The forex markets are currently extending a phase of indecision. Dollar, after briefly rallying against Euro and Swiss Franc, saw its gains diminish. Australian Dollar’s initial surge, fueled by optimism over China’s proposed stock market rescue plan, also quickly dissipated.

Presently, Japanese Yen emerges as the strongest currency for the week, continuing its near-term consolidation. It is closely followed by Dollar and British Pound. On the other end of the spectrum, Australian Dollar is lagging, trailed by Canadian Dollar and Euro.

But it’s emphasized that all major pairs and crosses are trading inside last week’s range, only except GBP/CHF. PMI data from Eurozone UK has the potential to trigger some meaning movement, especially in EUR/GBP. Then, the spotlight will turn to BoC rate decision later in the day.

It’s widely anticipated that BoC will hold the interest rate steady at the 22-year peak of 5.00%. This expectation is set against the backdrop of Canada’s headline inflation rate, which recently re-accelerated to 3.4% in December. BoC Governor Tiff Macklem is expected to underscore the ongoing challenge of taming inflation and to caution against any premature considerations for a rate cut.

The consensus among economists is that any potential rate reduction by the BoC would most likely occur in June or later. Given that’s it’s only January now, it is improbable that Macklem will offer any substantial hints or directional guidance at this juncture.

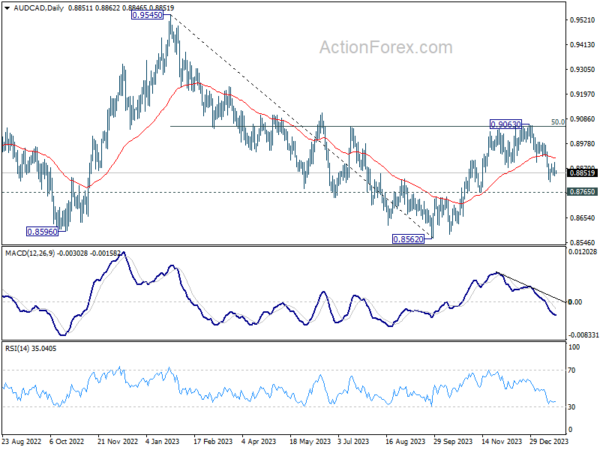

Technically, AUD/CAD’s rebound from 0.8562 should have completed at 0.9063, after hitting 50% retracement of 0.9545 to 0.8562 at 0.9054. Deeper fall should be seen to 0.8765. Sustained break there will target 0.8562 low. This will remain the favored case as long as 55 D EMA (now at 0.8912) holds.

In Asia, at the time of writing, Nikkei is down -1.00%. Hong Kong HSI is up 0.42%. China Shanghai SSE is down -0.70%. Singapore Strait Times is up 0.21%. Japan 10-year JGB yield is up 0.0900 at 0.727. Overnight, DOW fell -0.25%. S&P 500 rose 0.29%. NASDAQ rose 0.43%. 10-year yield rose 0.048 to 4.142.

Japan’s PMI shows modest growth, manufacturing still in contraction

Japan’s PMI Manufacturing rose fractionally from 47.9 to 48.0 in January, below expectation of 48.2. Manufacturing remained in contraction for the eighth consecutive months. PMI Services rose from 5.15 to 52.7. PMI Composite rose from 50.0 to 51.1.

Usamah Bhatti, Economist at S&P Global Market Intelligence, noted that while “modest” the private sector is having the strongest growth since September. However, there was disparity between the sectors, with services reaching a four-month high, while manufacturing marked its eighth consecutive month of contraction.

Regarding inflation, Bhatti said input price inflation “remains high historically”. But output inflation eased to its “lowest since February 2022”. This indicates that while input costs are still elevated, businesses are not passing these costs fully onto consumers.

Japan’s exports exceed JPY 1T in 2023, US reclaims top export destination

Japan’s exports rose 9.8% yoy to JPY 9648B in December, marking the biggest increase in a year. This boost was largely driven by 20.4% yoy jump in exports to US, predominantly from the automotive sector, while exports to Europe climbed by 10.3% yoy. Notably, shipments to China saw 9.6% yoy rise, registering their first growth in 13 months, primarily led by chip-making equipment. In contrast, imports declined -6.8% yoy to JPY 9586B. Consequently, trade balance turned positive, recording JPY 62.1B surplus.

Analyzing the whole year, Japan’s trade deficit in 2023 more than halved to JPY -9.29T from the previous year. The country’s total exports rose by 2.8% to reach JPY 100.89T , surpassing the JPY 100T mark for the first time ever. Meanwhile, total imports saw -7.0% decrease to JPY 110.18T.

A significant shift was observed in Japan’s export destinations in 2023. US reclaimed its position as the largest recipient of Japanese exports by value for the first time in four years, surpassing China. Exports to US reached JPY 20.27T, showing 11.0% increase, while exports to China decreased by -6.5% to JPY 17.76T.

New Zealand CPI slows to 0.5% qoq, 4.7% yoy in Q4

New Zealand CPI rose 0.5% qoq in Q4, down from 1.8% qoq in Q3, matched expectations. Tradeable inflation turned negative to -0.2% qoq, from 1.8% qoq. Non-tradeable inflation slowed to 1.1% qoq, down from 1.7% qoq.

Annually, CPI slowed from 5.6% yoy to 4.7% yoy, matched expectations. Tradeable inflation slowed from 4.7% yoy to 3.0% yoy. non-tradeable inflation also slowed from 6.3% yoy to 5.9% yoy.

“While this is the smallest annual rise in the CPI in over two years, it remains above the Reserve Bank of New Zealand’s target range of 1 to 3 percent,” consumers prices senior manager Nicola Growden said.

Australia’s PMI manufacturing Hits 11-month high, services Lagging

Australia PMI Manufacturing rose from 47.6 to 50.3 in January, back in expansion, and a 11-month high. PMI Services rose slightly from 47.1 to 47.9, a 3-month high. PMI Composite rose from 46.9 to 48.1, a 4-month high, but still in contraction.

Warren Hogan, Chief Economic Advisor at Judo Bank noted the PMI data indicates a that the economy remains on RBA’s “narrow path” for soft landing. He highlights the manufacturing sector’s rebound as a key factor in mitigating broader economic downturn risks.

Despite the general economic slowdown, Hogan observes that labor demand remains unexpectedly robust, differing from past economic cycles. However, he cautions that inflation pressures are still high, pointing out, “Input and output price indexes remain at levels suggesting CPI inflation is above the RBA’s target range.”

SNB’s Jordan: Real Franc appreciation hurts, yet no recession in sight

SNB Chairman Thomas Jordan, in his overnight address at an event, acknowledged the impact of the Franc’s nominal appreciation on lowering inflation. However, he warned, the “Franc has also appreciated in real terms in 2023. And that hurts, companies feel that.”

Despite the challenges posed by Franc’s appreciation, Jordan expressed confidence in the Swiss economy’s resilience. “Economists are confident that there won’t be a recession — and we are also confident, otherwise we would forecast one,” he commented, adding “So no recession, just weak growth.”

Looking ahead, Jordan reiterated SNB’s inflation expectations, stating that they anticipate Swiss inflation to approach but not exceed the 2% ceiling of their target range this year. The central bank does not foresee inflation breaching this mark until 2026.

Looking ahead

PMI from Eurozone and UK are the main focuses in European session. Later in the day, spotlight is on BoC rate decision. US will publish PMIs too.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.0812; (P) 1.0864; (R1) 1.0906; More…

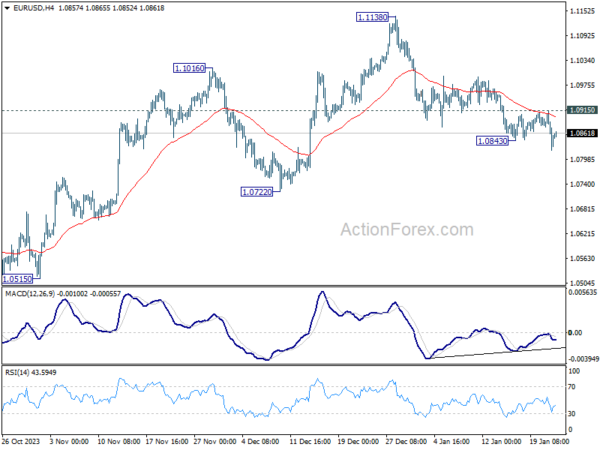

EUR/USD’s breach of 1.0843 temporary low suggests that fall from 1.1138 is resuming. Intraday bias is back on the downside for 1.0722 support first. Decisive break there will argue that whole rise from 1.0447 has completed, and target this low. Nevertheless, on the upside, firm break of 1.0915 will indicate short term bottoming, on bullish convergence condition in 4H MACD, and turn bias back to the upside for stronger rebound.

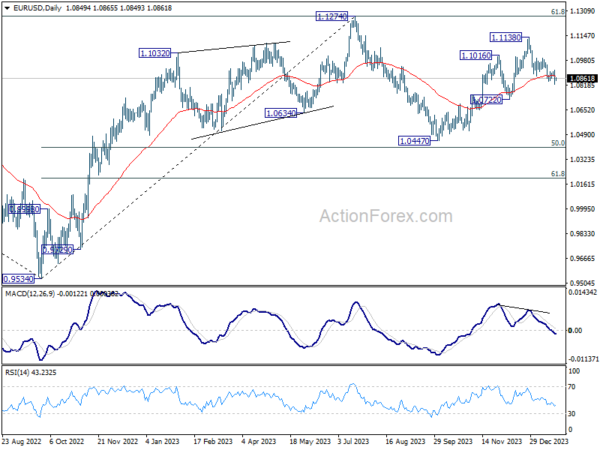

In the bigger picture, price actions from 1.1274 are viewed as a corrective pattern to rise from 0.9534 (2022 low). Rise from 1.0447 is seen as the second leg. While further rally could cannot be ruled out, upside should be limited by 1.1274 to bring the third leg of the pattern. Meanwhile, sustained break of 1.0722 support will argue that the third leg has already started for 1.0447 and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | CPI Q/Q Q4 | 0.50% | 0.50% | 1.80% | |

| 21:45 | NZD | CPI Y/Y Q4 | 4.70% | 4.70% | 5.60% | |

| 22:00 | AUD | Manufacturing PMI Jan P | 50.3 | 47.6 | ||

| 22:00 | AUD | Services PMI Jan P | 47.9 | 47.1 | ||

| 23:30 | AUD | Westpac Leading Index M/M Dec | 0.00% | 0.10% | ||

| 23:50 | JPY | Trade Balance (JPY) Dec | -0.41T | -0.45T | -0.41T | -0.35T |

| 00:30 | JPY | Manufacturing PMI Jan P | 48 | 48.2 | 47.9 | |

| 00:30 | JPY | Services PMI Jan P | 52.7 | 51.5 | ||

| 08:15 | EUR | France Manufacturing PMI Jan P | 42.5 | 42.1 | ||

| 08:15 | EUR | France Services PMI Jan P | 46 | 45.7 | ||

| 08:30 | EUR | Germany Manufacturing PMI Jan P | 43.7 | 43.3 | ||

| 08:30 | EUR | Germany Services PMI Jan P | 49.5 | 49.3 | ||

| 09:00 | EUR | Eurozone Manufacturing PMI Jan P | 44.8 | 44.4 | ||

| 09:00 | EUR | Eurozone Services PMI Jan P | 49.1 | 48.8 | ||

| 09:30 | GBP | Manufacturing PMI Jan P | 46.7 | 46.2 | ||

| 09:30 | GBP | Services PMI Jan P | 53.5 | 53.4 | ||

| 14:45 | CAD | BoC Interest Rate Decision | 5.00% | 5.00% | ||

| 14:45 | USD | Manufacturing PMI Jan P | 47.7 | 47.9 | ||

| 14:45 | USD | Services PMI Jan P | 51.1 | 51.4 | ||

| 15:30 | USD | Crude Oil Inventories | -1.2M | -2.5M | ||

| 15:30 | CAD | BoC Press Conference |