The Bank of Canada (Boc) matched consensus and reduced its policy rate by 25 bps to 4.75% at its event on Wednesday.

In the statement, the bank argued that with ongoing evidence that underlying inflation is easing, monetary policy no longer needs to be as restrictive. In additon, three-month measures of core inflation indicate a continued downward trend in CPI.

Furthermore, Governor Tiff Macklem mentioned that it is reasonable to expect more rate cuts if inflation continues to ease. He added that rate decisions are being taken one meeting at a time and that, with the economy experiencing excess supply, Macklem noted there is room for growth even as inflation continues to recede.

Key Takeaways

With continuing evidence that underlying inflation is easing, monetary policy no longer needs to be as restrictive.

Recent data have increased our confidence that inflation will continue to move towards the 2% target; risks to the inflation outlook remain.

Shelter price inflation remains high.

Wage pressures remain but look to be moderating gradually; overall, recent data suggest the economy is still operating in excess supply.

The governing council is closely watching the evolution of core inflation.

The governing council is particularly focused on the balance between demand and supply, inflation expectations, wage growth, and corporate pricing behavior.

Three-month measures of core inflation suggest continued downward momentum in CPI.

Market reaction

USD/CAD climbed to four-day tops past the 1.3700 mark as investors continue to assess the BoC’s rate decision. Governor Tiff Macklem speaks at 14:30 GMT.

Canadian Dollar PRICE Today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.08% | -0.14% | 0.64% | 0.20% | 0.01% | -0.23% | 0.22% | |

| EUR | 0.08% | -0.06% | 0.70% | 0.27% | 0.10% | -0.13% | 0.28% | |

| GBP | 0.14% | 0.06% | 0.76% | 0.33% | 0.16% | -0.07% | 0.37% | |

| JPY | -0.64% | -0.70% | -0.76% | -0.43% | -0.61% | -0.85% | -0.41% | |

| CAD | -0.20% | -0.27% | -0.33% | 0.43% | -0.18% | -0.39% | 0.02% | |

| AUD | -0.01% | -0.10% | -0.16% | 0.61% | 0.18% | -0.23% | 0.21% | |

| NZD | 0.23% | 0.13% | 0.07% | 0.85% | 0.39% | 0.23% | 0.43% | |

| CHF | -0.22% | -0.28% | -0.37% | 0.41% | -0.02% | -0.21% | -0.43% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Canadian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent CAD (base)/USD (quote).

This section below was published as a preview of the Bank of Canada interest rate decision at 08:00 GMT.

- The Bank of Canada (BoC) is anticipated to cut its policy rate by 25 bps.

- The Canadian Dollar maintains its consolidative phase vs. the US Dollar.

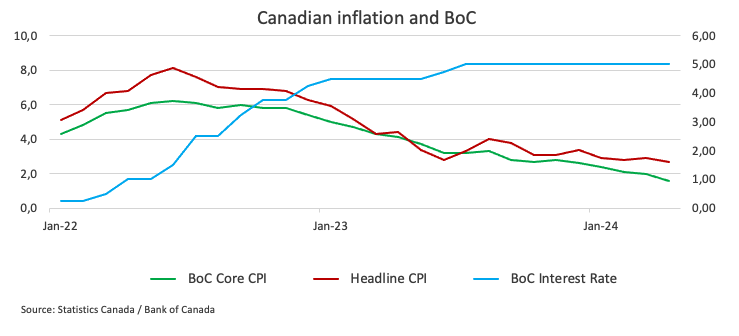

- Inflation in Canada has accelerated its downtrend since December.

- Money markets see around 21 bps of easing at the June meeting.

There is universal anticipation that the Bank of Canada (BoC) will reduce its policy rate by 25 bps at its upcoming gathering on Wednesday, June 5. It will be the first rate cut after six consecutive meetings of keeping rates unchanged at 5.00%.

Since the start of the year, the Canadian Dollar (CAD) has been gradually depreciating against its US counterpart (USD), though it has mostly been in a broader consolidation phase for the last couple of months.

In April, annual domestic inflation tracked by the headline Consumer Price Index (CPI) showed another downtick, while the BoC’s Core CPI dropped below the 2.0% threshold (1.6% YoY).

The reasoning behind the potential rate cut by the central bank may be found in the persistent decline in consumer prices, while further cooling of the Canadian labour market is also expected to contribute to the decision to reduce rates.

Inflation has been below 3% since January, in keeping with the central bank’s prediction for the first half of 2024, with carefully watched core consumer price indicators also falling steadily.

It is also expected that the BoC maintain its data dependency when it comes to future moves on rates. So far, money markets see around 30 bps of easing in July and nearly 42 bps in September. The BoC is expected to keep a cautious approach, it may also show some flexibility given the ongoing decline in domestic inflation.

A hawkish cut?

Despite the expected rate cut, the overall tone from the central bank could lean towards the cautious side, highlighting the current data-dependent stance while keeping a close eye on inflation developments.

In fact, BoC’s Governor Tiff Macklem told the House of Commons finance committee early in May that there is a limit to how much US and Canadian interest rates can diverge, but he emphasized that they are certainly not near that limit.

Furthermore, in his testimony to the Senate banking committee on May 1, Macklem mentioned that inflation was decreasing and acknowledged that Canadians were eager to know when the central bank would begin cutting interest rates. He stated that “the short answer is that we are getting closer.”

When will the BoC release its monetary policy decision, and how could it affect USD/CAD?

The Bank of Canada will announce its policy decision at 13:45 GMT on Wednesday, June 5, followed by Governor Macklem’s press conference at 14:30 GMT.

Eliminating any potential surprises, the impact on the Canadian currency is expected to come mainly from the message of the bank rather than the move on the interest rate per se. Taking a conservative approach may result in more support for CAD and a subsequent dip in USD/CAD. If the bank indicates that it intends to decrease interest rates further, the Canadian Dollar may see a significant drop in the near future.

According to Pablo Piovano, Senior Analyst at FXStreet.com, “the gradual uptrend in USD/CAD that has been in place since the beginning of the year appears to be reinforced by the recent surpass of the key 200-day SMA (1.3506).” However, this trend has so far encountered significant resistance around the year-to-date highs at 1.3650. A sustained break above this zone might drive the pair to go for the November 2023 high of 1.3898 (November 1).

Pablo adds: “If sellers get the upper hand, the 200-day SMA should provide excellent support until the March low of 1.3419 (March 8). Extra weakening from here might lead to a move below the weekly low of 1.3358 (January 31).”

Economic Indicator

BoC Monetary Policy Statement

At each of the Bank of Canada (BoC) eight meetings, the Governing Council releases a post-meeting statement explaining its policy decision. The statement may influence the volatility of the Canadian Dollar (CAD) and determine a short-term positive or negative trend. A hawkish view is considered bullish for CAD, whereas a dovish view is considered bearish.

Next release: Wed Jun 05, 2024 13:45

Frequency: Irregular

Consensus: –

Previous: –

Source: Bank of Canada