Yen is currently trading as the strongest currency for the day as the markets enter into US session. The earlier dip below 160 psychological support against Dollar spurred a wave of buying, propelling Yen sharply higher. However, subsequent trading has not shown clear follow-through momentum, indicating that the initial surge may have been more of a reactive spike.

Amidst speculation about market intervention by Japan, Masato Kanda, Vice Minister for International Affairs, did not confirm any direct actions but emphasized the government’s concern over “excessive and abnormal FX fluctuations driven by speculation.” He just reiterated Japan’s readiness to “take appropriate measures as necessary.”

From our perspective, the scale of today’s Yen movement suggests it was more likely driven by traders locking in profits from their USD/JPY long positions after the pair hit 160 mark, rather than direct government intervention. After all, Confirmation of any official intervention will likely need to wait until the release of official data at the end of May.

In the broader currency market, New Zealand Dollar and Australian Dollar also show strength, following Yen’s lead. Conversely, Dollar is the weakest performer, followed by Canadian and Euro, with British Pound and Swiss Franc holding middle ground.

Looking ahead to the upcoming Asian session, Australian Dollar will be in the spotlight with the release of local retail sales data and China’s PMI figures. Technically, AUD/USD’s fall from 0.6870 could have completed with three waves down to 0.6361. Further rise is now in favor to 0.6643 resistance first. Decisive break there will strengthen this bullish case and target 0.6870 next. Nevertheless, sustained trading below 55 D EMA will neutralize the near term bullishness and mix up the outlook.

In Europe, at the time of writing, FTSE is up 0.37%. DAX is flat. CAC is up 0.12%. UK 10-year yield is down -0.0284 at 4.298. Germany 10-year yield is down -0.052 at 2.527. Earlier in Asia, Japan was on holiday. Hong Kong HSI rose 0.54%. China Shanghai SSE rose 0.79%. Singapore Strait Times rose 0.06%.

Eurozone economic sentiment falls to 95.6, EU down to 96.2

Eurozone Economic Sentiment Indicator fell from 96.2 to 95.6 in April, below expectation of 96.9. Employment Expectations Indicator fell from 102.5 to 101.8. Economic Uncertainty Indicator fell from 19.3 to 18.8.

Eurozone industry confidence fell from -8.9 to -10.5. Services confidence fell from 6.4 to 6.0. Consumer confidence improved slightly from -14.9 to -14.7. Retail trade confidence fell from -6.0 to -6.8. Construction confidence fell from -5.6 to -6.0.

EU Economic Sentiment Indicator fell from 96.5 to 96.2. Employment Expectations Indicator fell from 102.2 to 101.7. Economic Uncertainty Indicator fell from 18.8 to 18.1.

For the largest EU economies, the ESI deteriorated significantly in France (-4.8) and more moderately in Italy (-1.3), while it improved markedly in Spain (+2.3), Germany (+1.5) and Poland (+1.5). The ESI remained broadly stable in the Netherlands (+0.3).

ECB’s Wunsch: Successive rate cuts in Jun and Jul could trigger excessive repricing

ECB Governing Council member Pierre Wunsch expressed today that he is “very comfortable” with rate cut in June. He also anticipates that at least two rates cuts this year, “barring any bad news”.

However, Wunsch was careful to temper expectations regarding the pace of future rate cuts, particularly stressing that a reduction in rates in July, following a potential June cut, is “not a done deal”.

He highlighted the importance of “managing expectations,” noting that too rapid a sequence of rate reductions could lead the markets to anticipate cuts at every ECB meeting. Such a perception could trigger an excessive repricing in the markets, which Wunsch views as problematic.

USD/JPY Mid-Day Outlook

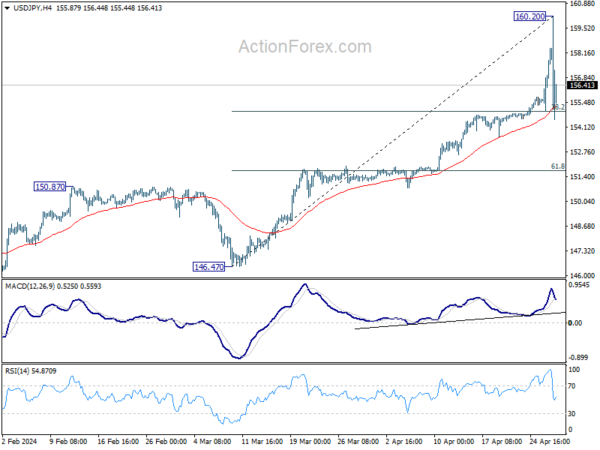

Daily Pivots: (S1) 156.06; (P) 157.26; (R1) 159.53; More…

Intraday bias in USD/JPY remains neutral at this point as consolidation from 160.20 short term top is extending. Strong support could be seen from 38.2% retracement of 146.47 to 160.20 at 154.95 to bring recovery. But break of 160.20 is not envisaged for now. However, firm break of 154.95 will turn bias to the downside for deeper correction to 55 D EMA (now at 151.83).

In the bigger picture, current rise from 140.25 is seen as the third leg of the up trend from 127.20 (2023 low). Next target is 100% projection of 127.20 to 151.89 from 140.25 at 164.94. Outlook will remain bullish as long as 150.87 resistance turned support holds, even in case of deep pullback.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 09:00 | EUR | Eurozone Economic Sentiment Indicator Apr | 95.6 | 96.9 | 96.3 | 96.2 |

| 09:00 | EUR | Eurozone Industrial Confidence Apr | -10.5 | -8.5 | -8.8 | -8.9 |

| 09:00 | EUR | Eurozone Services Sentiment Apr | 6 | 6.5 | 6.3 | 6.4 |

| 09:00 | EUR | Eurozone Consumer Confidence Apr F | -14.7 | -14.7 | -14.7 | |

| 12:00 | EUR | Germany CPI M/M Apr P | 0.50% | 0.60% | 0.40% | |

| 12:00 | EUR | Germany CPI Y/Y Apr P | 2.20% | 2.30% | 2.20% |