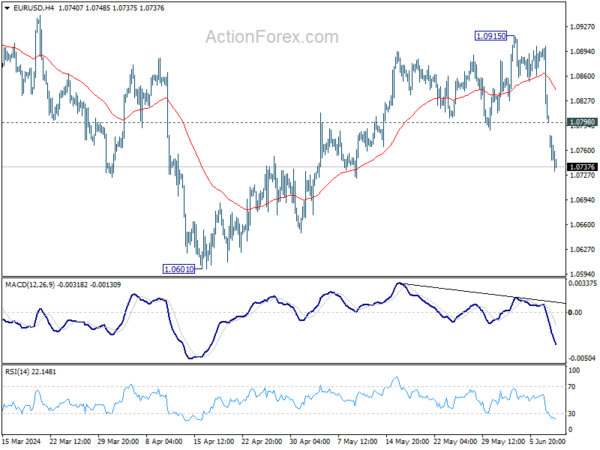

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0768; (P) 1.0835; (R1) 1.0870; More….

Intraday bias in EUR/USD stays on the downside at this point. Rebound from 1.0601 might have completed at 1.0915 already. Fall from there could be another falling leg of the corrective pattern from 1.1274. Further decline could be seen to retest 1.0601 support next. On the upside, above 1.0798 minor resistance will turn intraday bias neutral first. But risk will be mildly on the downside as long as 1.0915 resistance holds, in case of recovery.

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern, which might still be in progress. Break of 1.0601 will target 1.0447 support and possibly below. Nevertheless, on the upside, firm break of 1.1138 will argue that larger up trend from 0.9534 (2022 low) is ready to resume through 1.1274 high.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Bank Lending Y/Y May | 3.00% | 3.10% | 3.10% | |

| 23:50 | JPY | GDP Q/Q Q1 F | -0.50% | -0.50% | -0.50% | |

| 23:50 | JPY | GDP Deflator Y/Y Q1 F | 3.40% | 3.70% | 3.60% | |

| 23:50 | JPY | Current Account (JPY) Apr | 2.52T | 2.06T | 2.01T | |

| 05:00 | JPY | Eco Watchers Survey: Current May | 45.7 | 48.9 | 47.4 | |

| 08:00 | EUR | Itay Industrial Output M/M Apr | -1.00% | 0.30% | -0.50% | |

| 08:30 | EUR | Eurozone Sentix Investor Confidence Jun | 0.3 | -1.9 | -3.6 |