The subdued trading in the forex markets observed through the week continued in today’s Asian session. Despite numerous central bank decisions and key economic data releases, most major currency pairs and crosses are staying within last week’s range. Euro, as the worst performer. so far is a notable exception. This lackluster performance seems tied to relatively larger decline in Germany’s benchmark yield, which reflects concerns over the region’s economic prospects. Yet, selling momentum in the common currency is limited, except versus Sterling.

Meanwhile, Yen, Swiss Franc, and Dollar are leading as the strongest currencies for the week. This may suggest a shift toward risk-averse behavior among investors. However, this interpretation isn’t fully supported by global stock market activity; there’s a noticeable absence of significant selloffs. Even in China, where stocks have been underperforming globally this year, there has been a rebound following PBoC’s decision to cut the reserve requirement ratio to injects liquidity into the market. Commodity currencies are showing slight weakness, though they are performing marginally better than Euro.

The market’s attention is now pivoting to the upcoming US PCE inflation data. Expectations are set for headline PCE inflation to remain steady at 2.6% yoy in December, while core PCE is anticipated to slow from 3.2% yoy to 3.0% yoy. Despite the strong US Q4 GDP data released yesterday, the futures market continues to indicate a roughly 52% likelihood of a Fed rate cut in March. The impending inflation data is poised to play a crucial role in either reinforcing or altering these rate cut expectations.

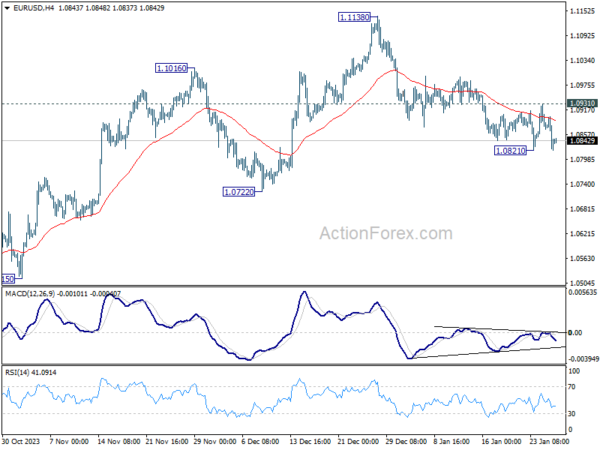

Technically, EUR/USD is now pressing 1.0821 temporary low again as this week’s recovery faltered quickly. Break there will resume the fall from 1.1138 to 1.0722 support. More importantly, decisive break of 1.0722 will argue that whole rebound from 1.0447 has completed, and turn near term outlook bearish for retesting this low. Let’s see how EUR/USD would react to today’s US inflation data.

In Asia, at the time of writing, Nikkei is down -1.39%. Hong Kong HSI is down -0.71%. China Shanghai SSE is down -0.12%. Singapore Strait Times is up 0.41%. Japan 10-year JGB yield is down -0.0369 at 0.713. Overnight, DOW rose 0.64%. S&P 500 rose 0.53%. NASDAQ rose 0.18%. 10-year yield fell -0.046 to 4.132.

Japan’s Tokyo CPI slows sharply to 1.6%, raises questions on BoJ’s negative rates exit

Japan’s Tokyo CPI core (ex-food) slowed significantly from 2.1% yoy to 1.6% yoy in January, below expectation of 1.9% yoy. That’s also the lowest rate since March 2022. Additionally, core-core CPI (ex-food and energy) declined from 3.5% yoy to 3.1% yoy, marking a fifth consecutive month of decline. Headline CPI mirrored this trend, falling from 2.4% yoy to 1.6% yoy.

The latest Tokyo CPI data has sparked a debate among economists regarding its influence on BoJ strategy to phase out negative interest rates. While some analysts believe this data won’t significantly impact BoJ’s plan, anticipating the first rate hike since 2007 in April, others are more cautious. They suggest that the surprising drop in Tokyo inflation might lead BoJ to reconsider or delay the decision.

In parallel, December’s corporate services price index remained steady at 2.4% yoy, aligning with the near nine-year high recorded in November.

BoJ’s minutes emphasize importance of discussions on exiting negative rates

The minutes from BoJ’s meeting on December 18-19 highlighted a focus on strategic discussions regarding the future of its monetary policy. The members agreed on the importance to “deepen discussions” about the “timing of the exit” from the current monetary policy framework and determining the “appropriate pace of raising policy interest rates thereafter.” This discussion is closely tied to the evolving dynamics of “wage and price developments.”

A key sentiment echoed by many members was the prerequisite for a sustainable and stable achievement of the price stability target before considering the termination of the negative interest rate policy and the yield curve control framework. The establishment of a “virtuous cycle between wages and prices” was reiterated as a necessary condition for these policy shifts.

Additionally, some members expressed the viewpoint that BoJ is “not in a situation where it would fall behind the curve” if it did not rush to raise policy interest rates. This perspective suggests a cautious approach to monetary tightening, implying that the central bank doesn’t feel pressured to act hastily in adjusting its interest rate policy.

Looking ahead

Germany Gfk consumer sentiment and Eurozone M3 money supply will be released in European session. Later in the day, US personal income and spending, as well as PCE inflation will be the main focus.

EUR/GBP Daily Outlook

Daily Pivots: (S1) 0.8516; (P) 0.8540; (R1) 0.8559; More…

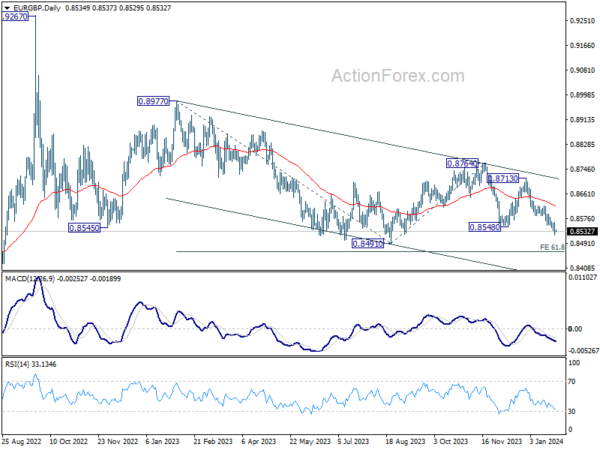

Intraday bias in EUR/GBP remains on the downside as fall from 0.8713 is in progress. Current decline is seen as part of the larger down trend. Next target is 0.8491 low, and then 0.8464 projection level. On the upside, above 0.8563 minor resistance will turn intraday bias neutral and bring consolidations again.

In the bigger picture, fall from 0.8764 is seen as another leg in the whole down trend from 0.9267 (2022 high). Outlook will stay bearish as long as 0.8713 resistance holds. Break of 0.8491 will target 61.8% projection of 0.8977 to 0.8491 from 0.8764 at 0.8464.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Tokyo CPI Y/Y Jan | 1.60% | 2.40% | ||

| 23:30 | JPY | Tokyo CPI ex Fresh Food Y/Y Jan | 1.60% | 1.90% | 2.10% | |

| 23:30 | JPY | Tokyo CPI ex Food & Energy Y/Y Jan | 3.10% | 3.50% | ||

| 23:50 | JPY | Corporate Service Price Index Y/Y Dec | 2.40% | 2.40% | 2.30% | 2.40% |

| 23:50 | JPY | BoJ minutes | ||||

| 00:01 | GBP | GfK Consumer Confidence Jan | -19 | -21 | -22 | |

| 07:00 | EUR | Germany Gfk Consumer Confidence Feb | -24.3 | -25.1 | ||

| 09:00 | EUR | Eurozone M3 Money Supply Y/Y Dec | -0.70% | -0.90% | ||

| 13:30 | USD | Personal Income M/M Dec | 0.30% | 0.40% | ||

| 13:30 | USD | Personal Spending Dec | 0.40% | 0.20% | ||

| 13:30 | USD | PCE Price Index M/M Dec | 0.20% | -0.10% | ||

| 13:30 | USD | PCE Price Index Y/Y Dec | 2.60% | 2.60% | ||

| 13:30 | USD | Core PCE Price Index M/M Dec | 0.20% | 0.10% | ||

| 13:30 | USD | Core PCE Price Index Y/Y Dec | 3.00% | 3.20% | ||

| 15:00 | USD | Pending Home Sales M/M Dec | 1.60% | 0.00% |