Dollar’s decline accelerated in the early US session, triggered by disappointing non-farm payroll data. Despite a seemingly robust headline job growth figure for February, the substantial downward revision of January’s numbers cast a shadow, marking the overall report as a miss. Moreover, the unemployment rate’s unexpected jump and the below-forecast earnings growth further dented investor sentiment towards the greenback.

As for the day, Japanese Yen stands out as the strongest currency for now, buoyed by reports from Jiji news suggesting BoJ is contemplating a new quantitative monetary policy framework, which hints at a slowdown in future government bond purchases. Australian and New Zealand Dollars also enjoy notable gains, riding the wave of strong risk-on market sentiment.

Conversely, Euro positions as the day’s second weakest currency, albeit maintaining strong gains against Dollar, which languishes as the day’s worst performer. Canadian Dollar trails as the third weakest, with the Swiss Franc and Sterling are mixed.

Technically, Gold rides of Dollar’s weakness and surges to new record high at 2185. It’s now in an upside acceleration phase as seen in D MACD. Next target is the critical cluster projection level at around 2260, 100% projection of 1810.26 to 2088.24 from 1984.05 at 2262.03 and 100% projection of 1614.60 to 2062.95 from 1810.26 at 2259.15.

In Europe, at the time of writing, FTSE is down -0.35%. DAX is up 0.06%. CAC is up 0.28%. UK 10-year yield is down -0.0489 at 4.038. Germany 10-year yield is down -0.059 at 2.250. Earlier in Asia, Nikkei rose 0.23%. Hong Kong HSI rose 0.76%. China Shanghai SSE rose 0.61%. Singapore Strait Times rose 0.42%. Japan 10-year JGB yield rose 0.0009 to 0.735.

US NFP grows 275k, unemployment rate rises to 3.9%, average hourly earning up just 0.1% mom

US non-farm payroll employment rose 275k in February, above expectation of 200k. However, January’s figure was revised sharply lower from 353k to 229k.

Unemployment rate jumped from 3.7% to 3.9%, above expectation of being unchanged at 3.7%. Labor force participation rate was unchanged at 62.5% for the third consecutive month.

Average hourly earnings rose 0.1% mom, below expectation of 0.2% mom. Average workweek edged up by 0.1 hour to 34.3 hours.

Canada’s employment grows 40.7k in Feb, unemployment rate ticks up to 5.8%

Canada’s employment rose 40.7k in February, above expectation of 20.0k. Unemployment rate ticked up from 5.7% to 5.8%, matched expectations. Employment rate fell -0.1% to 61.5%. Total hours worked was up 0.3% mom. Average hourly wages rose 5.0% yoy, down from January’s 5.3% yoy.

ECB officials signal rate cut prospects, eyeing Spring for initial move

Several ECB policymakers vocalized today their anticipation of impending rate cuts, pinpointing spring—likely June—as the probable period for the first reduction.

Governing Council member Francois Villeroy de Galhau, in an interview with BFM Business television, conveyed a “very probable” outlook for an inaugural rate cut within the spring months. Villeroy indicated there is “large consensus” among officials on the inevitability of rate reductions, albeit with ongoing discussions about the precise timing. He elaborated on the spring timeframe, suggesting it encompasses April to June, thus leaving a window open for an earlier adjustment.

Further adding to the conversation, Governing Council member Gediminas Šimkus acknowledged the prevailing conditions that pave the way for a shift to a less restrictive monetary stance. While not dismissing an April rate cut entirely, Šimkus posited a low likelihood for such an early move, aligning more with expectations for action in the subsequent months.

Compounding these sentiments, another Governing Council member Olli Rehn, expressed his viewpoint through a blog post. Rehn’s assessment, grounded in the latest forecasts, indicates that “the risks of too early a decrease in interest rates from the perspective of inflation control have significantly decreased.”

Japan’s household spending falls -6.3% yoy in Jan, deepening contraction

Japan’s household spending fell -6.3% yoy in January well below expectation of -4.3% yoy. That’s the 11th consecutive month of contraction, and the biggest annual drop since February 2021. On a seasonally adjusted, spending fell -2.1% mom, versus expectation of 0.4% mom increase.

The Ministry of Internal Affairs and Communications noted that one-off factors such as decreases in new car purchases amid factory suspensions and lower energy bills due to warm weather contributed to the spending drop. Also, the bigger-than-expected fall was also against the backdrop of higher spending in the same month last year from post-pandemic travel subsidies.

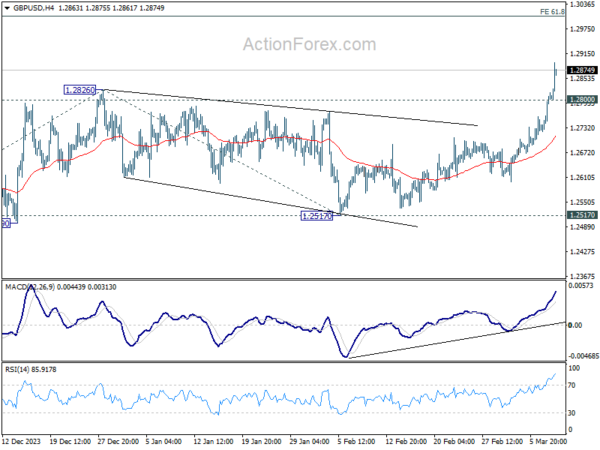

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2750; (P) 1.2781; (R1) 1.2839; More…

GBP/USD accelerates to as high as 1.2892 so far today. The strong break of 1.2826 resistance confirm resumption of whole rally from 1.2036. Intraday bias stays on the upside for 61.8% projection of 1.2036 to 1.2826 from 1.2517 at 1.3005 next. On the downside, below 1.2800 minor support will turn intraday bias neutral and bring consolidations first, before staging another rally.

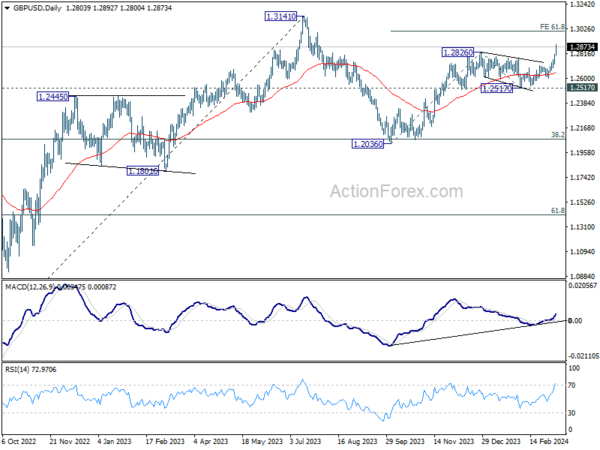

In the bigger picture, price actions from 1.3141 medium term top are seen as a corrective pattern to up trend from 1.0351 (2022 low). Rise from 1.2036 is seen as the second leg, which could be still in progress. But upside should be limited by 1.3141 to bring the third leg of the pattern. Meanwhile, break of 1.2517 support will argue that the third leg has already started for 38.2% retracement of 1.0351 (2022 low) to 1.3141 at 1.2075 again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Overall Household Spending Y/Y Jan | -6.30% | -4.30% | -2.50% | |

| 23:50 | JPY | Bank Lending Y/Y Feb | 3.00% | 3.20% | 3.10% | |

| 23:50 | JPY | Current Account (JPY) Jan | 2.73T | 2.07T | 1.81T | |

| 05:00 | JPY | Leading Economic Index Jan P | 109.9 | 109.7 | 110.2 | |

| 06:00 | JPY | Eco Watchers Survey: Current Feb | 51.3 | 50.6 | 50.2 | |

| 07:00 | EUR | Germany Industrial Production M/M Jan | 1.00% | 0.50% | -1.60% | -2.00% |

| 07:00 | EUR | Germany PPI M/M Jan | 0.20% | -0.10% | -1.20% | |

| 07:00 | EUR | Germany PPI Y/Y Jan | -4.40% | -6.60% | -8.60% | |

| 07:45 | EUR | France Trade Balance (EUR) Jan | -7.4B | -6.5B | -6.8B | -6.4B |

| 10:00 | EUR | Eurozone GDP Q/Q Q4 | 0.00% | 0.00% | 0.00% | |

| 13:30 | USD | Nonfarm Payrolls Feb | 275K | 200K | 353K | 229K |

| 13:30 | USD | Unemployment Rate Feb | 3.90% | 3.70% | 3.70% | |

| 13:30 | USD | Average Hourly Earnings M/M Feb | 0.10% | 0.20% | 0.60% | 0.50% |

| 13:30 | CAD | Net Change in Employment Feb | 40.7K | 20.0K | 37.3K | |

| 13:30 | CAD | Unemployment Rate Feb | 5.80% | 5.80% | 5.70% | |

| 13:30 | CAD | Capacity Utilization Q4 | 78.70% | 79.90% | 79.70% | 78.80% |