Dollar is trading broadly lower as markets enter into US session, with minimal backing from Fed Chair Jerome Powell’s prepared remarks for his Congressional testimony. Instead, the currency’s weakest is accentuated by extended drop in treasury yields and slightly disappointing ADP private job data. Amidst this backdrop, Swiss Franc emerges as the only currency performing worse than the greenback, with Canadian Dollar also lagging but drawing attention ahead of BoC’s impending rate decision.

Japanese Yen staged a robust rebound earlier today but has since faced challenges in overcoming near-term resistance against its primary counterparts. Yen also finds itself overshadowed by Australian and New Zealand Dollar’s strong comeback. Euro and Sterling are also gaining ground against Dollar, Canadian Dollar, and Swiss Franc, though they face difficulties when pitted against other currencies.

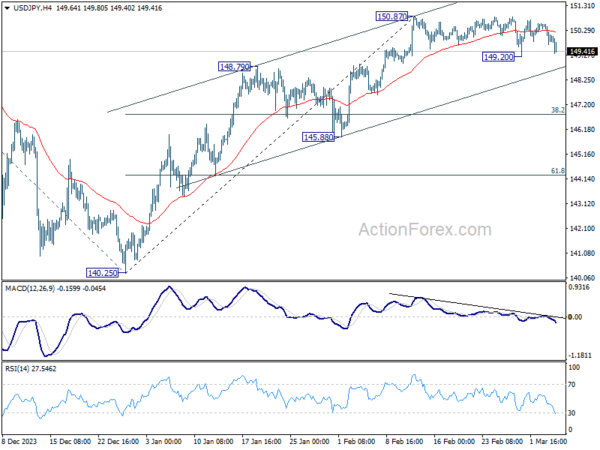

Technically, immediate focus is now on 149.20 in USD/JPY with today’s steep decline. Firm break there will argue that price actions from 150.87 are at least developing into a correction to whole rise from 140.25. There is also prospect of reversing whole rise too. But in either case, that would lead to deeper decline to 38.2% retracement of 140.25 to 150.87 at 146.81.

In Europe, at the time of writing, FTSE is up 0.32%. DAX is up 0.05%. CAC is up 0.16%. UK 19-year yield is up 0.006 at 4.112. Germany 10-year yield is up 0.017 at 2.339. Earlier in Asia, Nikkei fell -0.02%. Hong Kong HSI rose 1.70%. China Shanghai SSE fell -0.26%. Singapore Strait Times rose 0.93%. Japan 10-year JGB yield rose 0.0100 to 0.718.

Fed Powell stands firm: No rate cuts without greater confidence

In his semiannual Congressional testimony, Fed Chair Jerome Powell’s prepared remarks highlighted the necessity for Fed to await “greater confidence” in inflation’s sustainable movement towards 2 % target before considering any reduction in policy rates.

Powell acknowledged the policy rate is “likely at its peak” for the current cycle, and it’s appropriate for “dialing back policy restraint at some point this year.” However, he also stressed the “uncertain” economic outlook and noted that the path to 2% inflation is “not assured,”

The Fed Chair warned of the consequences of prematurely or excessively loosening policy, noting that such actions could jeopardize the progress made in inflation control, possibly necessitating “even tighter policy” in the future. Conversely, delaying or minimizing the reduction of policy restraint risks harming economic activity and employment.

US ADP employment rises 140k in Feb, gains remain solid

US ADP private employment rose 140k in February, below expectation of 140k. By sector, goods-producing jobs rose 30k while service-providing jobs rose 110k. By establishment size, small companies added 13k jobs, medium companies added 69k, large companies added 61k.

Annual pay for job-stayers rose 5.1% yoy, lowest since August 2021. Annual pay for job-changers rose 7.6% yoy, faster than the prior month for the first time since November 2022.

“Job gains remain solid. Pay gains are trending lower but are still above inflation,” said Nela Richardson, chief economist, ADP. “In short, the labor market is dynamic, but doesn’t tip the scales in terms of a Fed rate decision this year.”

Eurozone retail sales rises 0.1% mom in Jan, EU up 0.3% mom

Eurozone retail sales volume rose 0.1% mom in January, matched expectations. The volume of retail trade increased for food, drinks, tobacco by 1.0%, decreased for non-food products (except automotive fuel) by -0.2%, increased for automotive fuel in specialised stores by 1.7%.

EU retail sales rose 0.3% mom. Among Member States for which data are available, the highest monthly increases in the total retail trade volume were recorded in Luxembourg (+7.6%), Romania (+3.8%) and Cyprus (+1.5%). The largest decreases were observed in Estonia (-2.6%), Slovakia (-1.0%) and Latvia (-0.8%).

IfW slashes 2024 German growth forecast to 0.1% due to multiple challenges

Kiel Institute for the World Economy significantly downgraded its growth expectations for German economy, projecting a mere 0.1% increase in 2024, a sharp downward revision from its previous forecast of 0.9%. Slight improvement is anticipated in 2025, with growth expected to accelerate to 1.2%. On the inflation front, decline to 2.3% is projected for this year, down from 5.9% in 2023, with further reduction anticipated to 1.7% in 2025. Unemployment rate is expected to marginally decrease from 5.8% in 2024 to 5.6% in 2025.

Moritz Schularick, President of the Kiel Institute, pointed to a “whole range of factors” currently dampening sentiment and economic performance in Germany. These include global economic slowdown impacting exports, ECB’s restrictive monetary policy expected to extend into the next year, and German government’s austerity measures, which Schularick believes are being implemented at an inopportune time, fostering additional pessimism.

Stefan Kooths, Head of Economic Research at the Kiel Institute, added that despite gradual recovery expected over the year, the overall economic dynamism in Germany remains subdued. He underscored the emergence of signs indicating that structural issues are mainly to blame for the economic slowdown, with private investment falling short, partly due to the significant uncertainty provoked by current economic policies.

RBNZ’s Conway: OCR to stay restrictive for some time into the future

RBNZ Chief Economist Paul Conway, speaking at a webinar today, noted that emphasizing the contractionary nature of current interest rates is effectively “tapping the brakes” on the economy to moderate its pace of growth and address inflationary pressures.

Conway expressed optimism about the recent declines in core inflation and business inflation expectations. However, he also highlighted ongoing concerns regarding elevated household inflation expectations, which pose a potential risk to the inflation outlook.

Looking forward, Conway underscored the necessity for OCR to maintain a restrictive level “for some time into the future” to get headline inflation, currently at 4.7%, back into the 1-3% target band.

An interesting consideration Conway raised was the impact of Fed’s policy moves on New Zealand’s monetary policy trajectory. He suggested that if Fed were to initiate rate cuts towards the end of the year, and RBNZ did not follow suit, the resulting appreciation in NZD could alleviate inflationary pressures in New Zealand. This scenario might prompt RBNZ to reassess its rate cut timeline, leading to earlier-than-anticipated adjustments depending on the broader economic implications.

Australia’s GDP up 0.2% qoq in Q4, continuing consistent slowdown

Australia GDP grew 0.2% qoq in Q4, slightly below expectation of 0.3% qoq. On an annual basis, the economy expanded by 1.5% yoy.

The data indicates deceleration in economic momentum as the year progressed, with Katherine Keenan, the head of national accounts at ABS, noting a consistent slowdown across each quarter of 2023.

The main pillars supporting GDP growth were identified as government spending and private business investment. Government final consumption expenditure saw 0.6% qoq increase , while private business investment grew 0.7% qoq.

The significant contribution of net trade, which added 0.6 percentage points to the overall GDP growth, was largely attributed to a -3.4% qoq decrease in import.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0840; (P) 1.0858; (R1) 1.0875; More…

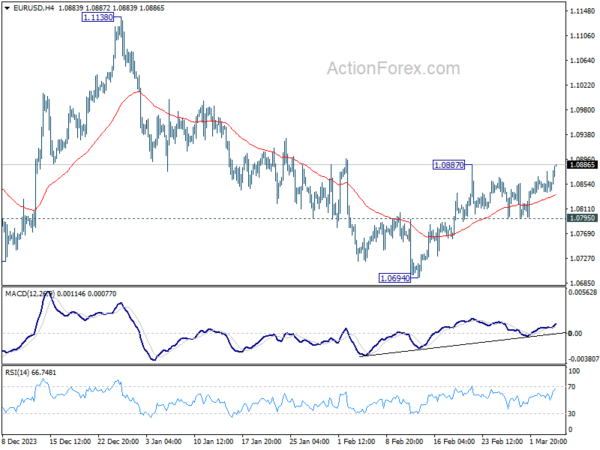

Immediate focus is now on 1.0887 resistance in EUR/USD with today’s rally. Firm break there will resume whole rise from 1.0694. Also, sustained trading above 55 D EMA (now at 1.0831) will affirm the case that fall from 1.1138 has completed. In this case, intraday bias will be back on the upside for retesting 1.1138 high. Nevertheless, on the downside, break of 1.0795 minor support will turn bias back to the downside for retesting 1.0694 support.

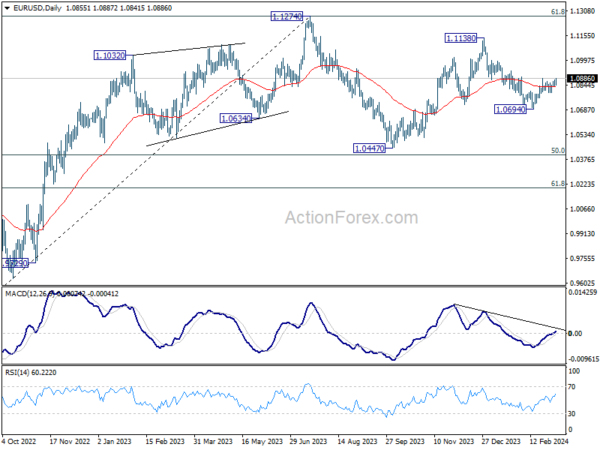

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern to rise from 0.9534 (2022 low). Rise from 1.0447 is seen as the second leg. While further rally could cannot be ruled out, upside should be limited by 1.1274 to bring the third leg of the pattern. Meanwhile, sustained break of 1.0694 support will argue that the third leg has already started for 1.0447 and possibly below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | GDP Q/Q Q4 | 0.20% | 0.30% | 0.20% | 0.30% |

| 07:00 | EUR | Germany Trade Balance (EUR) Jan | 27.5B | 21.0B | 22.2B | 22.4B |

| 09:30 | GBP | Construction PMI Feb | 49.7 | 49.2 | 48.8 | |

| 10:00 | EUR | Eurozone Retail Sales M/M Jan | 0.10% | 0.10% | -1.10% | -0.60% |

| 13:15 | USD | ADP Employment Change Feb | 140K | 150K | 107K | |

| 13:30 | CAD | Labor Productivity Q/Q Q4 | 0.40% | -0.10% | -0.80% | |

| 14:45 | CAD | BoC Interest Rate Decision | 5.00% | 5.00% | ||

| 15:00 | USD | Fed’s Chair Powell testifies | ||||

| 15:00 | USD | Wholesale Inventories Jan F | -0.10% | -0.10% | ||

| 15:00 | CAD | Ivey PMI Feb | 54.4 | |||

| 15:30 | USD | Crude Oil Inventories | 2.4M | 4.2M | ||

| 19:00 | USD | Fed’s Beige Book |