Australian Dollar strengthened broadly in Asian session today, shrugging off lackluster retail sales data. Instead, Aussie is responding positively to Shanghai’s announcement of significant policy measures aimed at boosting the housing market. Yesterday, China’s commercial and financial hub declared it would relax home purchase restrictions and provide subsidies for new flat buyers. This move is designed to invigorate the city’s real estate sector and comes less than two weeks after the central government introduced a rescue package to prevent a property market collapse.

Conversely, Dollar is trading broadly lower as last week’s rebound attempt has faded. There has been no new information to suggest a shift in Fed’s policy outlook. Fed fund futures still indicate a 50/50 chance of a rate cut in September. As financial markets are digesting these expectations well, risk-on sentiment could return, putting pressure on the greenback.

For the week thus far, New Zealand Dollar is following Aussie as the second strongest currency, followed by British Pound and Canadian Dollar. Japanese Yen is the second weakest next to Dollar, followed by Swiss Franc. This alignment reflects typical risk-on sentiment in the market.

Technically, despite some hesitation last week, NZD/USD is picking up momentum to resume the rise from 0.5873. This rally could represent the third leg of the rise from 0.5771. For now, outlook will stay cautiously bullish as long as 0.6086 support holds. Break of 0.6216 resistance will affirm this bullish case and target 0.6368 and above.

In Asia, at the time of writing, Nikkei is down -0.17%. Hong Kong HSI is up 0.57%. China Shanghai SSE is up 0.01%. Singapore Strait Times is up 0.36%. Japan 10-year JGB yield is up 0.013 at 1.038.

Japan’s CSPI rises 2.8% yoy in Apr, highest annual increase since 2015

Japan’s Corporate Service Price Index saw a notable increase of 2.8% yoy in April, surpassing the expected 2.3% yoy and accelerating from 2.4% yoy in the previous month. This marks the fastest annual rise since March 2015. On a monthly basis, service prices rose 0.7% mom from March, though this was a slight slowdown from the prior month’s 0.9% mom increase.

The significant annual gains can be attributed to rising labor costs in labor-intensive service sectors, particularly in areas such as machine repair and industrial facility renovation. This surge in service prices highlights the growing cost pressures within Japan’s service industry, driven by an tight labor market.

Australia’s retail sales rises 0.1% mom in Apr, weak consumer spending continues

Australia’s retail sales rose by 0.1% mom to AUD 35.7B in April, falling short of the expected 0.3% mom increase. This modest rise followed a -0.4% mom decline in March, indicating continued weakness in consumer spending.

Ben Dorber, ABS head of retail statistics, commented, “Underlying retail spending continues to be weak with a small rise in turnover in April not enough to make up for a fall in March.”

He further noted that “since the start of 2024, trend retail turnover has been flat as cautious consumers reduce their discretionary spending.”

Looking ahead

Canada IPPI and RMPI will be released in European session. US will release house price index and consumer confidence.

AUD/USD Daily Report

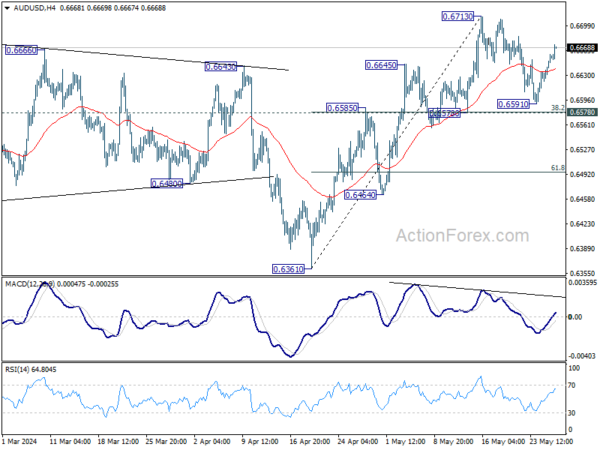

Daily Pivots: (S1) 0.6631; (P) 0.6645; (R1) 0.6669; More...

AUD/USD’s recovery from 0.6591 extends higher today, but stays below 0.6713 resistance. Intraday bias remains neutral first. Further rally is in favor with 0.6578 cluster support (38.2% retracement of 0.6361 to 0.6713 at 0.6579 intact. On the upside, firm break of 0.6713 will resume whole rise from 0.6361 to 0.6870 resistance next. However, firm break of 0.6578 will dampen this bullish view, and bring deeper fall to 61.8% retracement at 0.6495.

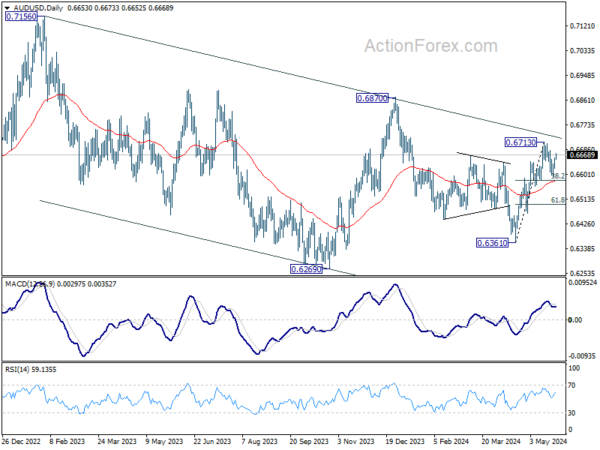

In the bigger picture, price actions from 0.6169 (2022 low) are seen as a medium term corrective pattern to the down trend from 0.8006 (2021 high). Fall from 0.7156 (2023 high) is seen as the second leg, which could have completed at 0.6269 already. Rise from there is seen as the third leg which is now trying to resume through 0.6870 resistance.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | BRC Shop Price Index Y/Y Apr | 0.60% | 0.80% | ||

| 23:50 | JPY | Corporate Service Price Index Y/Y Apr | 2.80% | 2.30% | 2.30% | 2.40% |

| 01:30 | AUD | Retail Sales M/M Apr | 0.10% | 0.30% | -0.40% | |

| 12:30 | CAD | Industrial Product Price M/M Apr | 0.60% | 0.80% | ||

| 12:30 | CAD | Raw Material Price Index Apr | 3.20% | 4.70% | ||

| 13:00 | USD | S&P/Case-Shiller Home Price Indices Y/Y Mar | 7.50% | 7.30% | ||

| 13:00 | USD | Housing Price Index M/M Mar | 0.60% | 1.20% | ||

| 14:00 | USD | Consumer Confidence May | 96.1 | 97 |