Dollar rises broadly in early US session, standing out in a day characterized by relatively slow news flow. The move in the greenback can be primarily attributed to the rise in US benchmark yields, which outpaced those of other regions, thereby bolstering the greenback’s appeal.

Sentiment surrounding the US market remains positive, with traders showing confidence in resilience of the US economy. This optimism persists despite expectations that Fed’s cycle of interest rate cuts may commence later than previously anticipated.

The development is fostering a relatively unusual scenario where Dollar, yields, and stocks may ascend in tandem, a convergence that could persist until the correlation dynamics shift.

Meanwhile, Japanese Yen finds itself at the bottom of today’s performance chart, initially dragged down by dovish remarks from a senior BoJ official and further pressured by the strength in US and European benchmark yields.

Following closely behind in terms of underperformance were Australian and New Zealand Dollars, which succumbed to the gravitational pull of concerning economic data from China indicating deepening of deflationary pressures as the new year commenced.

In contrast, the Swiss Franc and Canadian Dollar showcased resilience, managing to secure firmer ground amidst the currency tumult, while the Euro and Sterling exhibit mixed performance.

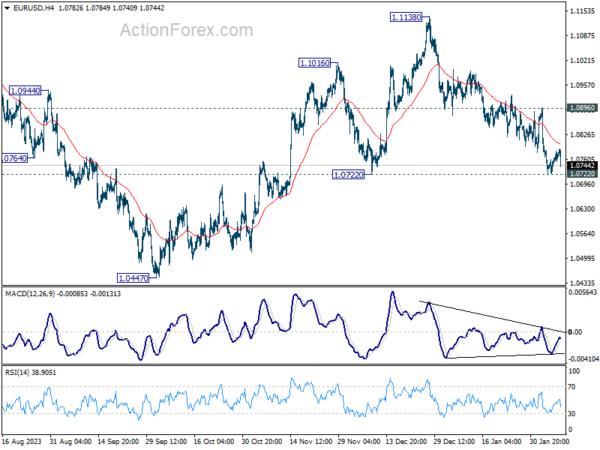

Technically, it’s possible that EUR/USD’s recovery since Monday has already completed, after failing to even tough 55 4H EMA. 1.0722 support is back as the focus for the rest of the week. Decisive break there will indicate that whole rebound from 1.0447 has completed at 1.1138, and solidify near term bearishness for retesting 1.0447 low later in the month.

In Europe, at the time of writing, FTSE is down -0.09%. DAX is up 0.51%. CAC is up 0.81%. UK 10-year yield is up 0.0030 at 4.021. Germany 10-year yield is up 0.019 at 2.337. Earlier in Asia, Nikkei rose 2.06%. Hong Kong HSI fell -1.27%. China Shanghai SSE rose 1.28%. Singapore Strait Times fell -0.42%. Japan 10-year JGB yield fell -0.0108 to 0.699.

US initial jobless claims falls to 218k, vs exp 220k

US initial jobless claims fell -9k to 218k in the week ending February 3, slightly better than expectation of 220k. Four-week moving average of continuing claims rose 4k to 212k.

Continuing claims fell -23k to 1871k in the week ending January 27. Four-week moving average of continuing claims rose 9.5k to 1850k.

ECB’s Wunsch sees some value to waiting

ECB Governing Council member Pierre Wunsch said today, “I’m on the side of those that believe there’s some value to waiting” before cutting interest rates.

Nevertheless, Wunsch also acknowledged the inherent uncertainties in economic forecasting and the eventual need to make decisions based on the best available data. “But again, we won’t get full comfort. So at some point, we’ll have to look at all the information we have and take a bet,” he said.

A critical factor in Wunsch’s cautious stance is the current state of wage growth within Eurozone. He pointed out that wage increases are occurring at a pace that may undermine ECB’s efforts to bring inflation down to 2% inflation target. Were it not for the uptick in salaries, ECB might already be in a position to initiate monetary easing.

BoJ’s Uchida signals no swift hikes after negative rate ends

In a speech today, BoJ Deputy Governor Shinichi Uchida articulated a scenario where, despite an end to the negative interest rate policy, rapid interest rate hikes remain unlikely.

“Even if the Bank were to terminate the negative interest rate policy, it is hard to imagine a path in which it would then keep raising the interest rate rapidly,” he stated, suggesting a gradual adjustment process, while financial conditions wild remain “accommodative.

Uchida projected gradual increase in underlying inflation toward 2 percent target through fiscal 2025. This forecast anticipates core CPI (all items less fresh food) at 2.8% for fiscal 2023, with a subsequent moderation to 2.4% in fiscal 2024 and 1.8% in fiscal 2025.

Theses projections are based on the outlook that “while the pass-through of cost increases will continue to wane, prices such as of services will rise, accompanied by wage increases.”

To achieve this economic outlook, Uchida emphasized, the virtuous cycle needs to intensify in both directions, from prices to wages and from wages to prices.”

China’s deepening deflation: CPI hits 14-year low in Jan

China’s CPI took a notable dip in January, registering decrease of -0.8% yoy, marking a significant deepening of deflationary pressures from the previous month’s -0.3% and falling short of expectation -0.5% yoy. This downturn represents the fourth consecutive negative reading and the most substantial fall observed since 2009, over fourteen years ago.

The decline was particularly pronounced in food prices, which was down -5.9% yoy. Meanwhile, core CPI, which excludes volatile energy and food prices, rose by a modest 0.4% yoy, slowing from December’s 0.6% yoy increase. Despite the annual downturn, CPI saw a slight month-on-month increase of 0.3%, albeit below the anticipated 0.4% growth.

The NBS attributed January’s inflation figures to the high base effect associated with the Spring Festival, or Lunar New Year, which occurred in January the previous year. This annual holiday, which shifts between January and February depending on the lunar calendar, significantly impacts consumption patterns and inflation metrics due to its influence on consumer spending and business operations.

In parallel, PPI fell by -2.5% yoy in January, showing a modest improvement from the -2.7% yoy observed in the previous month and slightly better than -2.6% forecast. This marks the 16th consecutive month of annual declines for PPI, with factory-gate prices decreasing by -0.2% mom, following -0.3% mom drop in December.

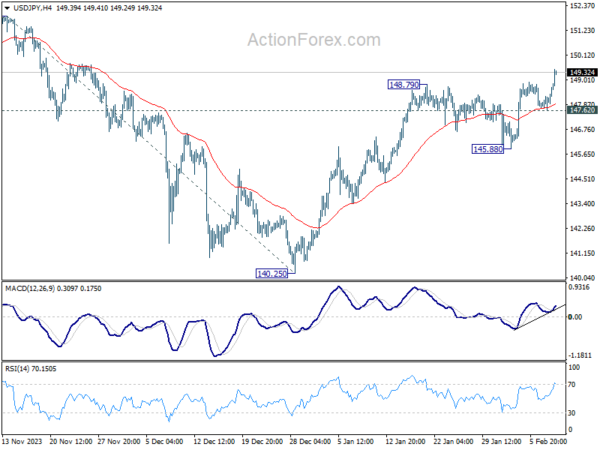

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 147.79; (P) 148.02; (R1) 148.42; More…

USD/JPY’s rally from 140.25 is in progress and intraday bias remains on the upside. Further rally is expected to retest 151.89/93 key resistance zone. Decisive break there will confirm resumption of larger up trend. On the downside, below 147.62 minor support will turn intraday bias neutral first. But near term outlook will remain cautiously bullish as long as 145.88 support holds.

In the bigger picture, fall from 151.89 is seen as a correction to the rally from 127.20, which might have completed at 140.25 already. Firm break of 151.89/93 resistance zone will confirm up trend resumption next target will be 61.8% projection of 127.20 to 151.89 from 140.25 at 155.50. This will now remain the favored case as long as 140.25 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Bank Lending Y/Y Jan | 3.10% | 3.20% | 3.10% | 3.00% |

| 00:01 | GBP | RICS Housing Price Balance Jan | -18% | -28% | -30% | |

| 01:30 | CNY | CPI Y/Y Jan | -0.80% | -0.50% | -0.30% | |

| 01:30 | CNY | PPI Y/Y Jan | -2.50% | -2.60% | -2.70% | |

| 05:00 | JPY | Eco Watchers Survey: Current Jan | 50.2 | 50.3 | 50.7 | |

| 09:00 | EUR | ECB Economic Bulletin | ||||

| 13:30 | USD | Initial Jobless Claims (Feb 2) | 218K | 220K | 224K | 227K |

| 15:00 | USD | Wholesale Inventories Dec F | 0.40% | 0.40% | ||

| 15:30 | USD | Natural Gas Storage | -73B | -197B |