Dollar is continuing its streak as the weakest performer for the week, amid a global surge in risk appetite. Major stock indices around the world, including S&P 500, NASDAQ, DAX, and CAC, have notched new record highs overnight. This wave of optimism has seamlessly transitioned into Asian session today. Investors have been absorbing the latest adjustment in central bank rate cut expectations rather well. While a bit later than originally thought, Fed and ECB are on course to deliver their first rate cuts in June. Focuses will now turn to non-farm payroll report from the US today, so further solidify the expectation on Fed.

Australian Dollar overtakes Yen’s position as the best performer for the week so far. Aussie is buoyed by news from China’s Guangdong Energy regarding its plans to import 80 million tons of coal from Australia this year. This move signals a return to pre-sanction trade levels between Australia and China, providing a notable lift to Australian Dollar. Meanwhile, despite paring much of earlier gains, Japanese Yen is currently in the second spot in terms of strength, support by increasing bets on BoJ rate hike later this month.

Conversely, Swiss Franc is only marginally outperforming the Dollar, with Canadian Dollar trailing closely as market participants await Canadian employment data for further direction. Euro and the British Pound find themselves in a relatively neutral position, with Pound having a slight advantage.

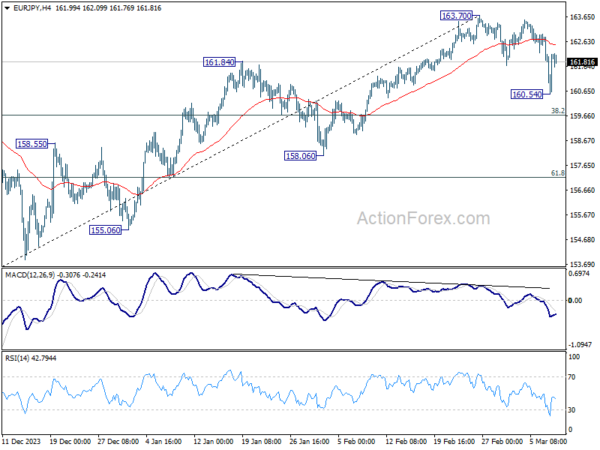

Technically, Yen has pared back much gains against most but Dollar. For example, EUR/JPY recovered strongly after dipping to 160.54. Current development open up the case that fall from 163.70 is merely a near term corrective pullback. Sustained trading above 55 D EMA (now at 162.51) would argue that this correction has completed and bring stronger rebound back to 163.70. If realized in this way, Yen’s reversal in crosses might help USD/JPY bounce from 38.2% retracement of 140.25 to 150.87 at 146.81. Let’s see how it plays out.

In Asia, at the time of writing, Nikkei is up 0.47%. Hong Kong HSI is up 1.22%. China Shanghai SSE is up 0.11%. Singapore Strait Times is up 0.65%. Japan 10-year JGB yield is up 0.0014 at 0.735. Overnight, DOW rose 0.34%. S&P 500 rose 1.03%. NASDAQ rose 1.51%. 10-year yield fell -0.012 to 4.092.

Japan’s household spending falls -6.3% yoy in Jan, deepening contraction

Japan’s household spending fell -6.3% yoy in January well below expectation of -4.3% yoy. That’s the 11th consecutive month of contraction, and the biggest annual drop since February 2021. On a seasonally adjusted, spending fell -2.1% mom, versus expectation of 0.4% mom increase.

The Ministry of Internal Affairs and Communications noted that one-off factors such as decreases in new car purchases amid factory suspensions and lower energy bills due to warm weather contributed to the spending drop. Also, the bigger-than-expected fall was also against the backdrop of higher spending in the same month last year from post-pandemic travel subsidies.

NFP takes center stage, S&P 500 hits record, Dollar Index falters

The main focus of the day is February US non-farm payroll report, with the market anticipating headline job growth of 200k. Unemployment rate is expected to hold steady at 3.7%. Attention is particularly focused on average hourly earnings, anticipated to grow by 0.2% mom, amidst a backdrop of mixed employment indicators from related data sources.

The manufacturing sector, as represented by ISM manufacturing employment index, witnessed a decline from 47.1 to 45.9, while the services sector, through ISM services employment figure, also saw a decrease from 50.5 to 48.0. ADP private employment report indicated a modest job growth of 140k. There was a slight uptick in four-week moving average of initial jobless claims from 208k to 212k. Together they suggest the labor market’s resilience may be cooling. These indicators collectively temper expectations for a significant upside surprise in the NFP data, while wage growth presenting an unpredictable element as usual.

Investors are particularly interested in how the payroll data might reinforce the likelihood of a June rate cut by Fed. A favorable set of data supporting this case would at least align Fed with its projected path of three rate cuts this year, with the other two in Q3 and Q4, as in the latest dot plot projections.

S&P 500 closed at new record high overnight as its recent uptrend continued. For now, outlook will stay bullish as long as 5056.82 support holds. Next target is 138.2% projection of 3808.86 to 4607.07 from 4103.78 at 5206.91. Firm break there will pave the way to 161.8% projection at 5395.28. Nevertheless, considering bearish divergence condition in D MACD, break of 5056.82 should indicate short term topping, and bring deeper pullback first.

Dollar Index’s close below 102.90 support overnight argues that rebound from 100.61 has completed much earlier than expected at 104.97. Risk will now stay on the downside as long as 55 D EMA (now at 103.69) holds. Deeper decline would be seen back towards 100.61 support, aligning with rally in stock markets. But strong support should emerge around 100 psychological level to bring rebound, to extend medium term range trading.

Looking ahead

Germany industrial production and PPI, France trade balance and Eurozone GDP revision will be featured in Euroepan session. Later in the day US non-farm payrolls and Canada employment will be the main focuses.

AUD/USD Daily Report

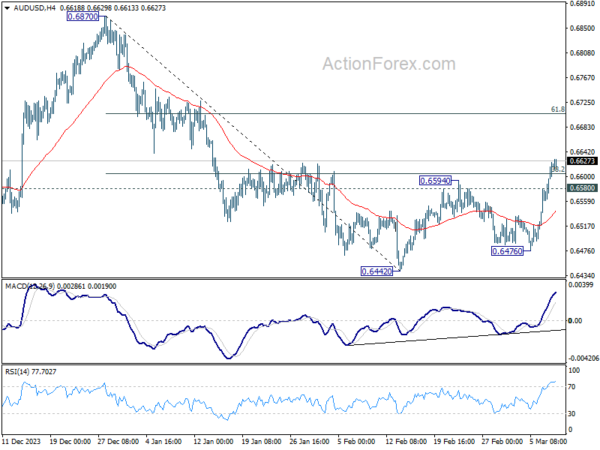

Daily Pivots: (S1) 0.6580; (P) 0.6602; (R1) 0.6643; More…

AUD/USD’s rebound extends to as high as 0.6629 so far today, breaking 38.2% retracement of 0.6877 to 0.6442 at 0.6605. Current upside acceleration as seen in 4H MACD indicates that further rally is underway. Intraday bias stays on the upside for 61.8% retracement at 0.6707 next. On the downside, below 0.6580 minor support will turn intraday bias neutral first.

In the bigger picture, price actions from 0.6169 (2022 low) are seen as a medium term corrective pattern to the down trend from 0.8006 (2021 high). Fall from 0.7156 (2023 high) is seen as the second leg, which might still be in progress. Overall, sideway trading could continue in range of 0.6169/7156 for some more time. But as long as 0.7156 holds, an eventual downside breakout would be mildly in favor.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Overall Household Spending Y/Y Jan | -6.30% | -4.30% | -2.50% | |

| 23:50 | JPY | Bank Lending Y/Y Feb | 3.00% | 3.20% | 3.10% | |

| 23:50 | JPY | Current Account (JPY) Jan | 2.73T | 2.07T | 1.81T | |

| 05:00 | JPY | Leading Economic Index Jan P | 109.9 | 109.7 | 110.2 | |

| 05:00 | JPY | Eco Watchers Survey: Current Feb | 50.6 | 50.2 | ||

| 07:00 | EUR | Germany Industrial Production M/M Jan | 0.50% | -1.60% | ||

| 07:00 | EUR | Germany PPI M/M Jan | -0.10% | -1.20% | ||

| 07:00 | EUR | Germany PPI Y/Y Jan | -6.60% | -8.60% | ||

| 07:45 | EUR | France Trade Balance (EUR) Jan | -6.5B | -6.8B | ||

| 10:00 | EUR | Eurozone GDP Q/Q Q4 | 0.00% | 0.00% | ||

| 13:30 | USD | Nonfarm Payrolls Feb | 200K | 353K | ||

| 13:30 | USD | Unemployment Rate Feb | 3.70% | 3.70% | ||

| 13:30 | USD | Average Hourly Earnings M/M Feb | 0.20% | 0.60% | ||

| 13:30 | CAD | Capacity Utilization Q4 | 79.90% | 79.70% | ||

| 13:30 | CAD | Net Change in Employment Feb | 20.0K | 37.3K | ||

| 13:30 | CAD | Unemployment Rate Feb | 5.80% | 5.70% |