UPCOMING EVENTS:

- Tuesday: Japan

Industrial Production and Retail Sales, Australia Retail Sales, China

PMIs, China Caixin Manufacturing PMI, Eurozone CPI, Canada GDP, US ECI, US

Consumer Confidence. - Wednesday: New

Zealand Jobs data, Canada Manufacturing PMI, US ADP, Treasury Refunding

Announcement, US ISM Manufacturing PMI, US Job Openings, FOMC Policy Decision. - Thursday:

Switzerland CPI, Swiss Manufacturing PMI, US Challenger Job Cuts, US

Jobless Claims. - Friday:

Eurozone Unemployment Rate, US NFP, Canada Services PMI, US ISM Services

PMI.

Tuesday

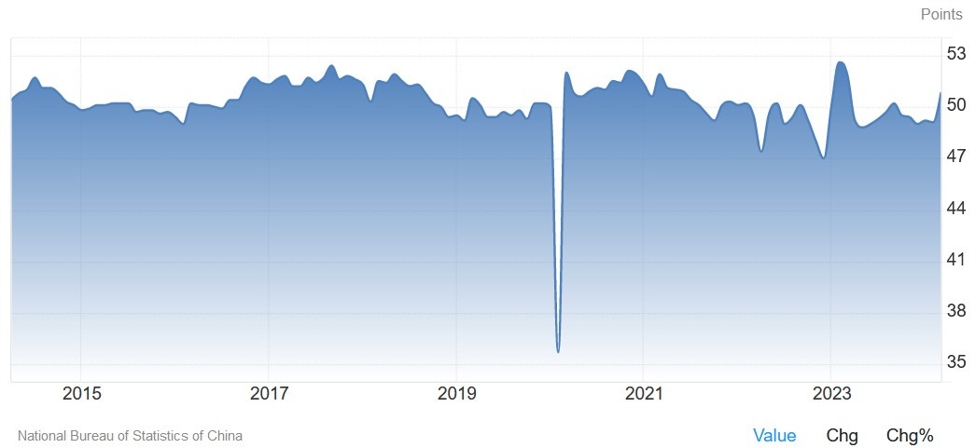

The Chinese Manufacturing PMI is expected

to tick lower to 50.3 vs. 50.8 prior,

while the Services PMI is expected at 52.2 vs. 53.0 prior. The Chinese PMIs

have been very volatile in the past few years making it hard to gauge the state

of the economy. Nonetheless, they picked up well recently improving

the risk sentiment around the Chinese economy. As long as they are not too

bad, we can expect the market to be positive about it, especially with the

promised policy support from the officials.

China Manufacturing PMI

The Eurozone CPI Y/Y is expected at 2.4%

vs. 2.4% prior,

while the Core CPI Y/Y is seen at 2.6% vs. 2.9% prior. The ECB has already

telegraphed a rate cut in June and it will likely take two hot reports

and a disappointing Q1 2024 wage growth data to force them to abort the mission.

The market expects three rate cuts this year, and while it’s unlikely that this

week’s report can change much the probability for the June move, it can change

the market’s pricing for the rest of the year.

Eurozone Core CPI YoY

The US Q1 Employment Cost Index (ECI) is

expected at 1.0% vs. 0.9% prior.

This is the most comprehensive measure of labour costs, but unfortunately, it’s

not as timely as the Average Hourly Earnings data. The Fed though watches

this indicator closely. Wage growth has been easing in the past two years,

but it remains relatively elevated. Hot data is likely to trigger a hawkish

response from the market considering the recent shift in the Fed’s stance.

This is because even if it might not cause

a second inflationary wave, elevated wage growth with a tight labour market

can keep inflation higher for longer risking a de-anchoring of expectations

and make it hard to return to target sustainably. Conversely, soft data can

lead to some positive risk sentiment with less fears about inflation and more

focus on growth.

US ECI

The US Consumer Confidence is expected to tick

lower in April to 104.0 vs. 104.7 in

March. The Chief Economists at The

Conference Board highlighted that over the last six months, confidence has

been moving sideways with no real trend to the upside or downside either by

income or age group. Moreover, they added that consumers remained concerned

with elevated price levels but in general complaints have been trending

downward. Recession fears have also been trending downward and the assessments

of the present situation improved in March, primarily driven by more

positive views of the current employment situation. The Present Situation

Index will be something to watch as that’s generally a leading indicator

for the unemployment rate.

US Consumer Confidence

Wednesday

The New Zealand Q1 Labour Market report is

expected to show a 0.3% change in employment vs. 0.4% prior

with the Unemployment Rate rising to 4.3% vs. 4.0% prior. The Labour Costs Q/Q

is expected at 0.8% vs. 1.0% prior, while the Y/Y measure is seen ticking lower

to 3.8% vs. 3.9% prior. The RBNZ continues to expect the first rate cut in

2025, while the market sees the first move in August 2024. This might be

just the central bank’s strategy to avoid a premature easing in financial

conditions, especially after seeing what happened with the Fed’s pivot. A

sustained deterioration in the labour market though might not only make the

market to confirm the rate cut in 2024 but also increase the number of cuts.

New Zealand Unemployment Rate

The US ISM Manufacturing PMI is expected

to tick lower to 50.1 vs. 50.3 prior. Last

month, the index jumped into expansion for

the first time after 16 consecutive months in contraction with generally upbeat

commentary. The latest S&P

Global US Manufacturing PMI returned back

into contraction after the Q1 2024 expansion. The commentary this time has

been pretty bleak with even mentions of strong layoff activity, although there

was also good news on the inflation front. The ISM report is generally

considered more important by the market, so it will be used to confirm or

deny the S&P Global result.

US ISM Manufacturing PMI

The US Job Openings is expected at 8.680M

vs. 8.756M prior. This will be the first major US labour market report of

the week and, although it’s old (March data), it’s generally a market

moving release. The last

report we got a slight beat with negative

revisions to the prior readings highlighting a resilient although normalising

labour market. The market will also focus on the hiring and quit rates as they

both fell below the pre-pandemic trend lately.

US Job Openings

The Fed is expected to keep interest rates

unchanged at 5.25-5.50% with no major changes to the statement except possibly

an acknowledgement of the recent setback in the disinflationary impulse. The

focus will be mostly on Fed Chair Powell’s Press Conference and possible

updates on the QT taper. Overall, it’s hard to expect something new given the

recent hawkish Fedspeak with Fed’s

Williams even opening the door for a rate

hike in case the progress on inflation were to stall or worse, reverse. The

market is now fully pricing just one rate cut in 2024, which is incredible

given that it was pricing SEVEN! at the start of the year.

Federal Reserve

Thursday

The Switzerland CPI M/M is expected at

0.1% vs. 0.0% prior, while there’s no consensus for the Y/Y measure at the time

of writing although the prior

report missed forecasts once again falling

to 1.0% vs. 1.3% expected. The market has already priced in a rate cut in

June and for the rest of the year, so another marked fall could at the

margin increase the magnitude of the cuts from 25 bps to 50 bps.

Switzerland CPI YoY

The US Jobless Claims continue to be one

of the most important releases to follow every week as it’s a timelier

indicator on the state of the labour market. This is because disinflation to

the Fed’s target is more likely with a weakening labour market. A resilient

labour market though could make the achievement of the target more difficult.

Initial Claims keep on hovering around cycle lows, while Continuing Claims

remain firm around the 1800K level. This week Initial Claims are expected at 212K

vs. 207K prior,

while there is no consensus at the time of writing for Continuing Claims

although the prior release showed a decrease to 1781K vs. 1814K expected and

1796K prior.

US Jobless Claims

Friday

The US NFP report is expected to show 243K

jobs added in April vs. 303K in

March with the Unemployment Rate seen

unchanged at 3.8%. The Average Hourly Earnings M/M is expected at 0.3% vs. 0.3%

prior, while there’s no consensus for the Y/Y figure at the time of writing

although the previous release showed an easing to 4.1% vs. 4.3% prior. The

general expectations into the report will be shaped but other jobs data

throughout the week. We got some mixed signals recently with strong Jobless

Claims but weakening data in the NFIB Hiring Intentions and the S&P Global

PMIs. The focus will also be on wage growth as a good report with falling wage

growth might trigger some positive risk sentiment, while an uptick will likely

result in a hawkish reaction.

US Unemployment Rate

The US ISM Services PMI is expected at

52.0 vs. 51.4 prior. Last

month, the index missed expectations with

some general weakness in the sub-indexes, especially the prices component which

fell to the lowest level since March 2020. The latest S&P

Global US Services PMI missed expectations. The

commentary has been downbeat with even mentions of strong layoff activity,

although there was also good news on the inflation front. The most

important data to watch will be the price and employment sub-indexes.

US ISM Services PMI