Market sentiment was clearly mixed in Asian session today, highlighted by Nikkei’s remarkable resilience and Hong Kong’s stocks’ downturn. The day commenced with Nikkei momentarily succumbing to profit taking pressure, dropping below 40k mark after Tokyo’s CPI was reported to have risen to 2.5%. This initial dip, however, was short-lived as the index swiftly recaptured its losses, soaring back above 40k psychological by the afternoon. This swift recovery not only showcases the robust confidence permeating among investors but also suggests that speculations of an imminent market correction might be premature. It appears that the bullish momentum engulfing the index is likely to sustain at least until BoJ clarifies its stance on interest rate hikes at the meeting later this month.

On the other hand, Hong Kong’s equity market faced significant setbacks, as reaction to Chinese Premier Li Qiang’s economic outlook announcements. The setting of a somewhat conservative GDP growth target at around 5% for the year, coupled with consumer price inflation goal of about 3%, has been interpreted by some economists as a tacit acknowledgment of the prevailing economic challenges. Additionally, the central government’s decision to cap deficit at 3% of GDP indicates a reluctance to deploy substantial fiscal stimulus, further tempering expectations of aggressive economic interventions.

In the currency markets, Australian and New Zealand Dollars are languishing as the day’s underperformers sofar, trailed by Canadian. Conversely, Dollar and Yen carved out modest gains, with Euro not far behind in performance. Sterling and Swiss Franc found themselves mixed in a middle path. Attention in the forex markets now turns towards upcoming US ISM Services data, with particular emphasis on price and employment components, in addition to the headline figure.

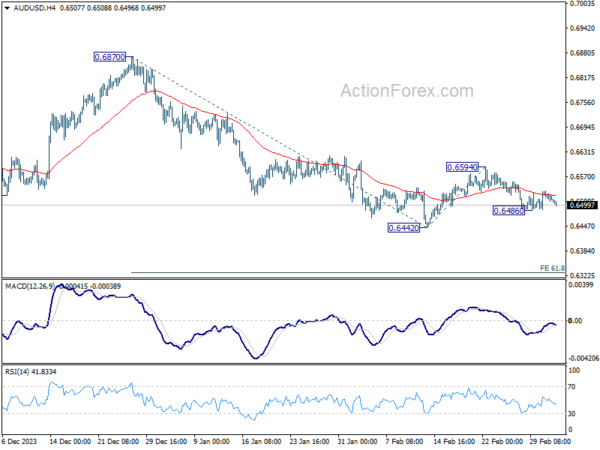

Technically, focus in AUD/USD is back on 0.6486 temporary low after rejection by 55 4H EMA. Break there will resume the fall from 0.6594 to retest 0.6442 low first. Firm break there will resume whole decline from 0.6870 for 61.8% projection of 0.6870 to 0.6442 from 0.6594 at 0.6329 next.

In Asia, at the time of writing, Nikkei is up 0.21%. Hong Kong HSI is down -1.95%. China Shanghai SSE is up 0.26%. Singapore Strait Times is down -0.39%. Japan 10-year JGB yield is down -0.004 at 0.712. Overnight, DOW fell -0.25%. S&P 500 fell -0.12%. NASDAQ fell -0.41%. 10-year yield rose 0.039 to 4.219.

Fed’s Bostic: No sequential rate cuts and highlights risks of pent-up exuberance

Atlanta Fed President Raphael Bostic emphasized the necessity of seeing “more progress” on inflation reduction before considering any rate cuts. He said overnight that the prosperity in the labor market and the economy, granting the FOMC the “luxury of making policy without the pressure of urgency.”

In terms of the pace of policy loosening once initiated, Bostic envisages a measured approach rather than “back to back” adjustments. The reaction of market participants, business leaders, and households to policy changes will critically influence the pace of rate cuts.

Highlighting ongoing inflation concerns, Bostic pointed out the continued price increases in a significant portion of goods and services at rates exceeding 5% annually. Moreover, a Dallas Fed measure indicated that underlying inflation remains slightly above Fed’s target at 2.6%, further complicating the path towards rate normalization.

Bostic also reflected on the feedback from business executives, noting a widespread strategy of holding back investments and hiring until more favorable conditions emerge. He warned of the “pent-up exuberance” that could result from a large-scale unleashing of this dormant capacity, introducing a new variable of upside risk to the economy.

Japan’s Tokyo CPI core rises to 2.5% yoy, PMI services finalized at 52.9

Japan’s Tokyo CPI core (ex-fresh food) rose from upwardly 1.8% yoy to 2.5% yoy in February, matched expectations. CPI core-core (ex-food and energy) slowed from 3.3% yoy to 3.1% yoy. Headline CPI in the capital city rose from 1.8% yoy to 2.6% yoy.

Also released, PMI Services was finalized at 52.9 in February, down from January’s 53.1, but stays in expansion for the 18th month in a row. PMI Composite was finalized at 50.6, down from prior month’s 51.5.

According to Usamah Bhatti, Economist at S&P Global Market Intelligence,services business activity growth was sustained into February while the rate of growth in new business accelerated to a six-month high. However, steeper reduction in manufacturing output levels contributed to a slowdown in overall private sector activity growth.

China’s Caixin PMI services falls to 52.5, composite unchanged at 52.5

China’s Caixin PMI Services fell from 52.7 to 52.5 in February, below expectation of 52.9. PMI Composite was unchanged at 52.5.

Wang Zhe, Senior Economist at Caixin Insight Group, noted that both manufacturing and services sectors recorded steady growth. However, he noted supply was “still running ahead” of improved demand. Employment across both sectors saw contraction. On the pricing front, pressures of low prices becoming more pronounced within the manufacturing sector.

Overall, “market sentiment remained optimistic”, Wang noted.

Looking ahead

Eurozone PMI services final and PPI will be released in European session. UK will also publish PMI services final. Later in the day, US ISM services will take center stage while factory orders will also be featured.

USD/JPY Daily Outlook

Daily Pivots: (S1) 150.05; (P) 150.31; (R1) 150.78; More…

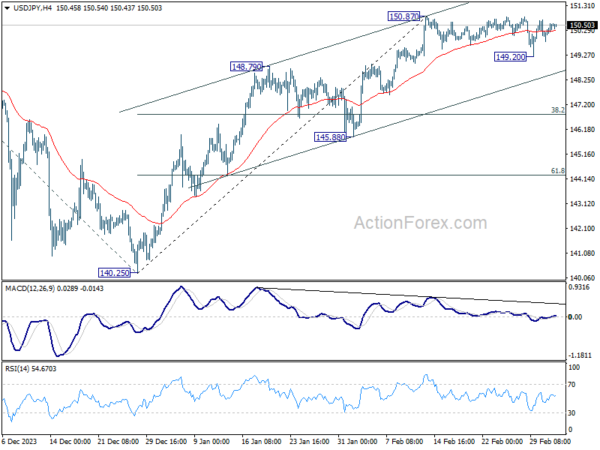

No change in USD/JPY’s outlook as consolidation from 150.87 is extending. Intraday bias stays neutral for the moment. On the upside, break of 150.87 will resume the rise from 140.25 to 151.89/93 key resistance zone. On the other hand, considering bearish divergence condition in 4H MACD, firm break of 149.20 will confirm short term topping at 150.87. Deeper fall would be seen to channel support (now at 148.60) and possibly below, even as a corrective move.

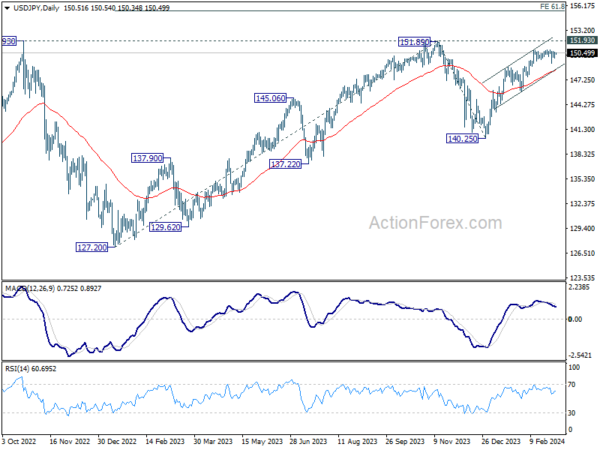

In the bigger picture, rise from 140.25 is seen as resuming the trend from 127.20 (2023 low). Decisive break of 151.89/.93 resistance zone will confirm this bullish case and target 61.8% projection of 127.20 to 151.89 from 140.25 at 155.50. However, break of 148.79 resistance turned support will delay this bullish case, and extend the corrective pattern from 151.89 with another falling leg.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Tokyo CPI Y/Y Feb | 2.60% | 1.60% | 1.80% | |

| 23:30 | JPY | Tokyo CPI ex Fresh Food Y/Y Feb | 2.50% | 2.50% | 1.60% | 1.80% |

| 23:30 | JPY | Tokyo CPI ex Food & Energy Y/Y Feb | 3.10% | 3.10% | 3.30% | |

| 00:01 | GBP | BRC Like-For-Like Retail Sales Y/Y Feb | 1.00% | 1.40% | ||

| 00:30 | AUD | Current Account Balance (AUD) Q4 | 11.8B | 5.0B | -0.2B | 1.3B |

| 01:45 | CNY | Caixin Services PMI Feb | 52.5 | 52.9 | 52.7 | |

| 07:45 | EUR | France Industrial Output M/M Jan | -0.10% | 1.10% | ||

| 08:45 | EUR | Italy Services PMI Feb | 52.3 | 51.2 | ||

| 08:50 | EUR | France Services PMI Feb F | 48 | 48 | ||

| 08:55 | EUR | Germany Services PMI Feb F | 48.2 | 48.2 | ||

| 09:00 | EUR | Eurozone Services PMI Feb F | 50 | 50 | ||

| 09:30 | GBP | Services PMI Feb F | 54.3 | 54.3 | ||

| 10:00 | EUR | Eurozone PPI M/M Jan | -0.10% | -0.80% | ||

| 10:00 | EUR | Eurozone PPI Y/Y Jan | -8.10% | -10.60% | ||

| 14:45 | USD | Services PMI Feb F | 51.3 | 51.3 | ||

| 15:00 | USD | ISM Services PMI Feb | 0.30% | 53.4 | ||

| 15:00 | USD | Factory Orders M/M Jan | -2.80% | 0.20% |