Sterling remains one of the weakest performers this week, despite lack of strong selling momentum. BoE Chief Economist Huw Pill reaffirmed the market’s expectations that the central bank would start to consider interest rate cuts in upcoming meetings. These messages echoed the slight dovish shift noted in yesterday’s BoE rate decision. Attention is now shifting towards the upcoming UK GDP data, which will provide crucial insights into the strength of the economic rebound from last year’s modest recession.

In other developments, Japanese Yen continues to be the weakest overall. But Yen’s decline is notably slowing, particularly against Dollar. Swiss Franc is not far behind the Pound, ranking as the third weakest. On the more positive side, New Zealand Dollar stands out as the strongest performer at this moment, finding support from slight improvements in manufacturing data. Euro follows as the second strongest, with the Canadian dollar close behind, which will likely see some volatility with the release of Canada’s employment data later today. Dollar and Australian Dollar are positioned in the middle of the pack in terms of performance.

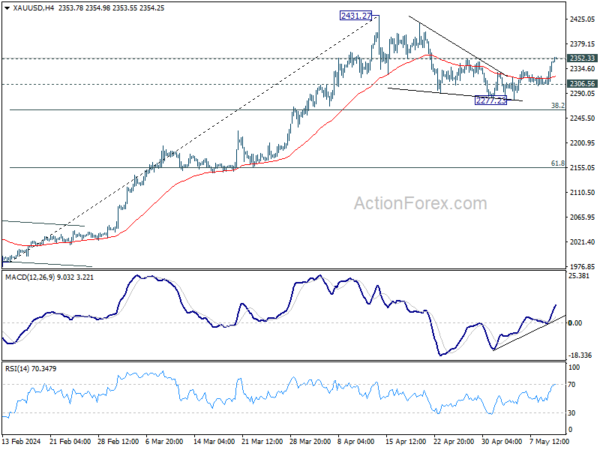

Technically, Gold’s break of 2352.33 resistance now suggests that correction from 2431.27 has completed at 2277.23 as a triangle pattern. Further rally should be seen to retest 2431.27 record high. Firm break there will confirm larger up trend resumption. This will remain the favored case as long as 2306.56 support holds, in case of retreat.

In Asia, at the time of writing, Nikkei is up 0.35%. Hong Kong HSI is up 1.74%. China Shanghai SSE is down -0.22%. Singapore Strait Times is up 0.82%. Japan 10-year JGB yield is up 0.0045 at 0.918. Overnight, DOW rose 0.85%. S&P 500 rose 0.51%. NASDAQ rose 0.27%. 10-year yield fell -0.043 to 4.449.

BoE’s Pill signals rate cut discussions in upcoming meetings

BoE Chief Economist Huw Pill expressed growing confidence in the possibility of lowering interest rates and stated that the committee would start discussing it “over the next few meetings”.

“We’re growing more and more confident that we can begin to reduce the restriction that monetary policy is putting in the economy and start to cut interest rate,” Pill said at a Q&A session organized by the central bank yesterday.

Pill emphasized that the Bank is not quite ready to make these adjustments, stating, “We’re not quite there yet, and we need more evidence.”

Yet, he also mentioned, “In the absence of big new disturbances in the economy, we’re going to be thinking about moving interest rates over the next few meetings.”

This commentary came after the Bank’s decision to maintain the interest rate at 5.25%, a decision supported by an 8-2 vote. Deputy Governor Dave Ramsden joined Swati Dhingra, the usual dove, in voting for a rate cut, signaling a slight shift towards a more dovish stance within policy-setting committee.

Fed’s Daly discusses dual scenarios for interest rate amid inflation uncertainty

San Francisco Fed President Mary Daly articulated the challenges surrounding US inflation, describing it as likely to be a “bumpy ride” going forward. In her comments yesterday, Daly highlighted there is “uncertainly about what the next few months of inflation will look like”.

Daly presented two potential scenarios that could influence Fed’s interest rate decisions. In the first scenario, if inflation continues on its recent downward trend alongside a cooling job market, Daly noted that lowering interest rates would be appropriate.

Conversely, Daly outlined a second scenario where inflation does not decline as expected but instead remains stagnant, as observed in the first quarter of this year. In such a situation, Daly stated that it would not be appropriate to cut interest rates, unless there is a concurrent weakening in the job market.

NZ BNZ manufacturing rises to 48.9, signs of life despite prolonged contraction

New Zealand BusinessNZ Performance of Manufacturing Index rose from 46.8 to 48.9 in April. Despite this improvement, the sector remains in contraction for the 14th consecutive month.

Breaking down the components of the index, there were some positive developments in April. Production notably increased to 50.8 from 46.0, and employment also rose to 50.8 from 46.8, both crossing into expansion territory. However, new orders still lagged behind, albeit with a slight improvement to 45.3 from 44.6, indicating that demand continues to be tepid. Additionally, finished stocks and deliveries edged closer to a neutral stance, registering at 50.4 and 48.4, respectively.

Catherine Beard, BusinessNZ’s Director of Advocacy, , noted slight improvement in April but also increase in negative sentiment among businesses. She highlighted that “the proportion of negative comments again increased to 69%, compared with 65% in March and 62% in February,” with lack of sales and orders being a recurrent concern alongside the broader struggles of the economy.

BNZ Senior Economist Doug Steel provided further insights, stating that “the PMI this year to date is consistent with manufacturing GDP trailing year earlier levels.” He also noted that the details for April were “a bit more mixed,” and they presented a less uniformly weak picture than in recent months.

Looking ahead

UK GDP is the main focus in European while production and trade balance will also be released. Italy will publish industrial output. Later in the day, Canada employment will take center stage. US will release U of Michigan consumer sentiment too.

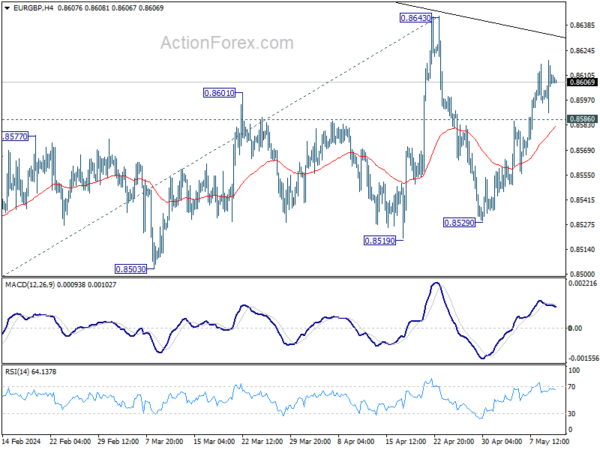

EUR/GBP Daily Outlook

Daily Pivots: (S1) 0.8593; (P) 0.8607; (R1) 0.8623; More…

Intraday bias in EUR/GBP stays mildly on the upside at this point, and further rally could be seen to 0.8643 resistance. Firm break there will resume the choppy rebound from 0.8497 low. On the downside, below 0.8585 minor support will argue that rebound from 0.8529 has completed, and larger fall might finally be ready to resume. Intraday bias will be back on the downside for 0.8529 support first.

In the bigger picture, outlook remains bearish as EUR/GBP is capped below medium term falling trendline. That is, down trend from 0.9267 (2022 high) is still in progress. Firm break of 0.8491/7 will target 100% projection of 0.8764 to 0.8497 from 0.8643 at 0.8376.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | NZD | Business NZ PMI Apr | 48.9 | 47.1 | 46.8 | |

| 23:30 | JPY | Overall Household Spending Y/Y Mar | -1.20% | -2.40% | -0.50% | |

| 23:50 | JPY | Current Account (JPY) Mar | 2.01T | 2.05T | 1.37T | |

| 05:00 | JPY | Eco Watchers Survey: Current Apr | 47.4 | 49.8 | ||

| 06:00 | GBP | GDP M/M Mar | 0.10% | 0.10% | ||

| 06:00 | GBP | GDP Q/Q Q1 P | 0.40% | -0.30% | ||

| 06:00 | GBP | Manufacturing Production M/M Mar | -0.50% | 1.20% | ||

| 06:00 | GBP | Manufacturing Production Y/Y Mar | 1.80% | 2.70% | ||

| 06:00 | GBP | Industrial Production M/M Mar | -0.50% | 1.10% | ||

| 06:00 | GBP | Industrial Production Y/Y Mar | 0.30% | 1.40% | ||

| 06:00 | GBP | Goods Trade Balance (GBP) Mar | -14.5B | -14.2B | ||

| 08:00 | EUR | Italy Industrial Output M/M Mar | 0.30% | 0.10% | ||

| 12:30 | CAD | Net Change in Employment Apr | 17.5K | -2.2K | ||

| 12:30 | CAD | Unemployment Rate Apr | 6.20% | 6.10% | ||

| 13:00 | GBP | NIESR GDP Estimate (3M) Apr | 0.40% | |||

| 14:00 | USD | Michigan Consumer Sentiment Index May P | 77 | 77.2 |