I am eyeing Tesla stock before tommorow’s earnings report, and starting to buy now

As equity traders, we’re always on the lookout for opportunities that promise a good return against measured risk. Tesla Inc. (TSLA), the innovative electric vehicle and clean energy company, presents such an opportunity. Ahead of its earnings release tomorrow, post-market close, let’s delve into why Tesla stock might be gearing up for a favorable entry point.

Tesla’s stock performance has been a rollercoaster of highs and lows. Since its all-time peak — where the company’s value skyrocketed by over 100% — the price has corrected significantly, hovering around 52% below that zenith. This correction has captured the attention of traders looking for discounted entries into high-potential stocks.

The technical perspective at TSLA stock, see my video

From a technical analysis standpoint, there’s an interesting setup forming. Tesla’s price action is approaching the lower band of a Pitchfork pattern, coinciding with a gap formed post the earnings announcement on January 23. These technical indicators often attract traders who look for historical patterns to repeat themselves.

A net of buy orders predefined and ready, with the Levitan Method

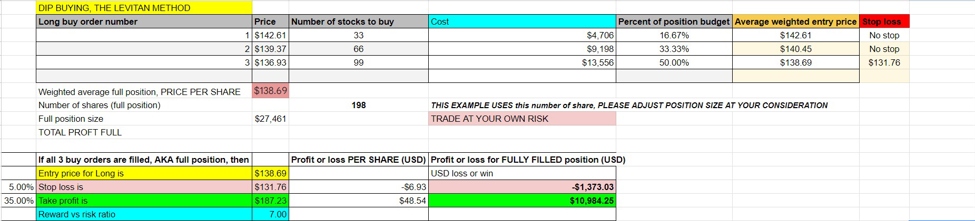

Most traders do not know the Levitan method for dip buying so here goes… Although they might see this as an auspicious moment to consider entry as the downtrend is in play, that is clear. As the video shows a range where we target our buys, one might look to initiate a position at $142.61, closely aligned with the current premarket price. The plan involves scaling into the position — buying more shares at calculated lower points — and employing a disciplined stop-loss and take-profit strategy to manage risk.

A Contrarian bet With calculated risk

One could argue that much of the negative news surrounding Tesla might already be priced in. If true, this contrarian approach might just pay off handsomely, especially for those willing to endure short-term volatility for long-term gains. With a stop loss set at 5% below the entry point and a take-profit target at a hefty 35% above, the risk-reward ratio stands at an attractive 7:1.

Long-term optimism but sharp risk management

While traders might decide to take partial profits along the way, holding a portion of Tesla stock for the long haul could be wise. If Tesla were to revisit its all-time high — a prospect that is not out of the question — the upside could be substantial.

You can enlarge the below image to see the details of the buying method and trade plan or TSLA stock.

Dip buying TSLA stock with the Levitan Method

Buying this dip, IMHO, at TSLA stock

Trade Plan for TSLA using the Levitan Method

-

Identify Potential Dip Points: Analyze the stock chart of TSLA to identify potential dip points below the current market price where demand may increase, using technical analysis indicators and historical price levels.

-

Determine Buy Levels and Shares: Plan to enter three separate buy orders at these dip points, with the number of shares based on a Fibonacci series. For instance:

- First Buy Order: 33 shares (33 x 1)

- Second Buy Order: 66 shares (33 x 2)

- Third Buy Order: 99 shares (33 x 3)

-

Calculate Weighted Average Entry Price: If all three buy orders are filled, calculate the weighted average price of the shares purchased. This price will serve as the reference point for setting stop loss and take profit levels.

-

Set Stop Loss and Take Profit: Set a stop loss at 5% below the weighted average entry price to limit potential losses. Set a take profit level at 35% above the average entry price to lock in profits, aiming for a 7:1 reward-to-risk ratio.

-

Adjustments and Partial Profits: Traders may choose to take partial profits at a 2:1 reward-to-risk ratio if the price reaches a 20% gain. Additionally, consider leaving a portion of the position (e.g., 20%) to potentially benefit from long-term growth in TSLA stock.

-

Risk Management: Allocate a specific portion of the trading budget to this strategy, and do not exceed it to manage risk effectively.

-

Monitor the Trade: Keep a close eye on TSLA’s price action, news, and overall market sentiment, ready to adjust the trade plan as needed.

-

Document and Review: Record the details of all trades and review them regularly to refine the strategy over time.

Investing in Tesla right now is a classic contrarian bet, rooted in technical analysis and a belief in the company’s market position. As with all trading, there’s an inherent risk, and it’s crucial to trade based on one’s own research and risk tolerance. For those with an appetite for risk and an eye for potential, Tesla’s dip could be a launching pad for significant returns. Stay tuned to ForexLive.com for further analysis and updates on this developing story.

Remember, trade at your own risk. This article is not financial advice but rather a perspective on market opportunities based on current conditions. Always conduct thorough research or consult with a financial advisor before engaging in equity trading.