New Zealand Dollar strengthens broadly in an otherwise quiet Asian session today, leading Aussie along with it. This notable rise can partly be attributed to two key domestic factors: a significant improvement in consumer sentiment and robust data from the country’s services sector. In the broader context, Kiwi’s strength is also accentuated by monetary policy landscape. Unlike major central banks such as Fed and ECB, which are grappling with the prospect of rate cuts, RBNZ is not expected to follow a similar path through 2024. This divergence in policy direction sets the stage for the Kiwi to outperform Dollar and Europeans, at least in the short term.

Meanwhile, Japanese Yen and Dollar are softening mildly in the currency markets. Yen, in particular, is the focus of heightened caution among traders, primarily due to the impending policy decision by BoJ scheduled for Tuesday. There is growing expectation that BoJ might initiate steps to pave the way for exiting its negative interest rate policy in the coming year. Regardless of the specific nature of BoJ’s announcement, it is expected to introduce a significant level of volatility in currency markets.

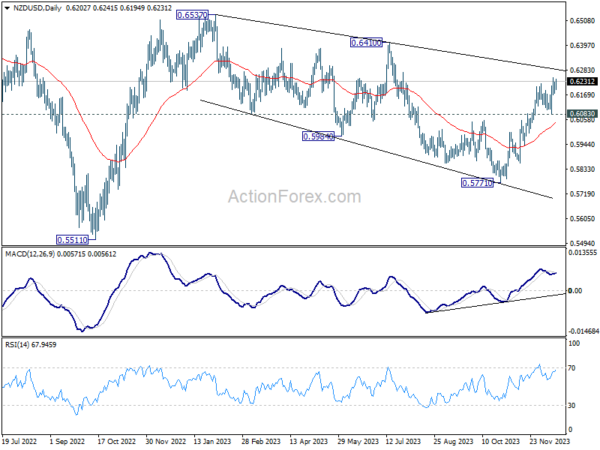

Technically, NZD/USD’s rally from 0.5771 support is in progress. Current preferred view is that correction from 0.6537 has completed with three waves down to 0.5771. Rise from there is seen as resuming whole rally from 0.5511 (2022 low). Sustained break of trend line resistance (now at 0.6286) will solidify this case and target 0.6410 resistance for confirmation. However, rejection by the trend line, followed by break of 0.6083 support, will dampen this bullish view.

In Asia, at the time of writing, Nikkei is down -0.76%. Hong Kong HSI is down -0.94%. China Shanghai SSE is down -0.13%. Singapore Strait Times is down -0.45%. Japan 10-year JGB yield is down -0.0184 at 0.691.

NZ BNZ services rises to 51.2, maintains oscillating course

New Zealand BusinessNZ Performance of Services Index rose from 49.2 to 51.2 in November, crossing the threshold from contraction to expansion. However, it’s crucial to note that this figure remains below the long-term average of 53.5, suggesting that recovery is still in its nascent stages.

Looking at more details, activity/sales rose from 47.5 to 48.7. Employment rose from 49.5 to 51.0. New orders/business rose from 52.1 to 52.3. Stocks/inventories jumped from 51.5 to 55.0. Supplier deliveries rose from 50.1 to 52.9.

BusinessNZ Chief Executive Kirk Hope’s observation that the sector has been oscillating between contraction and expansion in recent months underscores the volatility and uncertainty still prevalent in the business environment.

The proportion of negative comments from businesses decreased from 58.2% in October to 54.0%. This reduction, though modest, is a positive sign, indicating a slight improvement in business sentiment. Hope added, “negative comments continued to be pinpointed on key areas such as the economy, inflation and cost of living”.

New Zealand Westpac consumer confidence rises to 88.9 in Q4, encouraging sign

New Zealand Westpac Consumer Confidence Index rose notably from 80.2 to 88.9 in Q4, hitting the highest level in nearly two years. Present Conditions Index rose from 69.5 to 77.1. Expected Conditions Index also rose from 87.4 to 96.7.

However, Westpac noted that the index is still below historical average. This means “many more New Zealanders [are] feeling pessimistic about economic conditions.” But it’s important to recognize the positive trajectory reflected in these recent months. The rise in the Consumer Confidence Index is an “encouraging sign,” as noted by Westpac.

Fed’s Goolsbee: Declaring inflation victory now is premature, akin to counting the chickens

Appearing in CBS’s Face the Nation on Sunday, Chicago Fed President Austan Goolsbee acknowledged the significant progress made in 2023 but tempered expectations with a note of caution, emphasizing that the fight against inflation is far from over. His stated, “I still caution everyone, it’s not done”. As he also noted, “data is going to drive what’s going to happen to rates,”

Discussing the scenario of “soft landing” for the economy, Goolsbee expressed caution, deeming it premature to claim victory in this regard. He projected that 2023 would likely witness a significant reduction in inflation, coupled with a stable unemployment rate. Referring to this balance as “the golden path”.

In his words, Goolsbee conveyed a message of continued vigilance. He cautioned against premature celebration, using the metaphor of “counting the chickens” to emphasize the need for consistent evidence of economic recovery.

BoJ’s upcoming decision: Setting the stage for departure from negative rates?

As we approach the highly anticipated BoJ meeting scheduled for December 18-19, the financial markets are abuzz with speculation and expectations. The focus is squarely on the BoJ’s strategy for the upcoming year, particularly its approach towards ending the prolonged phase of negative interest rates. Although there is no immediate expectation of an interest rate change post this meeting, the critical aspect lies in the BoJ’s strategic planning and signaling for the upcoming months.

Currently, April 2024 stands as the most probable timeframe for an interest rate hike, as indicated by a recent Reuters poll where 61% (17 out of 28) of economists favored this timeline. However, the opinions are still rather divided. Notably, four prominent institutions – Daiwa Securities, Mitsubishi UFJ Morgan Stanley, Nomura Securities, and T&D Asset Management – representing 14%, project an earlier shift, anticipating the conclusion of negative interest rate as soon as at January 22-23 meeting. Additionally, alternate timelines are also in consideration, with July and post-2025 being other potential pivot points.

Another aspect of this discussion revolves around BoJ’s Yield Curve Control. Predictions from Mitsubishi UFJ Morgan Stanley, JP Morgan, and ZKB suggest that BoJ might abandon YCC policy in January. This prediction somewhat aligns with views of nearly 90% of economists (23 out of 26), who believe that BoJ will abandon YCC rather than tweaking it again. The current smoothness of yield curve really negates the need for any further adjustment.

The unfolding scenario seems would be a two-step process. The first move could be ending YCC in January, substantiated by economic projections presented at the meeting. This step would set the stage for the subsequent action in April, where an interest rate hike might occur, once again backed by a fresh batch of economic forecasts.

Hence, the importance of this December meeting lies in its potential to set the stage for these significant policy shifts. Any hints of this strategic plan could trigger a bullish response, potentially driving the Yen higher.

In term of central bank activities, RBA minutes and BoC summary of deliberations are the main focuses. On the data front, US durable goods orders and PCE inflation, German Ifo business climate, Japan CPI, UK CPI and retail sales, Canada CPI and GDP are the most important releases, before going into a holiday long weekend.

Here are some highlights for the week:

- Monday: New Zealand Westpac consumer sentiment, BusinessNZ services index; German Ifo business climate; Canada new housing price index; US NAHB housing index.

- Tuesday: New Zealand Trade balance, ANZ business confidence; Australia RBA minutes; BoJ rate decision; Swiss Trade balance; Eurozone CPI final; Canada CPI, IPPI and RMPI; US building permits and housing starts.

- Wednesday: Japan trade balance; German Gfk consumer sentiment, PPI; UK CPI, PPI; Eurozone current account; US current account, consumer confidence, existing home sales; BoC minutes.

- Thursday: UK public sector net borrowing; Canada retail sales; US GDP final, jobless claims, Philly Fed survey.

- Friday: Japan CPI, BoJ minutes; German import prices; UK retail sales, Q3 GDP final; Canada GDP; US durable goods orders, personal income and spending, PCE inflation; new home sales.

EUR/JPY Daily Outlook

Daily Pivots: (S1) 154.53; (P) 155.29; (R1) 156.72; More..

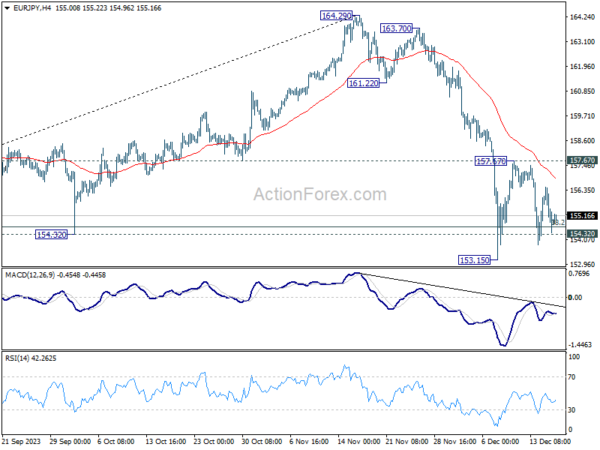

Intraday bias in EUR/JPY stays neutral as consolidation from 153.15 is extending. Outlook will stay bearish as long as 157.67 resistance holds. Break of 153.15 will resume whole fall from 164.39 to 61.8% retracement of 139.05 to 164.29 at 148.69.

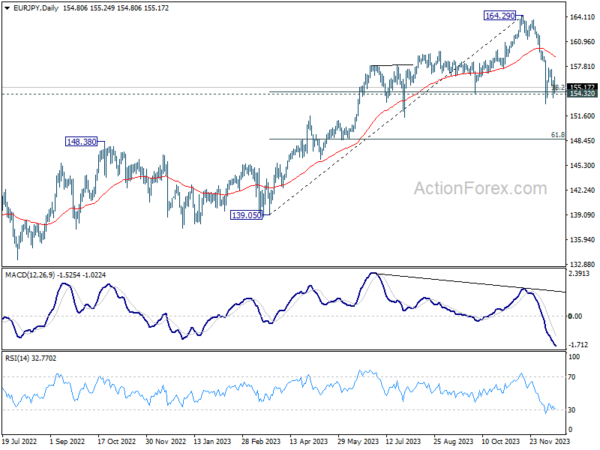

In the bigger picture, price actions from 164.29 medium term top are tentatively seen as a correction to rise from 139.05 for now. As long as 148.48 resistance turned support holds (2022 high), larger up trend from 114.42 (2020 low) could still resume through 164.29 at a later stage.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 20:00 | NZD | Westpac Consumer Survey Q4 | 88.9 | 80.2 | ||

| 21:30 | NZD | Business NZ PSI Nov | 51.2 | 48.9 | 49.2 | |

| 09:00 | EUR | Germany IFO Business Climate Dec | 87.8 | 87.3 | ||

| 09:00 | EUR | Germany IFO Current Assessment Dec | 89.5 | 89.4 | ||

| 09:00 | EUR | Germany IFO Expectations Dec | 85.8 | 85.2 | ||

| 13:30 | CAD | New Housing Price Index M/M Nov | 0.10% | 0.00% | ||

| 15:00 | USD | NAHB Housing Market Index Dec | 37 | 34 |