For the y/y data:

CPI +0.3%

- continuing to claw its way out of deflation

- this is the third consecutive month of above zero CPI y/y

- expected +0.2%, prior +0.1%

PPI -2.5%

- still in deep deflation, as it has been since October of 2022

- expected -2.3%, prior -2.8%

The slight lift for the CPI is good news in China and should be a positive for China markets, and China proxy trades, such as AUD, at the margin.

Stay tuned, its an active week coming from China with the People’s Bank of China’s medium-term lending facility (MLF) rate decision due on Wednesday. No change to the rate is expected. If we do see cuts from the PBOC, the first is likely to be to the reserve requirement ratio (RRR). Actual cuts to lending rates would widen the interest rate differential with the rest of the world (cough … USA) and would further pressure the yuan. In the months to come the PBOC may have no choice but to cut rates if the economy continues to only stumble along though. There are ‘green shoots’ showing (last week’s trade data was a welcome improvement), but they are sporadic and the debt-ridden property sector remains a huge drag.

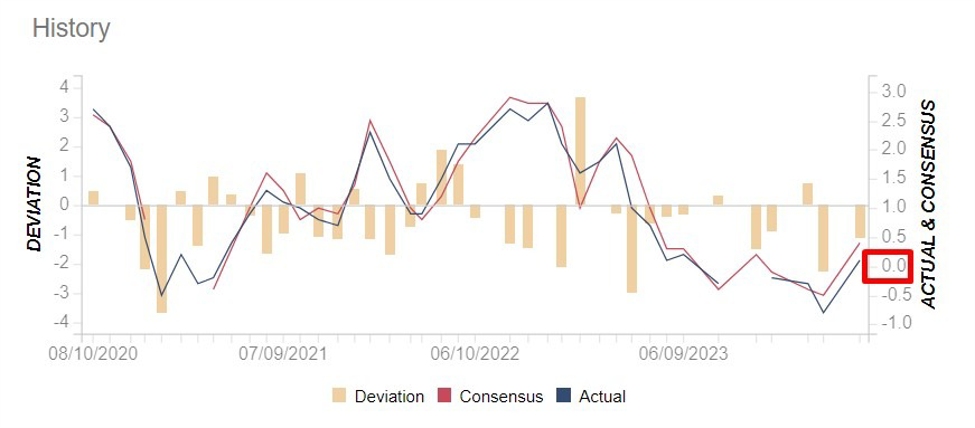

This screenshot, from our Economic Calendar, is of y/y CPI. The CPI scale is on the righ- hand side and its a wee bit confusing, but I’ve put a box around the zero point to make it a little easier to see: