In a week crowded with high-profile events like FOMC rate decision overnight and the upcoming BoE meeting today, Japanese Yen is surprisingly stealing the show as the star performer in the currency markets. This rally in Yen’s can be attributed to the significant drop in global benchmark treasury yields, driven by renewed flight to safety amidst fresh concerns over banking stability. The apprehension in the banking sector has prompted investors to flock to bonds. Meanwhile, it’s also bolstering Yen, especially against Australian Dollar, which is currently under pressure due to more lackluster Chinese economic data.

Dollar, meanwhile, regained some ground overnight and stayed firm in Asian session. Fed Chair Jerome Powell’s unequivocal stance against a March rate cut has led to significant pullback in US stocks. However, the impact on Asian equities has been relatively muted, with the markets showing mixed response. Focuses will now shift to Eurozone CPI flash, BoE rate decision, and US ISM manufacturing today, and then non-farm payrolls tomorrow.

As the week progresses, Yen stands out as the strongest currency, buoyed by its safe-haven appeal amid the current market uncertainties. New Zealand Dollar and Canadian Dollar follow as the next strongest. On the flip side, Australian Dollar finds itself at the bottom of the performance chart, reflecting regional economic challenges, while Euro and Sterling also lag. Dollar and Swiss Franc find themselves in mixed positions.

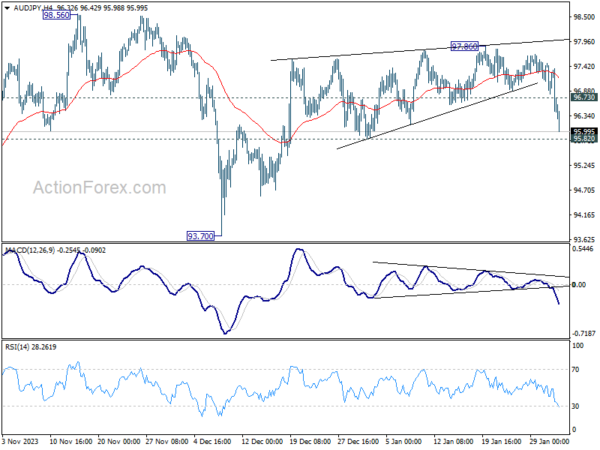

Technically, let’s follow up on AUD/JPY’s development as it accelerates down to as low as 95.98 so far. Fall from 97.86 is seen as the third leg of the pattern from 98.56 high. Further decline is expected as long as 96.73 minor resistance holds. Decisive break of 95.82 will target 93.70, and possibly further to 93.00 key support level.

In Asia, at the time of writing, Nikkei is down -0.78%. Hong Kong HSI is up 0.71%. China Shanghai SSE is down -0.29%. Singapore Strait Times is down -0.33%. Japan 10-year JGB yield is down -0.0303 at 0.706. Overnight, DOW fell -0.82%. S&P 500 fell -1.61%. NASDAQ fell -2.23%. 10-year yield fell -0.092 to 3.967.

DOW tumbles as Fed Powell rules out March rate cut

US stocks plunged sharply overnight, following Fed’s decision to maintain the interest rate at 5.25-5.50%. While Fed finally dropped tightening bias, indicating the peak of the tightening cycle, it firmly dismissed the possibility of an imminent rate cut in March.

Chair Jerome Powell’s statement during the post-meeting press conference was clear: “I don’t think it’s likely that the committee will reach a level of confidence by the time of the March meeting to identify March is the time to do that”.This comment has effectively quashed hopes for an early rate cut.

Policy loosening is still underway, echoing December’s dot plot. Powell said, “We believe that our policy rate is likely at its peak for this tightening cycle and that if the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint, at some point this year.”

Some Fed reviews:

In response to these developments, DOW closed down -317.01 pts or -0.81% at 38150.30. Near term focus is now on 37795.71 support. Decisive break there will confirm initial rejection by 100% projection of 28660.94 to 34712.28 from 32327.20, possibly on bearish divergence condition in D MACD too. That would kick start a correction phase back to 55 D EMA (now at 36856.81).

Similarly, for S&P 500, break of 4802.40 support will confirm short term bottoming, after rejection by 100% projection of 3808.86 to 4607.07 from 4103.78, on bearish divergence condition in D MACD. Deeper correction should then be seen to 55 D EMA (now at 4697.73).

US 10-year yield dives below 4% as fresh bank fears prompt flight-to-safety

US 10-year yield declined significant overnight, closing below 4% psychological at 3.967, as investors flocked to the safety of bonds amidst growing concerns over the banking sector. This shift in sentiment was triggered by New York Community Bancorp’s unexpected quarterly loss and subsequent dividend cut, which led to a steep 34% drop in its stock. The unease quickly spread to other smaller lending institutions, reigniting memories of last year’s brief banking crisis and spurring a rush towards Treasury bonds.

This flight to safety was further influenced by the Treasury Department’s announcement. It revealed moderate increases in upcoming Treasury auctions for shorter-duration bonds, specifically two-, three-, and five-year government bonds, while signaling only minimal increases for longer durations, including 10 years and beyond. Notably, the Treasury indicated that these adjustments are likely to be the last for several quarters.

Technically, 10-year yield’s rebound from 3.785 should have completed at 4.198, after rejection by 55 D EMA (now at 4.147), and ahead of 38.2% retracement of 4.997 to 3.785 at 4.247. Deeper fall is expected towards 3.785 low, but stronger support should be seen there to bring rebound, to extend sideway trading first. However, firm break of 3.785 will resume the whole decline from 4.997, with 3.253 medium term support as next target.

Japan’s PMI manufacturing finalized at 48.0, depressed economy and escalating cost pressures

Japan’s PMI Manufacturing was finalized at 48.0 in January, a minimal increase from December’s 47.9, yet still indicative of ongoing challenges in the sector.

According to S&P Global, this figure represents a “modest deterioration” in the health of the manufacturing sector, marking a “sustained downturn” at the start of the year.

Usamah Bhatti of S&P Global Market Intelligence highlights the “depressed economic conditions” both domestically and globally as significant contributors to the sector’s struggles. The data also shows notable declines in both output and new orders, with the latter experiencing a particularly sharp drop.

Manufacturers in Japan are also facing heightened pressures related to costs and supply. The cost burdens have been rising sharply, driven by increased prices of raw materials, labor, and fuel.

Additionally, supplier performance has deteriorated significantly, marked as the worst in three months. Issues such as delivery and logistical delays have been frequently mentioned, with some attributing these challenges to the ongoing disruption in the Red Sea.

China’s Caixin PMI manufacturing unchanged at 50.8, economic challenges persist

China’s Caixin PMI Manufacturing was unchanged at 50.8 in January, matched expectations. The sector showed modest production growth, although the overall sales expansion softened. Notably, this period marked the first rise in new export business in seven months, and business confidence reached a nine-month high. However, the employment sector continued to contract, and the market faced ongoing deflationary pressures.

Wang Zhe, Senior Economist at Caixin Insight Group, highlighted that despite the stability in manufacturing, the Chinese economy still grapples with “significant challenges”, including weak demand, employment pressures, and subdued market expectations. He emphasized that these issues are yet to see a “fundamental shift reversal”.

BoE watched with focus on voting dynamics and economic projections

Expectations are firmly set for BoE to keep interest rate unchanged at 5.25% today, marking the fourth consecutive session without a change. Several crucial factors could inject volatility into the financial markets, including the vote split, updated economic projections, and guidance.

A critical aspect to watch is the voting pattern among the MPC’s nine members. It is unlikely that any member will advocate for an interest rate hike. The central question is whether any members, like known dove Swati Dhingra, will begin to vote for a rate cut.

Another key area of interest lies in the revised economic forecasts. Given recent economic developments, it’s plausible that the growth forecasts may see a notable upgrade, while the near-term inflation outlook could be revised downwards. These changes would come with a lowered condition rate path.

The meeting is also expected to see BoE finally dropping its tightening bias, aligning with the broader global central banking trend. However, BoE would likely try to temper any enthusiasm for imminent rate cuts by emphasizing the necessity of maintaining higher interest rates “for longer.” The central bank would require more evidence of wage growth deceleration before feeling confident enough to reduce rates.

There is a divergence of opinions among economists regarding the timing of the first rate cut, with general consensus fluctuates between May and August of this year. Currently, August is the more probable scenario for the initial cut. However, if today’s meeting leans more dovishly than anticipated, it could tilt the scales in favor of a May cut.

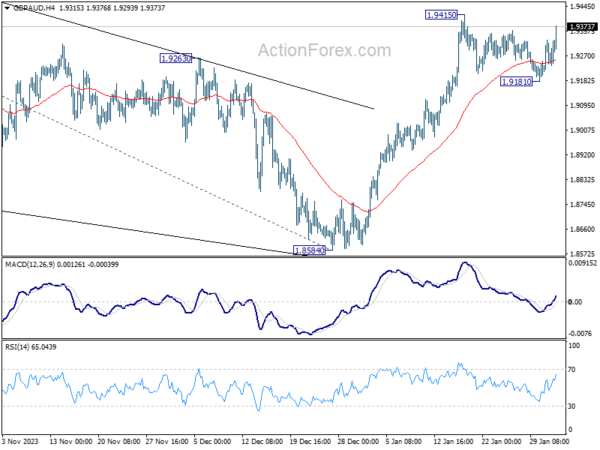

With today’s strong bounce, GBP/AUD’s sideway consolidation from 1.9415 appears to have completed at 1.9181 already. Rise from 1.8584 is probably ready to resume. Firm break of 1.9415 will confirm this bullish case. Nevertheless, break of 1.9181 support will dampen this view and mix up the outlook.

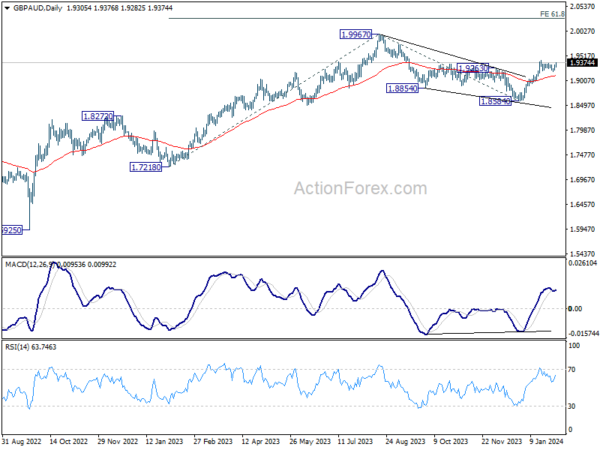

In the bigger picture, corrective pattern from 1.9967 (2023 high) should have completed with three waves down to 1.8584 already. Rise from from there is resuming the long term up trend. Next target is 1.9967 high, with prospect of hitting 61.8% projection of 1.7218 to 1.9967 from 1.8584 at 2.0283.

Looking ahead

BoE rate decision is the major focus today, and UK PMI manufacturing will be released too. Eurozone CPI flash is another highlight, while unemployment rate and PMI manufacturing final will be featured. Swiss will also publish PMI manufacturing. Later in the day, US will release jobless claims and ISM manufacturing. Canada will also release PMI manufacturing.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.0820; (P) 1.0838; (R1) 1.0865; More…

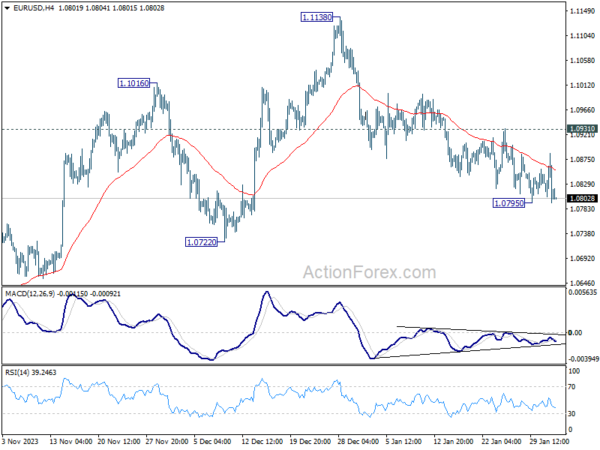

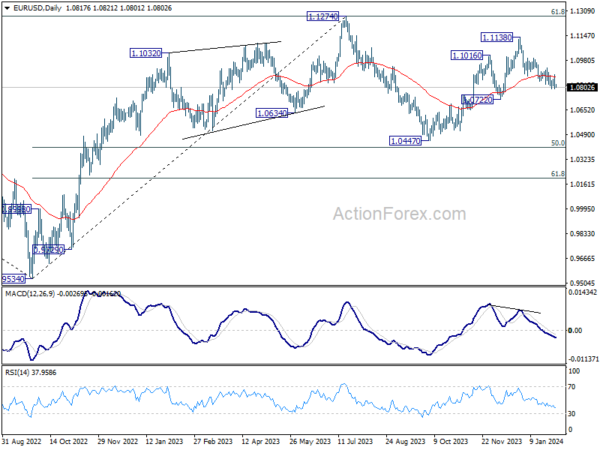

Intraday bias in EUR/USD remains neutral for the moment and outlook is unchanged. Further decline is expected as long as 1.0931 minor resistance holds. Below 1.0795 will resume the fall from 1.1138 to 1.0722 structural support next. Decisive break there will argue that whole rise from 1.0447 has completed, and target this low. On the upside, however, break of 1.0931 will turn bias back to the upside for stronger rebound instead.

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern to rise from 0.9534 (2022 low). Rise from 1.0447 is seen as the second leg. While further rally could cannot be ruled out, upside should be limited by 1.1274 to bring the third leg of the pattern. Meanwhile, sustained break of 1.0722 support will argue that the third leg has already started for 1.0447 and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | NAB Business Confidence Q4 | -6 | -1 | ||

| 00:30 | AUD | Building Permits M/M Dec | -9.50% | 0.10% | 1.60% | |

| 00:30 | AUD | Import Price Index Q/Q Q4 | 1.10% | 0.60% | 0.80% | |

| 00:30 | JPY | Manufacturing PMI Jan F | 48 | 48 | 48 | |

| 01:45 | CNY | Caixin Manufacturing PMI Jan | 50.8 | 50.8 | 50.8 | |

| 08:30 | CHF | Manufacturing PMI Jan | 44.5 | 43 | ||

| 08:45 | EUR | Italy Manufacturing PMI Jan | 47.3 | 45.3 | ||

| 08:50 | EUR | France Manufacturing PMI Jan F | 43.2 | 43.2 | ||

| 08:55 | EUR | Germany Manufacturing PMI Jan F | 45.4 | 45.4 | ||

| 09:00 | EUR | Eurozone Manufacturing PMI Jan F | 46.6 | 46.6 | ||

| 09:30 | GBP | Manufacturing PMI Jan F | 46.9 | 47.3 | ||

| 10:00 | EUR | Eurozone Unemployment Rate Dec | 6.40% | 6.40% | ||

| 10:00 | EUR | Eurozone CPI Y/Y P | 2.70% | 2.90% | ||

| 10:00 | EUR | Eurozone CPI Core Y/Y P | 3.20% | 3.40% | ||

| 12:00 | GBP | BoE Interest Rate Decision | 5.25% | 5.25% | ||

| 12:00 | GBP | MPC Official Bank Rate Votes | 2–0–7 | 3–0–6 | ||

| 12:30 | USD | Challenger Job Cuts Y/Y Jan | -20.20% | |||

| 13:30 | USD | Initial Jobless Claims (Jan 26) | 211K | 214K | ||

| 13:30 | USD | Nonfarm Productivity Q4 P | 2.40% | 5.20% | ||

| 13:30 | USD | Unit Labor Costs Q4 P | 2.10% | -1.20% | ||

| 14:30 | CAD | Manufacturing PMI Jan | 45.4 | |||

| 14:45 | USD | Manufacturing PMI Jan F | 50.3 | 50.3 | ||

| 15:00 | USD | ISM Manufacturing PMI Jan | 47.7 | 47.4 | ||

| 15:00 | USD | ISM Manufacturing Prices Paid Jan | 45.6 | 45.2 | ||

| 15:00 | USD | ISM Manufacturing Employment Index Jan | 48.1 | |||

| 15:00 | USD | Construction Spending M/M Dec | 0.50% | 0.40% | ||

| 15:30 | USD | Natural Gas Storage | -202B | -326B |