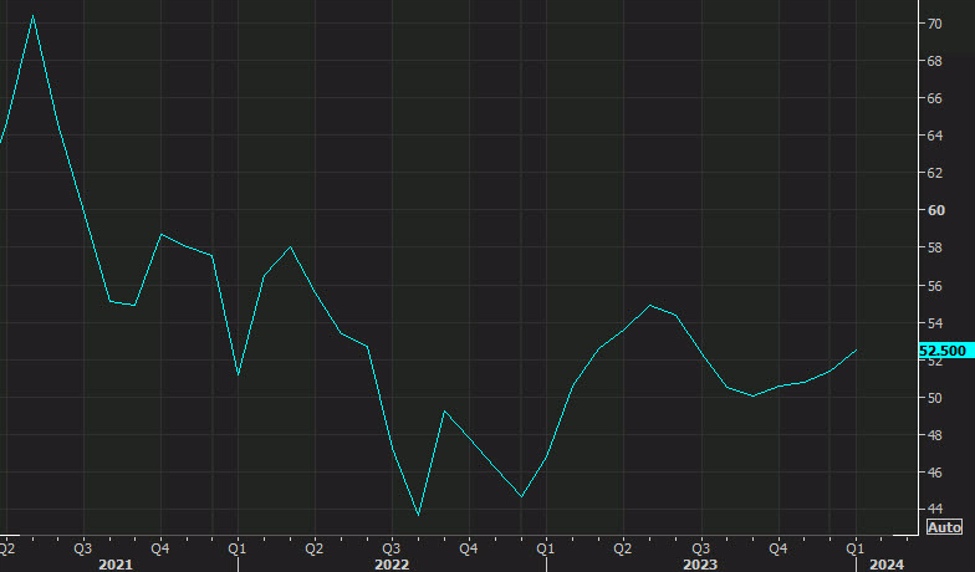

ISM services

The theme so far in 2024 has been the dominance of economic data. Each release re-calibrates Fed expectations and all the market pricing that’s built around it.

A great example was on Friday when a series of soft second-tier data led to a slump in the US dollar and declining Treasury yields. Rates are down again today but the dollar is firm so far, with some angst rising due to China’s larger military budget.

That will continue to play out in the background but data will dominate in the next few hours. There is nothing due out at the bottom of the hour as the action doesn’t kick off until 9:45 am ET with the release of the final S&P Global US services PMI. The prelim was 51.3 compared to 52.5 last month.

That report sets the stage for the ISM services reading, which is expected to dip to 53.0 from 53.4. An undershoot, especially with soft prices paid would add a dovish injection to markets. At the same time, we also get the US factory orders report, which includes revisions to durable goods orders.

On the Fed calendar, Barr participates in a couple roundtables at noon at 3:30 pm ET but the topics are more regulatory. Tomorrow we get the first day of Powell’s two-day testimony.

For more, see the economic calendar.