Dollar bounces slightly in early US trading following unexpectedly strong retail sales data. However, there is no clear follow through buying in the greenback for now. The only exception is USD/JPY which continues to make new 34-year highs. Against others, Dollar might extend its consolidation phase for a while longer, as the impact from rising treasury yields is offset by rebound in risk sentiment.

Despite improvements in Eurozone industrial production, Euro remains under pressure. ECB officials have presented a divided front, reflecting varying degrees of enthusiasm for ongoing monetary policy easing. While there is a general consensus on a prospective rate cut in June, the council is split on the path forward. Doves like ECB member Gediminas Simkus has voiced support for additional easing post-June. However, other members have adopted a more cautious approach, reluctant to commit to further actions beyond the initial rate cut.

In broader currency market movements, New Zealand Dollar trails Yen as the second weakest currency, adversely affected by disappointing service sector data. Conversely, Canadian Dollar leads as the strongest, with Australian Dollar and Sterling also showing robust performance. US Dollar holds a middle position awaiting range breakout.

In Europe, at the time of writing, FTSE is up 0.04%. DAX is up 1.32%. CAC is up 1.24%. UK 10-year yield is up 0.070 at 4.211. Germany 10-year yield is up 0.0654 at 2.424. Earlier in Asia, Nikkei fell -0.79%. Hong Kong HSI fell -0.72%. China Shanghai SSE rose 1.26%. Singapore Strait Times fell -1.09%. Japan 10-year JGB yield fell -0.0005 to 0.866.

US retail sales rises 0.7% mom in Jun, ex-auto sales up 1.1% mom

US retail sales rose 0.7% mom to 709.6B in June, above expectation of 0.4% mom. Ex-auto sales rose 1.1% mom to USD 575.5B, above expectation of 0.5% mom. Ex-gasoline sales rose 0.6% mom to USD 655.0B. Ex-auto and gasoline sales rose 1.0% mom. to USD 520.9B.

Total sales for the January through March period were up 2.1% from the same period a year ago.

ECB’s Lane: Disinflation process necessarily bumpy at current phase

ECB Chief Economist Philip Lane described disinflation process as “necessarily bumpy” at the current phase. In a speech, he pointed out that headline inflation is expected to “fluctuate around current levels in the near term,” influenced by base effects in energy sector and recent reversal of service inflation spikes caused by the early timing of Easter.

Meanwhile, Lane noting that while wage pressures are “gradually moderating,” they remain above what would be considered normal or steady-state levels. He emphasized that achieving ECB’s inflation target involves not just controlling wage growth but also managing profit margins across the economy.

Looking ahead to June Governing Council meeting, Lane indicated that ECB’s decisions would be informed by “updated staff projections” and comprehensive data on wage and profit dynamics from the early months of the year. He suggested that if these updated assessments and data provide stronger confidence that inflation is converging to ECB’s targets, it could be “appropriate to reduce the current level of monetary policy restriction.”

ECB’s Kazimir cautions on post-June monetary policy, stresses flexibility

ECB Governing Council member Peter Kazimir highlighted emphasized the importance of maintaining a flexible monetary policy stance beyond an initial rate reduction possibly in June. He underscored that the decision to lower rates in June should be viewed as a recalibration in response to improving economic conditions, rather than a firm commitment to continued easing.

“June is an opportunity to recalibrate our approach in light of improving economic conditions. Let’s be clear: We are not pre-committing to a definite path post-June,” Kazimir stated.

He elaborated, “Even after the first rate cut, our monetary policy will remain restrictive; it needs to.”

Kazimir also addressed the broader implications of easing monetary policy, clarifying that “The notion of easing doesn’t imply a commitment to specific future cuts but rather an openness to respond in kind, should the economic data advocate for it.”

Moreover, Kazimir cautioned about the vulnerability of the economy to unexpected shocks, emphasizing the necessity for ECB to maintain its agility in policymaking.

ECB’s Simkus anticipates three rate cuts this year, possibly four

ECB Governing Council member Gediminas Simkus forecasted three 25bps rate cuts for this year, with a potential for a fourth. “I see a higher than 50% chance there will be more than three cuts this year,” he told reporters.

Simkus also highlighted that the ECB might not stop at just one rate cut in June, stating, “I see a higher than zero chance that an interest rate cut may follow also in July. The July decision will be important in setting the trajectory.”

Regarding the pace and magnitude of these rate cuts, Simkus emphasized a cautious approach. He remarked that there is “no urgency to cut rates” by more than 25bps at a time, indicating he preference for gradual adjustments rather than larger, more aggressive cuts.

Eurozone industrial production rises 0.8% mom in Feb, EU up 0.7% mom

Eurozone industrial production rose 0.8% mom in February, matched expectations. Production increased by 0.5% for intermediate goods, 1.2% for capital goods, and 1.4% for durable consumer goods. On the other hand, production by -3.0% for energy, and -0.9% for non-durable consumer goods.

EU industrial production rose 0.7% mom. The highest monthly increases were recorded in Ireland (+3.8%), Hungary (+3.5%) and Slovenia (+3.3%). The largest decreases were observed in Croatia (-4.6%), Lithuania (-3.0%) and Belgium (-2.7%).

NZ BNZ services plummets to 47.5, signaling over 2% GDP contraction

New Zealand’s service sector saw a significant downturn in March, as evidenced by BusinessNZ Performance of Services Index, which fell sharply from 52.6 to 47.5. This decline places the index back in contraction territory, and well below its long-term average of 53.4.

The components of the PSI painted a concerning picture: activity and sales saw a steep decline from 52.4 to 44.8. While employment showed a slight improvement, rising marginally from 49.4 to 50.1, new orders and business fell significantly from 55.5 to 48.3. Stocks and inventories also dropped from 52.2 to 46.9, and supplier deliveries was stagnant at 48.7.

Business sentiment mirrored these negative trends, with proportion of negative comments rising sharply to 63.0% in March, up from 57.3% in February and 53.0% in January. Respondents frequently cited ongoing recession and persistent inflationary pressures, including rising costs of living, as key factors impacting their operations.

BNZ Senior Economist Doug Steel stated, “Combining today’s weak PSI activity with last week’s similarly weak PMI activity, yields a composite reading that would be consistent with GDP falling by more than 2% compared to year-earlier levels. That is much weaker than what folk are forecasting.”

GBP/USD Mid-Day Outlook

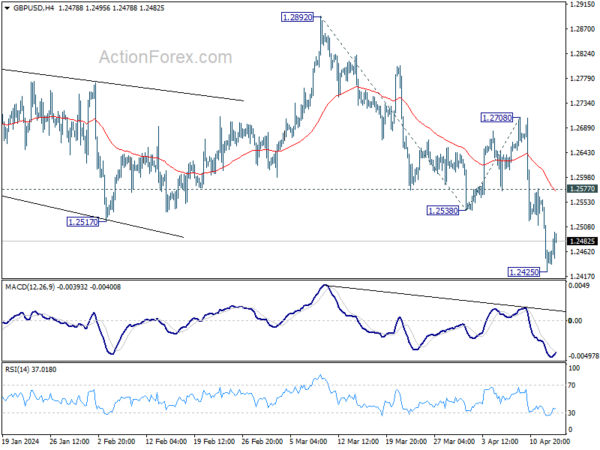

Daily Pivots: (S1) 1.2396; (P) 1.2481; (R1) 1.2535; More…

Intraday bias in GBP/USD is turned neutral with 4H MACD crossed above signal line. Some consolidations would be seen first, but recovery should be limited by 1.2577 minor resistance to bring another fall. On the downside, break of 1.2425 will resume the decline from 1.2892 to 100% projection of 1.2892 to 1.2538 from 1.2708 at 1.2354. Firm break there will target 161.8% projection at 1.2207 next.

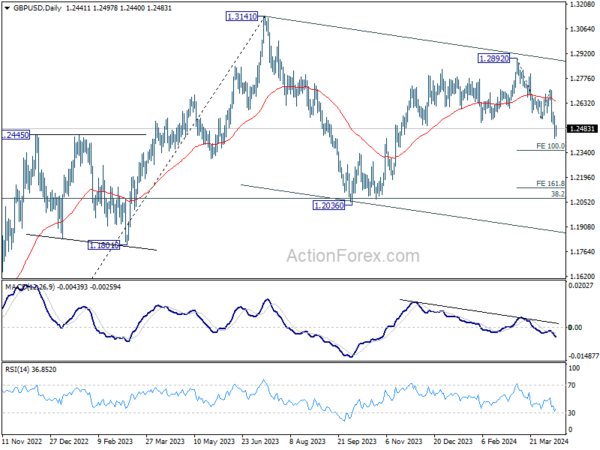

In the bigger picture, price actions from 1.3141 medium term top are seen as a corrective pattern to up trend from 1.0351 (2022 low). Fall from 1.2892 is seen as the third leg. Deeper decline would be seen to 1.2036 support and possibly below. But strong support should emerge from 61.8% retracement of 1.0351 to 1.2452 at 1.1417 to complete the correction.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | NZD | Business NZ PSI Mar | 47.5 | 53 | 52.6 | |

| 23:50 | JPY | Machinery Orders M/M Feb | 7.70% | 0.80% | -1.70% | |

| 06:30 | CHF | Producer and Import Prices M/M Mar | 0.10% | 0.20% | 0.10% | |

| 06:30 | CHF | Producer and Import Prices Y/Y Mar | -2.10% | -2.00% | ||

| 09:00 | EUR | Eurozone Industrial Production M/M Feb | 0.80% | 0.80% | -3.20% | |

| 12:30 | CAD | Manufacturing Sales M/M Feb | 0.70% | 0.70% | 0.20% | |

| 12:30 | CAD | Wholesale Sales M/M Feb | 0.00% | 0.80% | 0.10% | |

| 12:30 | USD | Empire State Manufacturing Index Apr | -14.3 | -9 | -20.9 | |

| 12:30 | USD | Retail Sales M/M Mar | 0.70% | 0.40% | 0.60% | |

| 12:30 | USD | Retail Sales ex Autos M/M Mar | 1.10% | 0.50% | 0.30% | |

| 14:00 | USD | Business Inventories Feb | 0.30% | 0.00% | ||

| 14:00 | USD | NAHB Housing Market Index Apr | 52 | 51 |